Costco Wholesale (COST +0.58%) and Target (TGT +3.43%) are two of the most recognizable names in American retail. While both have been longtime winners for shareholders, their stocks have lost steam in recent months.

However, when established leaders hit a rough patch, it can create a timely opportunity to invest at a more reasonable price.

Let's take a closer look at the valuation, shareholder returns, and recent financial performance to see which of these retail giants looks like the better buy today.

Image source: Getty Images.

Does Costco or Target have a better valuation?

Valuation is critical in determining whether a stock is priced attractively relative to its earnings potential. It helps investors gauge whether they're paying a fair price, a premium, or a potential bargain.

Target and Costco are blue chip retailers, but the market values them differently.

Costco, up just 2% in 2025, carries a market capitalization of more than $413 billion -- nearly 3 times the $47 billion of Target, which has seen its stock fall 23% year to date. That gap reflects investor confidence in Costco's steady growth and recurring membership revenue, while Target continues to work through declining sales.

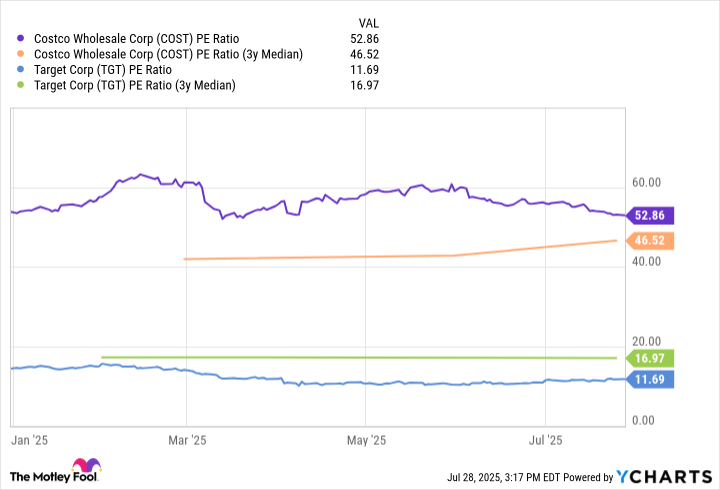

Costco trades at a trailing price-to-earnings (P/E) ratio of 52.8 -- well above its three-year median of 46.5 -- suggesting the stock may be richly valued. In contrast, Target trades at just 14.6 times trailing earnings, below its three-year median of 17, pointing to a potential discount.

While valuation alone doesn't tell the whole story, it's a meaningful starting point, and in this case, Target has the edge over Costco for investors looking for a discount.

COST PE Ratio data by YCharts

Returning capital to shareholders

Costco recently increased its quarterly dividend from $1.16 to $1.30 per share, its 21st consecutive annual raise -- bringing its yield to a modest 0.56%. While the yield may seem low, Costco has a track record of rewarding shareholders with sizable special dividends during periods of strong cash flow. In fact, it has issued five special dividends over the past 13 years, including a $15-per-share payout in January 2024. With a conservative payout ratio of just 20%, Costco has plenty of room to continue growing its dividend in the years ahead.

Target, meanwhile, is a Dividend King -- having raised its dividend for 54 straight years. Its most recent increase bumped the quarterly distribution from $1.12 to $1.14 per share, translating to a 4.4% yield, one of the most generous among major retailers. Notably, its 49% payout ratio leaves room for management to continue its tradition of dividend hikes.

When it comes to share repurchases, Target has been the more aggressive player. It bought back $251 million worth of stock last quarter and has reduced its outstanding share count by 9.3% over the past five years. However, with the stock trading near multiyear lows, some may question the effectiveness of those buybacks. Costco, by contrast, takes a more conservative approach, spending $215 million on repurchases last quarter, mainly to offset dilution. Over the past five years, its share count has remained essentially unchanged.

For income-focused investors, Target's generous yield and long-standing dividend track record are hard to beat. But its buyback strategy hasn't always delivered the intended value. Costco's disciplined approach, lower payout ratio, and history of special dividends offer a different kind of appeal. Ultimately, both companies prioritize rewarding shareholders, making this category a tie.

Recent financial performance and outlook

For the final, and arguably most important, category for future stock appreciation, let's examine each company's recent financial performance and near-term outlook.

Costco continues to deliver strong, consistent results. In its most recent quarter, the company reported $62 billion in revenue, an 8% increase year over year, driven by its 80 million paid household members. Net income rose 13% to $1.9 billion, and comparable sales (excluding the effects of gas prices and currency fluctuations) climbed 8%. E-commerce was particularly strong, growing 15.7%.

NASDAQ: COST

Key Data Points

While Costco doesn't provide formal financial guidance, CEO Ron Vachris expressed confidence heading into the final quarter of fiscal 2025, saying, "While the impacts of tariffs and the outlook for the economy in general remain unknown, we are confident in the ability of our operators and merchants to rise to the challenges and continue to offer great service and find consistent values for our members."

Vachris' confidence is supported by the company's membership renewal rates of 92.7% in the U.S. and Canada and 90.2% globally.

Target's latest quarter, by contrast, was more uneven. Revenue declined 2.8% to $23.8 billion, with comparable store sales down 5.7%. However, digital was a bright spot, with online sales up 4.7% thanks to a 36% increase in same-day delivery. Excluding a one-time legal settlement, adjusted earnings per share (EPS) came in at $1.30, down sharply from $2.03 the year prior.

NYSE: TGT

Key Data Points

CEO Brian Cornell acknowledged the challenges: "I want to be clear that we're not satisfied with this performance, and we're moving with urgency to navigate through this period of volatility."

Looking ahead, Target management expects adjusted EPS of $7 to $9 for 2025, compared to $8.86 in 2024 -- signaling continued uncertainty in the months ahead.

All told, Costco's consistent top- and bottom-line growth, strong digital momentum, and unmatched member loyalty give it a clear advantage in this category.

Which stock is the better buy?

Both Target and Costco have their strengths. If its turnaround efforts succeed, Target offers a higher dividend yield, cheaper valuation, and upside potential. On the other hand, Costco continues to deliver impressive growth, fueled by its membership model and global footprint.

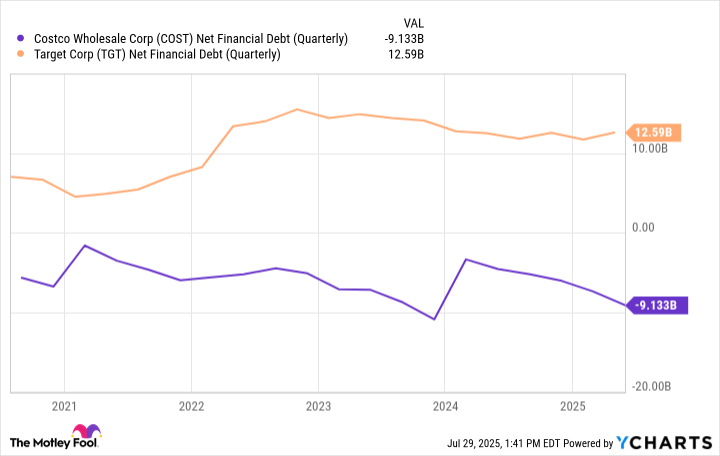

In a more uncertain economic environment, Costco's consistency and proven membership model make it the better buy for most long-term investors, especially considering that Costco has a stronger balance sheet with $9.1 billion in net cash versus Target's net debt of $12.6 billion.