With the emergence of artificial intelligence (AI) into the mainstream, driven by the popularity of generative AI tools like ChatGPT, numerous tech companies -- as well as those from any industry that utilizes AI -- have seen their valuations skyrocket.

No stock has benefited more from recent AI developments than Nvidia (NVDA 0.32%), which is up over 900% in just the past three years and is the world's most valuable public company with a market capitalization of over $4.2 trillion. For perspective, the S&P 500 is "only" up around 60% in that span.

NASDAQ: NVDA

Key Data Points

On Aug. 27, Nvidia is set to report its fiscal second-quarter earnings. Only time will tell what those earnings reveal, but it's natural for investors to wonder if they should buy Nvidia's stock before the earnings to potentially take advantage of a post-earnings stock price boost.

In theory, it sounds like a smart move if you anticipate good results; however, history has shown that this doesn't always work out in investors' favor, regardless of the earnings results.

Image source: The Motley Fool.

No correlation between earnings and stock performance

The first thing to notice in the above chart is that there's no consistency between Nvidia's earnings and the immediate performance of its stock price. Below is how Nvidia's stock price has performed the day after its past four earnings reports:

| Reporting Date | Beat Earnings Per Share Expectations? | Next-Day Stock Performance |

|---|---|---|

| May 2025 | No | (2.9%) |

| February 2025 | Yes | (8.5%) |

| November 2024 | Yes | 0.5% |

| August 2024 | Yes | (6.4%) |

Data source: AlphaQuery and YCharts.

Even after beating earnings expectations, Nvidia's stock has experienced noticeable declines on the next day. This shows that investors aren't solely concerned about over- or underperformance. They may also be looking at factors like future guidance, valuations, and overall market sentiment.

Correlation (or lack thereof) aside, one thing to keep in mind is that trying to time the market is a recipe for disappointment and can often be counterproductive. Even if it seems like a stock's price should move in a certain direction because of results, the stock market doesn't operate on logical cause and effect.

Nvidia's high valuation leaves little room for error

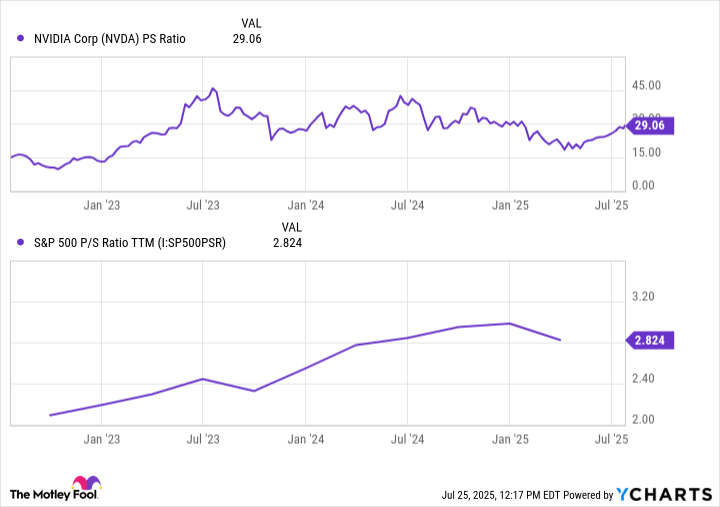

Nvidia's trailing-12-month price-to-sales (P/S) ratio of 29 is the highest you'll find in an S&P 500 stock and 10 times the S&P 500 average.

NVDA PS Ratio data by YCharts

This ultra-high valuation leaves Nvidia with little room for error -- or what investors may perceive as error -- and can increase volatility. If you like Nvidia as a company, a smart strategy would be to dollar-cost average. This will allow you to slowly but surely accumulate shares and offset some of the volatility risks.

Nvidia's stock has shown long-term growth despite short-term drops, and that's what investors should focus on the most and bank on.