Occidental Petroleum (OXY 0.82%), also known as Oxy, is an energy company specializing in oil and natural gas exploration, production, and manufacturing. Operating in all three segments of the energy pipeline -- upstream, midstream, and downstream -- has made Oxy a fully integrated energy company.

On Aug. 6, Oxy will report its fiscal second-quarter earnings, marking a key date for a company whose stock has lost a quarter of its value over the past 12 months. For investors looking to buy the stock pre-earnings to take advantage of a potential post-earnings stock price jump, you might want to reconsider this thought process. I'll show you why.

NYSE: OXY

Key Data Points

Even good earnings haven't meant a stock price increase for Oxy

Oftentimes, having a mindset of "this good thing happened, so the stock should rise" or "this bad thing happened, so the stock should decline" can be counterproductive in stock investing. It might make logical sense, but unfortunately, the stock market doesn't operate on that logic.

Image source: The Motley Fool.

There has been no correlation between Oxy beating, meeting, or missing its earnings-per-share (EPS) estimates and its next-day (or even week) stock price movements.

In its last eight quarters, Oxy has beaten or met EPS estimates seven times, yet the stock only increased the next day three times. This indicates that investors are giving weight to factors other than earnings.

| Reported Quarter | Beat EPS Estimates? | Next-Day Stock Price Move |

|---|---|---|

| May 2025 | Yes | Up |

| Feb. 2025 | Yes | Down |

| Nov. 2024 | Yes | Down |

| Aug. 2024 | Yes | Up |

| May 2024 | Yes | Up |

| Feb. 2024 | Met | Down |

| Nov. 2023 | Yes | Down |

| Aug. 2023 | No | Down |

Source: AlphaQuery and YCharts.

Here's a key number investors should be focusing on when it comes to Oxy

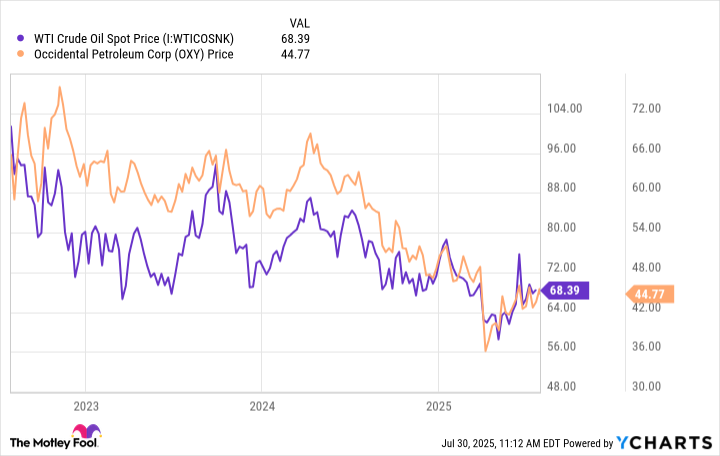

Earnings aside, one of the most important factors affecting Oxy's business (and how investors perceive it) is the West Texas Intermediate (WTI) crude oil prices. Simply put, the higher the WTI is, the more Oxy earns per barrel of oil because it sells most of its oil at a price tied to the WTI.

WTI Crude Oil Spot Price data by YCharts

Oxy's stock price and WTI prices follow a similar path, but you also don't want to buy the stock assuming you can anticipate how WTI prices will move, either. Ideally, you would acknowledge the correlation between the two, yet approach Oxy's stock with a long-term mindset.

Shares of Occidental Petroleum likely won't experience any hypergrowth that you sometimes see with flashy tech stocks, so the real value is unlocked by holding on to it for the long haul and taking advantage of its above-average dividend yield. If you're comfortable with that possibility, then by all means buy the stock before Aug. 6. If you're buying it before Aug. 6 strictly based on potential earnings, know that it's essentially a coin flip on how the stock price moves.