Constellation Energy (CEG 2.35%) sells unregulated electricity directly to consumers and businesses, which makes it a competitive power producer. That's very different from a regulated utility, which would have a government-granted monopoly in the areas it serves.

There are good and bad things about Constellation Energy's competitive power focus; here are three things you need to watch if you are thinking about buying it today.

1. Constellation's business can be volatile

Regulated utilities are granted monopolies in the areas they service, but they have to accept having their rates and capital spending plans dictated by the government. Regulators try to find a balance between investor returns, reliability of supply, and customer cost. The end result is normally slow and consistent growth for regulated utilities in both good economic times and bad. Constellation Energy is more of a hit-or-miss type of business.

Image source: Getty Images.

While the company does tend to sign long-term contracts with customers, it is still far more reliant on market rates for power. So, good times can result in attractive revenue and earnings trends. But bad times can lead to difficult periods on the top and bottom line. Moreover, without government regulation, any investments Constellation Energy makes come with far greater risk if they don't end up working out as planned.

Before you invest in Constellation Energy, make sure you fully understand the variability inherent in selling electricity outside of the more traditional regulatory framework in which utilities operate.

2. Constellation's nuclear power is hot today

Constellation has focused on nuclear power, which does not produce greenhouse gases; it generates power at a consistent and high level (making it a strong baseload power source), and, once built, is a fairly low-cost energy option. Given that many clean energy power sources, like solar and wind, are intermittent, nuclear power is having something of a renaissance today. So, not only is 90% of Constellation Energy's power carbon-free, but that power is heavily biased toward nuclear.

This is a double win for Constellation Energy. Essentially, nuclear power can help to smooth out the ups and downs in supply from solar and wind. Or, conversely, it can be used to supply clean power to energy-intensive industries like data centers and artificial intelligence (AI). With demand for data centers ramping up, Constellation Energy is already inking big nuclear power deals with tech giants like Meta Platforms. This is good news, but investors will want to watch the data center and AI spaces closely if they buy Constellation Energy.

NASDAQ: CEG

Key Data Points

3. Constellation's valuation may be a problem

Even great businesses can turn into bad investments if you pay too much for them. Right now, Constellation Energy's dividend yield is a miserly 0.5% or so. In 2024, the yield was twice that level. The average utility stock has a dividend yield of around 2.8%. Looking at Constellation Energy's valuation a different way, the price-to-earnings ratio is over 30x right now. That would be high for a fast-growing technology company, let alone a company that produces and sells electricity.

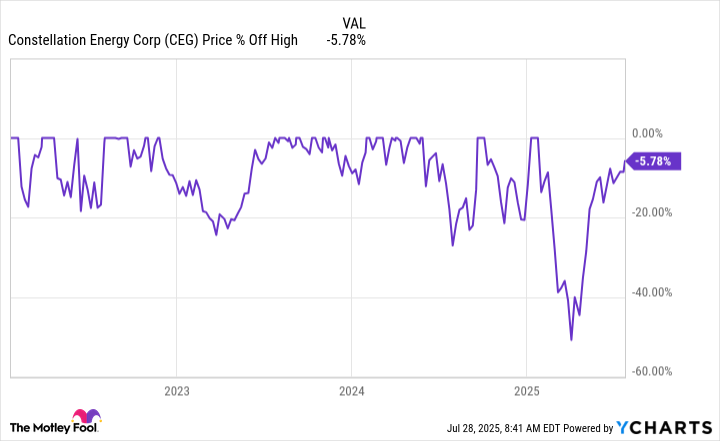

But here's the interesting thing. The stock pulled back by 50% earlier in 2025. And 25% drawdowns are pretty common, historically speaking. If you are looking at Constellation Energy right now, well, it seems a bit expensive. As noted, valuation matters when you buy a stock. But if you watch the price and valuation, history suggests you'll eventually find a better entry point.

Constellation Energy is probably a watcher, for now

Constellation Energy has an interesting business model that appears very well positioned right now, particularly on the nuclear power front. While those are important facts, so, too, is the price investors are paying for the stock. For most investors watching the valuation, this will probably be the best approach. The next pullback could be a chance to buy into the attractive long-term power story here. But you may only have the gumption to take advantage of the opportunity a sell-off presents if you prepare to buy ahead of time.