Artificial intelligence (AI) has brought more than just outsize gains in the technology sector over the last couple of years. The AI boom has acted as a transformational catalyst for companies across each major industry -- and with this increased appetite have come a number of highly anticipated public offerings.

In recent years, hot start-ups including Reddit, CoreWeave, Rubrik, and Tempus AI have made their debuts on the public exchanges. One company that has remained on the sidelines, however, is data lakehouse specialist Databricks.

With comparisons to Snowflake (SNOW +1.27%) and Palantir Technologies (PLTR 3.40%), investors have been champing at the bit at the prospects of a Databricks initial public offering (IPO).

Let's explore how going public works. From there, I'll cover some details around the performances of recent public offerings and make the case for why a Databricks IPO may or may not make sense in 2025.

NASDAQ: PLTR

Key Data Points

How does a company go public?

In recent years, you've likely seen a number of businesses go public through special purpose acquisition companies (SPACs). SPACs are more commonly referred to as "blank check companies." Essentially, a syndicate of investors pool money together with the objective of acquiring a private company and taking it public.

SPACs come with the allure of being able to invest in popular start-ups, which are typically reserved for venture capitalists or accredited investors. While this might make SPAC stocks tempting to follow, their long-run investment performances tell a pretty one-sided story.

A study conducted by the University of Florida found that between 2012 and 2022, the three-year average return following a de-SPAC event was negative 58%. Technology was one of the poorest performing sectors, with median de-SPAC returns of negative 56% between 2009 and 2025, according to data compiled by SPACInsider.

The more traditional way of going public is through the IPO process with an investment bank. Banks compile the financial statements and operating metrics of IPO clients into a thorough, well-packaged document called an S-1 filing. From there, the bank works on behalf of its client to market the IPO to institutional funds in order to get a sense of demand and pricing strategy around the offering.

Image source: Getty Images.

Databricks IPO: Bull Case

The S&P 500 and Nasdaq Composite are hovering near all-time highs, thanks in large part to soaring AI stocks such as Nvidia, Microsoft, and Palantir. Databricks could capitalize on bullish AI tailwinds and ride the coattails of its software peers to a premium valuation.

On the surface, a Databricks IPO might seem like a no-brainer. However, the valuation narrative has another side -- one that comes with some important risk factors.

Databricks IPO: Bear case

Considering how hot the AI market is right now, investor expectations are continually rising. In a scenario where Databricks goes public and witnesses an initial pop in its share price, the company will undoubtedly face heightened pressure and scrutiny around its earnings reports. Should the company miss a growth target or fail to captivate Wall Street, the share price could plummet.

In addition, with a comparable company like Palantir trading at all-time highs, Databricks could risk an IPO overlapping with the peak of a bubble. In a way, this is not dissimilar to what happened with Snowflake's IPO in late 2020.

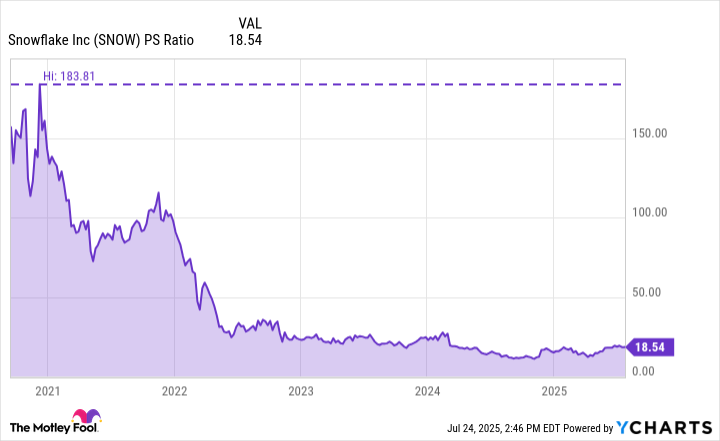

SNOW PS Ratio data by YCharts

As the graph above illustrates, Snowflake's price-to-sales (P/S) multiple peaked at 184 shortly following its IPO. Today, even with AI as its main tailwind, Snowflake is trading at a P/S of just 18.5. This is far lower than many other leading software-as-a-service (SaaS) stocks right now.

Another reason I've highlighted Snowflake here is because Databricks' reported annual recurring revenue (ARR) of $3.7 billion is in the ballpark of where Snowflake ended last fiscal year.

Given the comparable sizes between the two businesses, it's hard not to draw parallels between Snowflake and Databricks. It's entirely possible that investors begin to view Databricks as the "next Snowflake." It's my suspicion that Databricks could face some challenges differentiating its perceived image from Snowflake in the AI realm.

Will Databricks go public this year?

In reality, calling Databricks another version of Snowflake is oversimplified. Each company is developing their own AI infrastructure geared toward unique use cases. Moreover, both companies are growing at vastly different rates.

While I do think Databricks would be well received as a public company, I think the company faces considerable risk to its price action post-IPO as the market continues to digest frothy conditions and comparable businesses such as Palantir and Snowflake.