Investors in stock markets have witnessed historic volatility in 2025 so far. After peaking in February, the S&P 500 (^GSPC 0.84%) index briefly slipped into correction territory in April. Many feared a market crash, but the S&P 500 has instead staged one of its most dramatic V-shaped recoveries since and just hit a record high.

The wild ride has left investors wondering whether the stock market is overheated and whether they should invest in stocks now or remain on the sidelines. The fear is warranted. The S&P 500 is currently trading at over 25 times earnings, and U.S. stocks now account for 65% of all stocks worldwide. Those are historically high valuations.

Yet, even at these lofty market levels, you can still beat the market in the long term if you know where to look. The Motley Fool CEO and co-founder, Tom Gardner, believes the key to beating the market now lies in looking "where people aren't looking."

Image source: Getty Images.

The type of stocks investors should buy now

In a recent interview, Gardner shared his perspective on the current state of the market and how investors should approach investing. While recognizing that the markets are at high valuations, Gardner maintains that there are still hundreds of good stocks you could buy now, but they're probably "not the most well-known, actively followed, most richly valued" stocks. Gardner believes it's time to be "a little more defensive" right now and look for investments "where others aren't looking."

I'm saying if you're looking for good returns over the next 3-5 years that beat the market, I think you need to look where others aren't looking now, and you need to look for dividend payers, more value-oriented investing. At least where we are in valuation now.

So, where can you look to invest now? Think dividends, defensive, and value stocks.

While good dividend stocks can generate a steady stream of passive income even during turbulent times, defensive stocks are typically recession-proof stocks and a great way to reduce your portfolio risk. Value stocks, meanwhile, trade for a price lower than what their fundamentals merit. More often than not, some of the most boring businesses fit two or more of these three stock categories, and there are plenty of such stocks today that could beat the market in the long term.

In today's environment, three stocks come to mind.

A 6.9%-yielding safe energy dividend stock

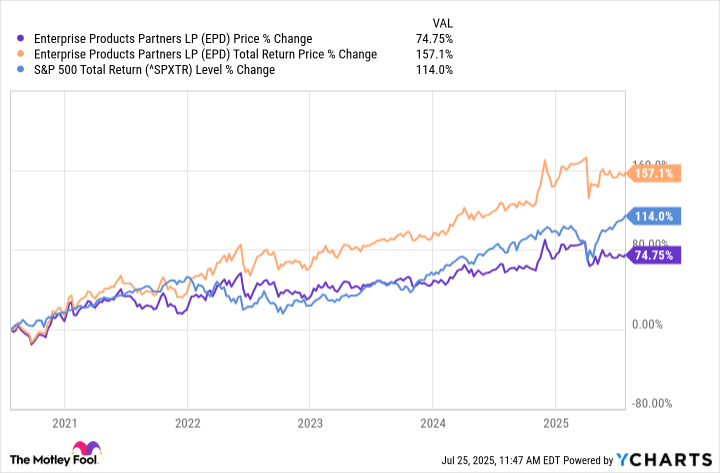

Enterprise Products Partners (EPD +4.73%) is one of the largest midstream energy companies in the U.S., owning over 50,000 miles of pipeline. It stores, processes, and transports natural gas liquids and other products under long-term contracts in return for a fee. The business is recession-proof and largely immune to the volatility in oil and gas prices. Moreover, 90% of the contracts have escalation clauses to offset the effects of inflation.

All those factors combined mean that Enterprise Products can generate steady, predictable cash flows and pay regular, growing dividends. The energy giant has increased its dividend for 26 consecutive years, and the stock yields a hefty 6.9%. With Enterprise Products bringing $6 billion of the $7.6 billion in major capital projects online this year, investors can expect to see steady growth in its cash flows and dividends, regardless of where the economy or stock markets are.

A defensive dividend growth bet

Brookfield Infrastructure's (BIPC 0.18%)(BIP +0.22%) business is also recession-resilient, as it earns from defensive assets, such as utilities, rail and toll roads, midstream energy, and data centers. Nearly 85% of Brookfield's funds from operations (FFO) are contracted or regulated and indexed to inflation. While that makes its cash flows predictable, regular acquisitions and recycling of old, mature assets drive cash flows higher.

NYSE: BIPC

Key Data Points

Over the past 15 years, Brookfield has grown its FFO per unit by a compound annual growth rate (CAGR) of 15% and its dividend by a 9% CAGR. With the company targeting over 10% FFO growth and 5% to 9% annual dividend growth in the long term, Brookfield Infrastructure is a great stock to own during uncertain times. The corporate shares also yield a good 4%.

A beaten-down Dividend King to buy

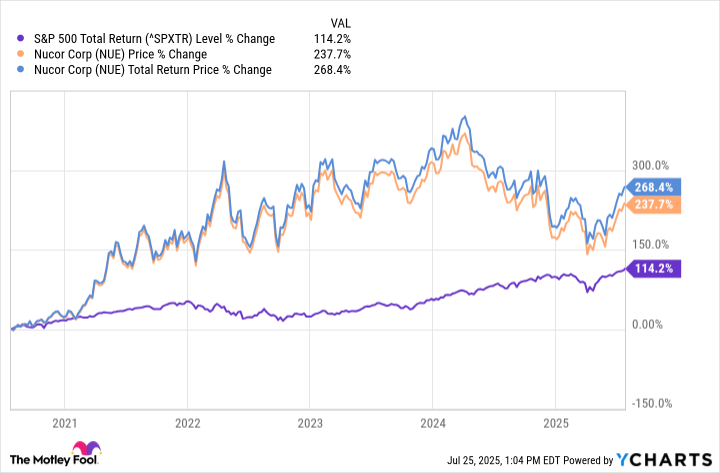

Unlike Enterprise Products and Brookfield Infrastructure, which are defensive stocks, Nucor (NUE +3.06%) is a cyclical stock. However, you'd be surprised to see the kind of total returns it has generated in recent years.

Nucor is the largest and most diversified steel producer in North America. While this exposes the company to commodity prices, Nucor has sailed through turbulent times primarily due to two reasons. First, it uses electric arc furnaces in steel mills. They are more flexible, efficient, and cost-effective compared to traditional blast furnaces. Second, its mills use scrap as the key raw material, which Nucor produces internally.

Vertical integration, a cost-efficient business model, and a strong balance sheet contribute to Nucor's status as a Dividend King, having increased its dividend for 52 consecutive years. With President Donald Trump imposing hefty tariffs on steel imports, Nucor could be a solid turnaround story. Trading at 30% off all-time highs as of this writing, Nucor is one value plus dividend growth stock you could buy now.