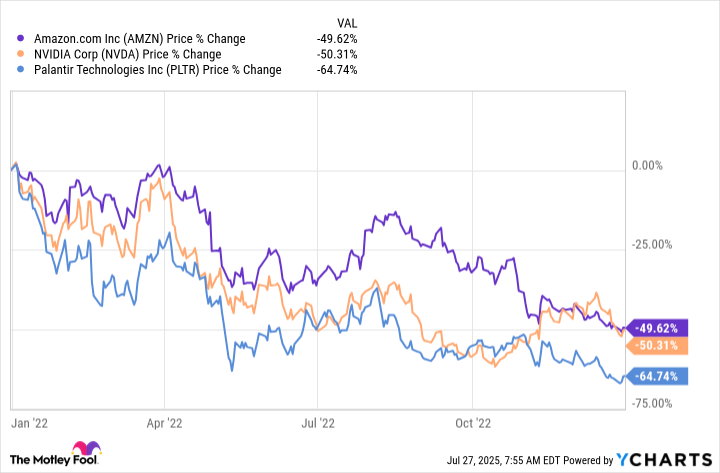

Artificial intelligence (AI) is still dominating market conversations, and after more than two years, it looks like it has real staying power. If you bought AI stocks three years ago, you might have seen your stocks skyrocket, but you likely went through a real down period on the way. Consider how Amazon, Nvidia, and Palantir Technologies stocks performed in 2022.

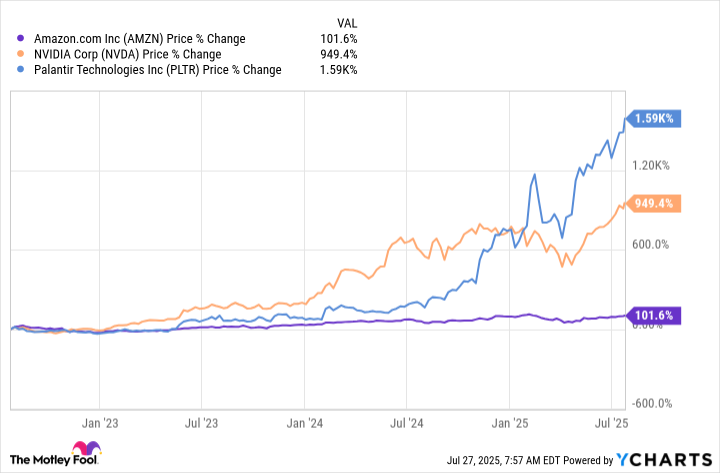

Now consider how they performed over that period and then onto the present.

The market has made a huge comeback, led by AI stocks. If you're looking for stocks that can still make you a millionaire, I think Taiwan Semiconductor Manufacturing (TSM -2.59%), Lemonade (LMND -3.37%), and Upstart Technologies (UPST -2.83%) all have tremendous upside and could be solid parts of a millionaire-making portfolio. Remember, there's no way to predict the future, and gains may not be linear, so you'll have to hold on through any dips.

Image source: Getty Images.

1. The chip king

Taiwan Semiconductor, or TSMC, is a foundry, which means it makes the chips that companies like Nvidia, Apple, and Advanced Micro Devices design. It's benefiting from tremendous tailwinds in AI, but since it works with so many clients in many different industries, its risk is well diversified. That gives it the best of both worlds.

For the time being, though, its AI segment is outperforming and driving growth. In the 2025 second quarter, revenue increased 35% year over year in U.S. dollars. The high computing segment, where the AI business falls, accounted for 59% of the total. TSMC is also extremely profitable, with a 58.8% gross margin and a 48.5% operating margin.

Management is guiding for sales to increase at a compound annual growth rate of 20% through 2029 and is targeting a long-term gross margin of at least 53%. To top it all off, Taiwan Semiconductor stock isn't expensive, giving it even more room to expand. It trades at a forward one-year P/E ratio of 22.

Like any stock, the amount you invest, how it grows, and how long you can stay invested will determine whether it will turn you into a millionaire. But over time and with enough of a starting stake, TSMC stock could grow your money significantly and at least be a part of a millionaire-maker portfolio.

2. The digital insurance revolution

When Lemonade's founders were looking to start a new business 10 years ago, they hit upon insurance as one industry that was in vast need of a digital makeover. They created Lemonade, which is an all-digital insurance company that doesn't work with independent agents. It relies on AI throughout its enterprise, using chatbots to onboard and file claims, and AI and machine learning to price policies.

Today, there are many insurance companies taking this leap, and the legacy insurers are all getting into AI. But having started at this a decade ago, Lemonade has a first-mover's edge and a decade of data and systems at the ready. It touts its interconnecting parts that all "speak to each other," which companies that are more than a century old are having a hard time replicating.

It's growing at a rapid pace, with 2.5 million customers as of the end of the 2025 first quarter. In-force premium, the insurance industry's top-line metric, increased 27% year over year in the first quarter. The loss ratio, which measures how much of a policy is being paid out in claims, has declined and stabilized over time, which means the model is working.

Lemonade stock has been climbing recently, but it's still well off its all-time highs. It's expected to report profitability on an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) basis next year, following with positive net income in 2027. As it captures more customers and moves closer to net profits, shareholders are likely to be rewarded with huge gains over time.

3. The AI answer to lending

Upstart stock seemed like a dream when it became public a few years ago; it demonstrated tremendous growth, was highly profitable, and seemed like it could do no wrong. But it landed with a thud when interest rates shot up and its AI-powered platform wasn't able to identify as many good lenders.

However, the business has persevered, and it has continued to develop strong algorithms that it maintains can approve more borrowers without increasing risk to lenders. As interest rates come down, its performance is improving, and the future looks bright.

In the 2025 first quarter, network volume increased 102% and revenue was up 67% year over year. Operating loss was $4.5 million, putting it into position to spring to positive very soon. For the full year, management is guiding for $1 billion in revenue, up from $637 million last year, and positive net income.

At the current price, Upstart stock, which had previously sported astronomical valuations, is now at more humble and attractive ratios. It trades at a price-to-sales ratio of 11 and a forward one-year a P/E ratio of 35. There may still be more volatility on the way, but at this price and with its opportunities, the stock now has much more room to expand, and if it continues to demonstrate high growth, it could be a valuable addition to a growth-oriented portfolio for risk-tolerant investors looking to become millionaires.