Shares of Teradyne (TER +3.52%) jumped on Wednesday, finishing the day up 18.9%. The spike comes as the S&P 500 (^GSPC) and the Nasdaq Composite (^IXIC) fell slightly.

Teradyne, an electronics testing company, released mostly better-than-expected earnings today, leading to a prominent analyst maintaining their "overweight" rating for the stock.

NASDAQ: TER

Key Data Points

Teradyne beats in the second quarter (mostly)

The company's reported earnings per share (EPS) and revenue figures both slightly topped expectations. Analysts had estimated $0.54 per share on sales of $651 million. Teradyne delivered $0.57 per share on sales of $651 million. While the company surpassed expectations for the quarter, its top line fell by 11% year over year (YOY).

Looking ahead, the company expects sales for Q3 of between $710 million and $770 million, above Wall Street targets. It did miss, however, on its EPS guidance. The company set a range of between $0.69 and $0.87, well below the expected $0.89.

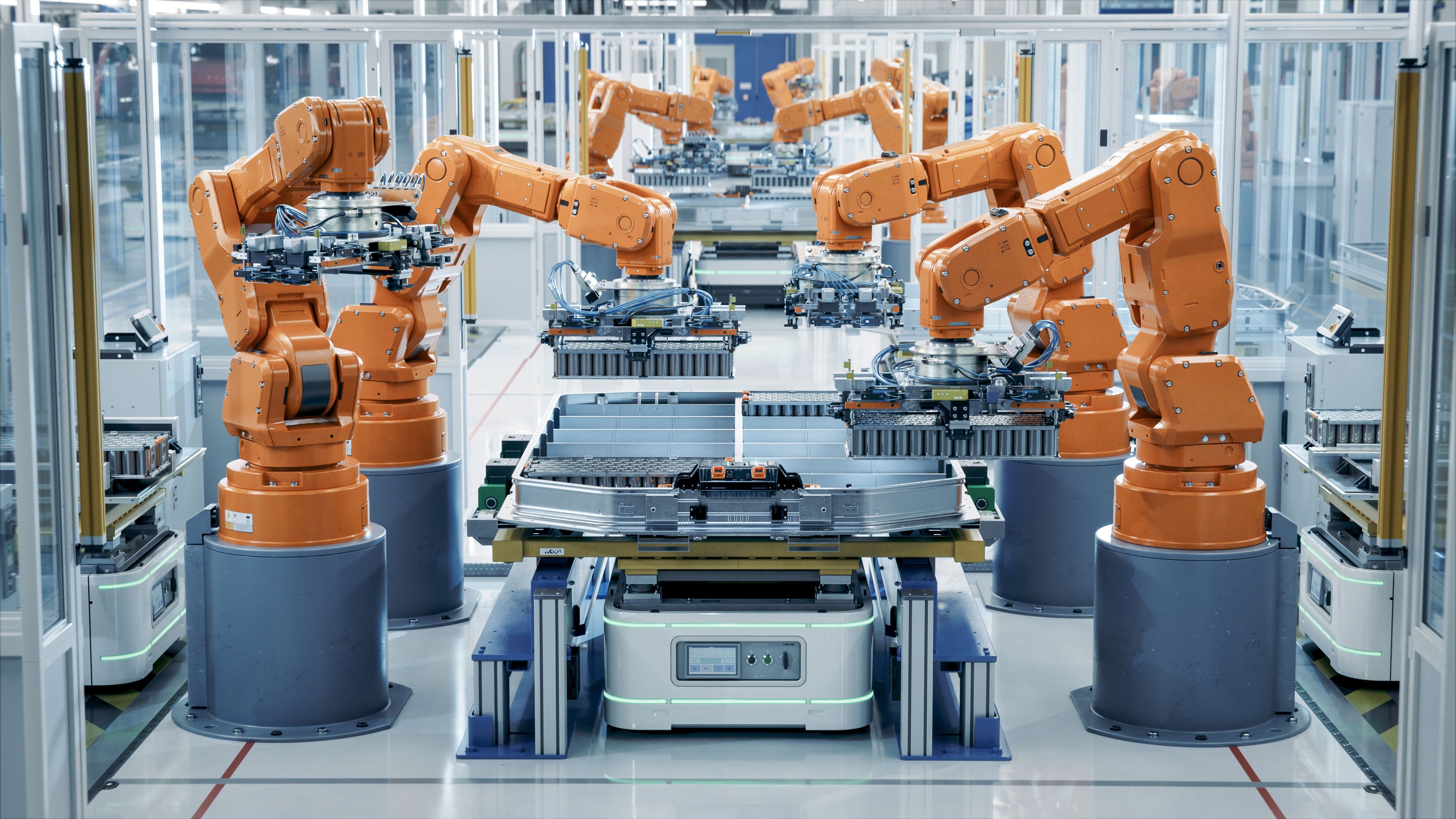

Image source: Getty Images.

CEO Greg Smith said he expects AI-related testing to drive growth: "As we progress through the third quarter, we are gaining confidence in AI compute-related revenue inflecting in the second half of the year."

Teradyne has room to grow

Impressed by the performance and not phased by the lower-than-expected earnings guidance, Cantor Fitzgerald analysts maintained their Overweight rating, citing AI growth prospects. I agree. I think AI-related chip testing could drive major growth over the next few years.