Costco Wholesale (COST 0.32%) is one of the largest and most successful retailers in the United States. It also has a global presence. And the company, despite already being a very large business, continues to find new opportunities to expand.

Here are three reasons to love Costco's business. Just make sure you understand this key fact before you buy the stock.

1. Costco is an industry-leading retailer

The first reason to consider buying Costco, perhaps like there's no tomorrow, is the strong success it is achieving right now. To put some numbers on that, the club store retailer managed to increase sales by 8% in the fiscal third quarter of 2025 (ended May 11). That was backed up by 5.7% in same-store-sales growth, which looks at the results of just existing locations.

Image source: Getty Images.

But that's not all the good news. Customer traffic at the retailer's stores rose 5.2% with the average ticket up 0.2%. That means more customers are spending more money. The company's e-commerce sales, meanwhile, rose roughly 15%. This is a business executing at the top of its game right now.

2. Costco is still growing at a solid pace

That strong growth brings up the second reason to like Costco: It is leaning in and opening new locations. The company ended fiscal 2024 with 890 stores and is projecting a store count of 914 by the end of fiscal 2025. Every new location adds to the revenue the company generates.

But new locations can take a little while to ramp up, so the benefit from the fiscal 2025 additions will likely spill over into fiscal 2026, meaning the good news here isn't over yet. And that doesn't even consider the high likelihood that Costco opens even more stores in fiscal 2026.

3. Costco's membership model gives it an advantage

The third reason to like Costco today is more basic to its business model. Customers pay an annual membership fee for the privilege to shop at a Costco store. Those fees allow Costco to compete aggressively on price, which makes shopping at the store a more attractive option for its customers. Customers seem quite pleased, too, with a roughly 90% renewal rate, creating an annuity-like income stream for Costco. That's an incredible foundation on which to keep growing the business.

NASDAQ: COST

Key Data Points

Costco is likely to keep doing well

The truth is that there is no reason to believe that Costco's core business approach is suddenly going to collapse. So there is material long-term appeal here for investors who think in decades and not days. The only problem is that Wall Street isn't ignorant of the positives behind Costco's business. And investors often extrapolate good trends too far into the future.

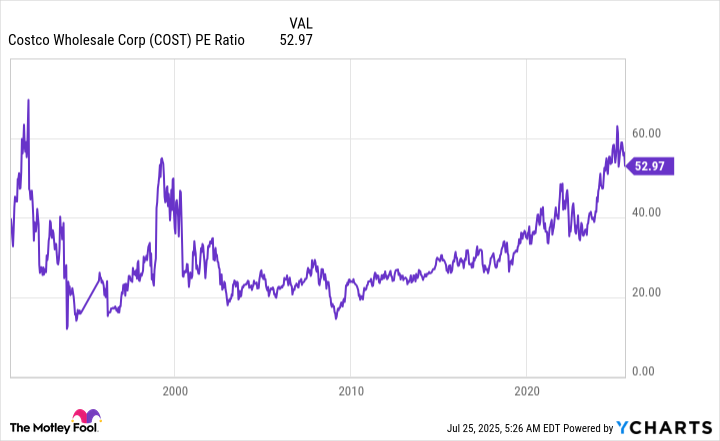

If you buy the stock and hold it long enough, Costco could grow into the current price-to-earnings ratio of roughly 52. But that P/E ratio is well above the five-year average of around 43. And it is near the highest levels in the company's history. This is currently an expensive stock to buy, a fact backed up by other traditional valuation metrics like historically elevated price-to-sales and price-to-book value ratios.

Data by YCharts.

For value-conscious investors, it would probably be better to put Costco on the wish list than the buy list. During a recession, Costco's performance will probably be relatively weak, and the stock will probably fall to more attractive levels. Such an outcome, however, won't really alter the strong core fundamentals of the club store's business, thus creating a short-term buying opportunity.

A great business, but be careful how excited you get

There's a tough call here. Do you buy a great company at a premium price and hold for the very long term? Or do you wait for a pullback, perhaps because of a recession or broad bear market, and buy at a lower valuation? There are very good reasons to like Costco, including its strong business performance, continued store base expansion, and the annuity-like nature of its membership fees. But anyone who cares about valuation will probably be better off waiting for a weak spell, preparing now for the emotional dissonance that will arise when you go in to buy when everyone else might be selling.