OpenAI is well recognized as one of the leaders in the generative AI world, as it was the first to reach mainstream usability with its ChatGPT product. OpenAI has maintained its position and is a clear example of the first-mover advantage. OpenAI's partnership with Microsoft (MSFT 0.74%) is well known, as are the struggles between the two. That's what makes this announcement such a big deal.

In addition to Microsoft, OpenAI will also use Alphabet's (GOOG 0.23%) (GOOGL 0.27%) Google Cloud servers to run ChatGPT prompts on. That's a significant development for Alphabet, and it could cause shares of its undervalued stock to surge as the market digests this news.

Image source: Getty Images.

Google Cloud is growing at a quick pace

Alphabet is a multifaceted business. While its legacy Google Search business dominates its financials, the company also operates other platforms, including Google Cloud, Waymo, and the Android operating system.

Google Cloud is Alphabet's cloud computing wing and provides clients with computing power that would be very expensive to build themselves. By building out massive data centers and renting out capacity to clients, Alphabet can make a solid profit, as it has proven quarter after quarter. In Q2, Google Cloud's revenue increased 32% year over year, yielding a 21% operating margin. While these are strong numbers, Google Cloud's margins can drastically improve from these levels.

NASDAQ: GOOGL

Key Data Points

In Q2 of 2024, its operating margin was 11%, so its Q2 2025 numbers represent a significant improvement over the year-ago period. However, industry leader Amazon Web Services (AWS) delivered a 39% operating margin during Q1. Google Cloud still has a way to go before catching up to AWS, but that's also good news for investors, as it shows there is still plenty of growth in store.

But that doesn't explain why Alphabet trades at such a discount to the market.

The market is still concerned about the Google Search engine's future

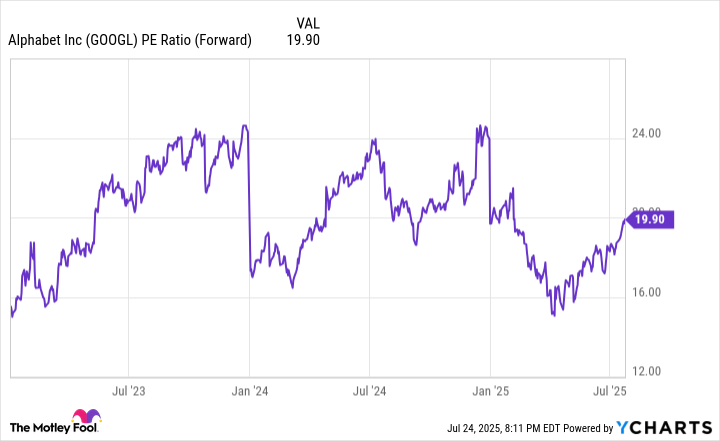

The S&P 500 index (^GSPC 0.52%) trades for 23.8 times forward earnings. However, Alphabet's stock trades at a discount to that figure, 20 times forward earnings.

GOOGL PE Ratio (Forward) data by YCharts

However, this discount doesn't make sense because Alphabet is performing well financially. In Q1, its revenue rose 14% year over year with diluted earnings per share (EPS) rising 22%. Most companies with those growth rates would have a forward price-to-earnings (P/E) valuation in the high 20s to low 30s, but not Alphabet.

The market is worried about Google Search losing market share to various generative AI services -- the very technology that OpenAI just moved onto Alphabet's servers. However, this isn't showing up in Alphabet's results.

In Q2, Google Search's revenue increased 12% year over year. Compared to the 10% growth experienced in Q1, this marks an acceleration of growth, clearly indicating that Google Search isn't going anywhere.

Additionally, the strong double-digit growth Alphabet reported is more than enough to outperform the market, which is why shares surged the day following the earnings release. Still, that's not nearly enough of a gain to value Alphabet among its big tech peers. The combined catalyst of ChatGPT running some of its workloads on Google Cloud's servers and the realization that Google Search isn't fading away anytime soon should be enough to convince the market that Alphabet's stock is worth far more than it's valued at today.

As a result, I believe Alphabet is one of the top stocks to buy now, as it offers value in a market that has become increasingly expensive.