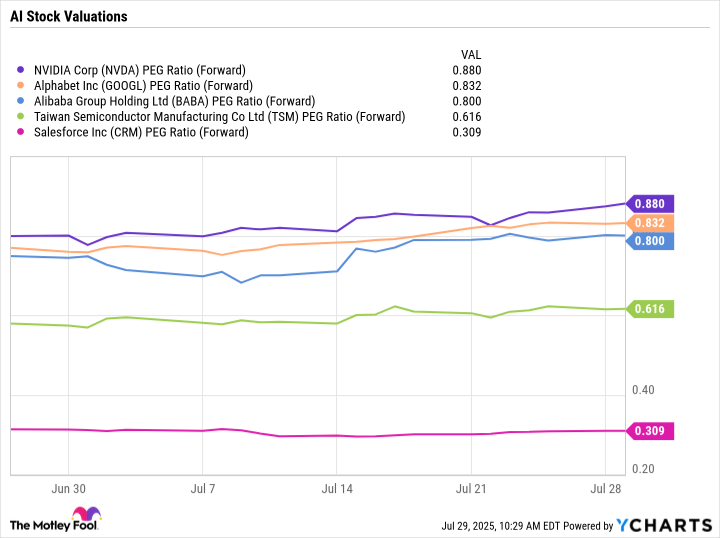

Tech stocks aren't usually the first place to look for value, but that doesn't mean you can't find undervalued ones. Currently, several top-tier tech names are trading with forward price/earnings-to-growth (PEG) ratios under 1 -- something that typically indicates a stock is undervalued relative to its growth. These aren't struggling companies, either. They are leaders in their fields with strong fundamentals, clear catalysts, and solid long-term upside.

Data by YCharts.

Here are five cheap tech stocks worth buying right now.

1. Nvidia (PEG: 0.9)

It's rare to see the market's top growth stock also sitting in value territory, but that's exactly where Nvidia (NVDA 0.44%) finds itself. With a forward PEG of under 0.9 and dominant market share in artificial intelligence (AI) chips, Nvidia remains one of the best long-term bets in tech. Despite the company's massive data center revenue growth over the past two years, there is still plenty of growth in front of the company.

The real differentiator for Nvidia is CUDA. Nvidia's early bet on building a software ecosystem around its graphics processing units (GPUs) has really paid off. Developers learned to code on CUDA, and tools and libraries were built around it, creating a powerful network effect that is hard to displace. This led the company to capture a staggering 92% share of the GPU market in Q1.

Nvidia isn't sitting still, either. The company has a huge automotive opportunity ahead and recently got approval to resume selling its H20 chips in China. The stock trades at a 41 times forward price-to-earnings (P/E) ratio, but when you're growing revenue at a huge clip and have this kind of moat, the PEG ratio tells the real story.

2. Taiwan Semiconductor Manufacturing (PEG: 0.6)

Taiwan Semiconductor Manufacturing (TSM +0.22%) is one of the most important companies involved in the AI infrastructure buildout. And at a forward PEG ratio of just over 0.6, it's also one of the cheapest high-growth stocks in the chip space. TSMC is the AI arms dealer, manufacturing the world's most advanced chips for companies like Nvidia, AMD, Broadcom, and Apple. It doesn't need to bet on a winner -- it manufactures chips for all of them.

NYSE: TSM

Key Data Points

TSMC's process node leadership is unmatched. Chips made on 7-nanometer or smaller nodes now make up 74% of revenue, and its 3nm tech already accounted for 24% last quarter. If you plan to make advanced AI chips at scale, you basically need to use TSMC at this point. This has led the company to have strong pricing power as well.

This could be seen in the company's Q2 results, with revenue surging 44% to $30.1 billion. Geopolitical and tariff risk is real, but TSMC is actively mitigating it with global expansion into the U.S., Japan, and Europe. AI demand continues to explode, and TSMC expects AI-related revenue to grow at a mid-40% compound annual growth rate (CAGR) through 2028. Trading at a forward P/E of under 25 times and a PEG well below 1, TSMC is a bargain.

3. Alphabet (PEG: 0.8)

Alphabet (GOOGL 0.80%) (GOOG 0.80%) is a dominant tech company trading like its search business is going away. At 19.5 times forward earnings and a PEG of 0.8, the stock is pricing in more risk than reality. Search isn't dying -- it's evolving, and Alphabet is leading that evolution with AI Overviews, AI Mode, and its Gemini models.

NASDAQ: GOOGL

Key Data Points

Search revenue actually accelerated last quarter, growing 12% to $54.2 billion in Q2. Over 2 billion people are now using AI Overviews monthly, and the company says those features are increasing query volume globally. Meanwhile, its cloud computing unit, Google Cloud, is growing like a weed. Revenue jumped 32% to $13.6 billion, while operating income more than doubled to $2.8 billion. The company's tensor processing units are gaining traction, and its Ironwood chip gives it a leg up on inference costs.

Alphabet is also building out its robotaxi business with Waymo, which is now live in multiple U.S. cities, and YouTube continues to deliver. Shorts are driving ad growth, and AI tools like Veo 3 are making content creation easier. It's even a leader in the emerging field of quantum computing with its Willow chip.

Alphabet is still growing earnings and revenue at a double-digit clip and remains one of the most attractively priced AI plays in the market.

4. Alibaba (PEG: 0.5)

Alibaba (BABA 3.23%) is absurdly cheap, trading at just 14 times forward earnings and a PEG ratio around 0.8. That would be interesting on its own, but the company also has nearly 30% of its market cap in net cash and investments. It's a textbook value stock with multiple growth levers in place.

Alibaba's AI story is quietly gaining momentum. Its Cloud Intelligence revenue jumped 18% last quarter, and AI-related revenue has now more than doubled for seven straight quarters. Apple even chose Alibaba's Qwen model to power Apple Intelligence in China, which was a major vote of confidence in its AI technology leadership.

Image source: Getty Images.

On the e-commerce front, Alibaba's gross merchandise value is reaccelerating, and it is better monetizing its platform with a small software fee and a new AI marketing tool. Its 88VIP loyalty program is expanding, and one-hour delivery is becoming a meaningful differentiator. The company also expects its international commerce unit to turn profitable soon, which could be a major boost to margins.

Alibaba has a lot of upside as its turnaround continues, but even if it stalls, the stock is so cheap that the downside looks limited.

5. Salesforce (PEG: 0.3)

Salesforce (CRM 2.75%) isn't typically considered a value stock, but perhaps it should be. With a forward P/E around 24 times and a PEG ratio of just 0.3, the stock is a bargain in the software-as-as-service (SaaS) space -- despite having a potential huge growth opportunity with AI agents.

NYSE: CRM

Key Data Points

Salesforce's Agentforce platform already has 4,000 paying customers just a few quarters after launch, and the company is working to become the leader in agentic AI. These agents can automate tasks across sales, service, and marketing, which could significantly increase productivity and reduce costs. When combined with its Data Cloud solution -- now generating $1 billion in annual recurring revenue -- the offering becomes even more powerful as Salesforce aims to build a digital workforce.

Salesforce is also rolling out a flexible, outcome-based pricing model for Agentforce to help drive adoption. It's a smart move that aligns costs with value and should help customers see a quick return on their investments. While there's execution risk, the company is already seeing early traction. At this valuation, Salesforce doesn't have to be perfect -- just good. If it hits on agentic AI, the stock could have a lot of upside.