After remaining out of the spotlight after 2021's red-hot rally (followed by a two-year unwinding of that run-up), movie theater chain AMC Entertainment (AMC 2.08%) is back in focus. It's not quite the same wild ride as last time; most investors seem hesitant to participate in the same unpredictable mania they saw unfurl then. Still, even though it's peeled back from its peaks, AMC stock's dished out a couple of big bullish moves since May's multiyear low.

Something's clearly going on here. Might it be evidence of the long-awaited turnaround? Here's what interested investors need to know.

Back from the dead

If it only vaguely rings a bell, this may refresh your memory: AMC was one of a handful of so-called meme stocks that went wild during and because of the COVID-19 pandemic. People were bored then, and a handful of speculators took to popular online forums like Reddit to tout certain small-cap stocks like AMC in an effort to inflate their prices. GameStop, BlackBerry, and Bed Bath & Beyond were other low-float tickers being bullishly targeted in this way at this time.

And it (mostly) worked. A bunch of these tickers did soar, perhaps more than these traders even meant to pump them up.

It then all came undone, of course. Bed Bath & Beyond declared bankruptcy in early 2023, crushing the stock. GameStop is still in business, but its shares remain below their 2021 high, mostly because the retailer hasn't been able to evolve with the video game industry. AMC Entertainment's stock fell below its pre-pandemic lows by late-2023, thanks to the damage streaming has done to the film business since the coronavirus contagion.

NYSE: AMC

Key Data Points

And this begs the question: What's suddenly seemingly lighting a fire under this stock? Does somebody know something about its second-quarter earnings report, scheduled for release on Friday? Will it offer a hint of a long-awaited turnaround following last week's announcement of the "successful closing of comprehensive refinancing transactions" that will "strengthen the balance sheet and position the company to prosper from robust box office recovery"? This certainly seems to be the case.

Before buying in, though, there are a couple of key things you need to know.

The only change is for the worse

If there's a "robust box office recovery" underway, somebody forgot to tell Hollywood.

The fact is, box office ticket sales remain below pre-pandemic levels. And it's not like the industry hasn't had its chance to fill movie theater seats since then. While Jurassic World: Rebirth, Disney's live-action remake of Lilo & Stitch, and Wicked have all performed pretty well, there are fewer total movies with their degree of draw, and certainly not the multiple massive blockbusters that the industry needs. Numbers from Box Office Mojo make it clear that the business just isn't bouncing back from its pandemic-prompted lull.

Data source: Box Office Mojo. Chart by author.

And it may never recover, with more and more theatrical-quality films being made exclusively for streaming services rather than theaters. Recently released Happy Gilmore 2, for example, can only be watched on Netflix.

Meanwhile, the films that do make it to theaters don't necessarily stay there very long. For instance, after only landing in theaters in early July, Jurassic World: Rebirth is now offered to subscribers of Comcast's Universal's streaming service Peacock.

Image source: Getty Images.

By the way, an outlook from PwC suggests the domestic and global film business won't reach its pre-COVID levels until 2029, growing at an average annual pace of less than 4% between now and then. That's not much for this struggling theater chain to work with.

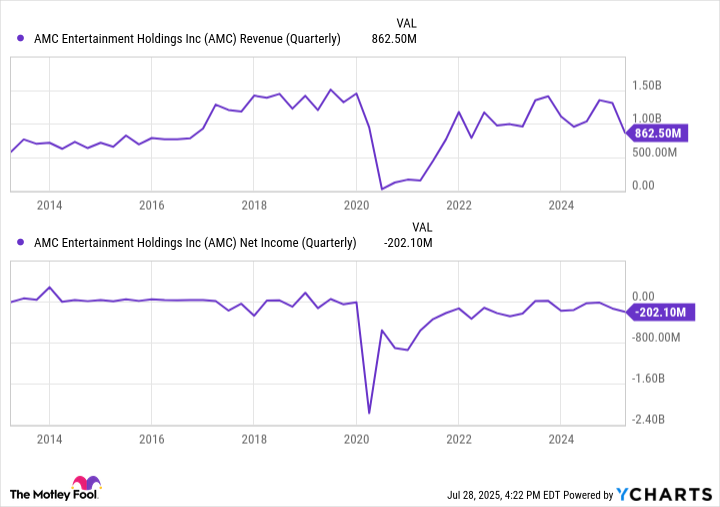

On that note, the other important detail to understand here is the fact that even before the COVID-19 pandemic wrecked the theatrical film industry, AMC wasn't exactly thriving. Indeed, it was barely -- as well as inconsistently -- profitable between 2017 and 2020 despite the surge in revenue stemming from hits like Spider-Man: Homecoming, Avengers: Endgame, and the live-action Lion King. Things for the company or the industry haven't improved in the meantime.

AMC Revenue (Quarterly) data by YCharts

And for what it's worth, kudos to the company for the "successful closing of comprehensive refinancing transactions." Just know that most of the newly raised money is only refinancing existing debt, much of which is maturing next year. And to the extent its total debt is being reduced, it's being done in conjunction with the issuance of more stock that's dilutive to existing shareholders ... and those shareholders have already been quite diluted. The 431 million shares of AMC outstanding as of March is well up from the year-ago comparison of 263 million, while the recent recapitalization deal allows for the issuance of even more shares.

That's not exactly a game-changing prospect this company's current investors should be cheering.

Not an investment

Is it possible things will be different going forward? Sure. Anything's possible.

Investors can't risk their hard-earned money on what's merely possible, though, despite how convincing the meme-driven arguments being made online by anonymous people may seem. Real investors are looking for something that's likely, or at least probable. Given what we know and can see, a turnaround here neither seems likely nor probable here.

Meme stocks are fun to watch, and maybe even fruitful to trade. Make no mistake about these stocks, though, and this one in particular -- there's no enduring bullish argument to be made for AMC Entertainment here, nor does there appear to be one on the long-term horizon. Nothing with Friday's report is apt to change this, either, even if the numbers roll in better than expected.

To this end, analysts are looking for a loss of $0.764 per share on revenue of just under $5 billion. Both would be year-over-year improvements.