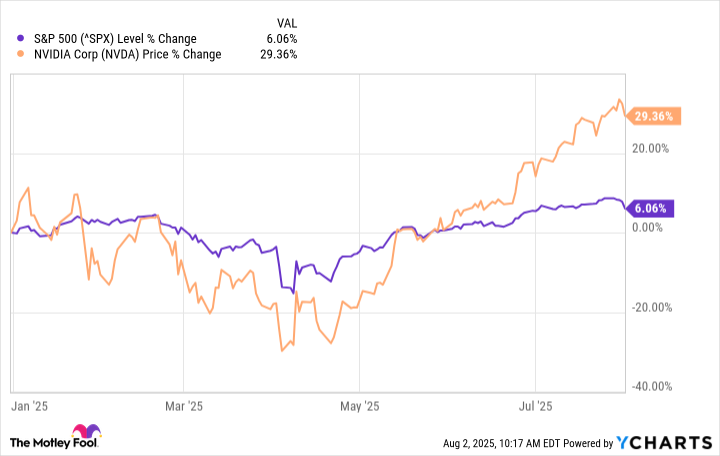

Nvidia (NVDA +2.92%) is the epicenter of the artificial intelligence (AI) boom. In 2025, it became the most valuable company on Earth, minting millionaires and reshaping global tech. But with shares trading at 56 times trailing sales and the stock far outpacing the S&P 500, investors have a tougher question to ask now.

Is Nvidia still a buy? Here's what the market is getting right -- and what it might be missing about this core AI stock.

Image source: Getty Images.

China changes everything for Nvidia's growth trajectory

A major shift in U.S. policy has reopened a crucial revenue stream for Nvidia. Regulators recently approved shipments of the company's H20 graphics processors to China -- just weeks after restricting their sale.

This reversal changes the calculus. Nvidia had taken a $5.5 billion write-down earlier this year, tied to unsellable China inventory, and analysts feared it had lost access to one of its largest AI markets. But with H20 shipments now cleared, Wall Street expects Nvidia to generate $5 billion in China revenue over the next two quarters -- and as much as $30 billion across fiscal 2027 and beyond.

Though the H20 is throttled to comply with export rules, it remains in high demand. China's aggressive AI buildout makes even these constrained chips valuable -- and for now, irreplaceable.

More strategically, this decision keeps Chinese AI firms tied to U.S. hardware and software infrastructure. Rather than pushing demand toward domestic alternatives like Huawei, the policy reversal reinforces Nvidia's dominance. It strengthens the company's competitive moat just as the global AI infrastructure buildout hits escape velocity.

The data center dominance story is far from over

Nvidia's evolution from a gaming chipmaker into the backbone of global AI infrastructure is one of the most successful pivots in corporate history. Its data center revenue surged from around $3 billion in fiscal 2020 to over $115 billion by fiscal 2025 -- a five-year run of hypergrowth few companies have ever matched.

And it's not demand that's holding Nvidia back -- it's supply. The company remains constrained by manufacturing capacity, with graphics processing unit (GPU) availability expected to stay tight through at least December. Cloud giants such as Microsoft (MSFT +0.40%), Amazon (AMZN +1.63%), and Alphabet (GOOGL +1.48%) show no signs of easing their AI infrastructure spending. Several customers have said they'd buy every chip Nvidia can deliver.

This demand is no longer just about training large models. While training powered Nvidia's early surge, the inference market -- where deployed models generate real-time outputs -- is emerging as a bigger, longer-term opportunity. As generative AI tools spread across industries, both training and inference workloads are growing fast, supporting Nvidia's multibillion-dollar revenue streams even as the market matures.

Competitive threats are real -- but contained

The most credible risk to Nvidia's dominance comes from intensifying competition, both from traditional chip rivals and cloud giants building their silicon. Advanced Micro Devices (AMD 0.06%) is ramping up its GPU lineup with the MI300 series, while hyperscalers such as Alphabet, Amazon, Microsoft, and Meta Platforms (META +0.59%) continue to roll out custom AI chips for internal use.

But hardware is only part of the story. Nvidia's moat is as much about software as it is about silicon. The company's Compute Unified Device Architecture platform powers nearly every major AI model in production today, and migrating those codebases to alternative stacks is costly, complex, and time-intensive. For now, most developers simply aren't willing to switch.

Then there's networking, a less flashy but equally critical layer of Nvidia's strategy. Large AI models don't run on stand-alone chips; they run on interconnected clusters of GPUs. Nvidia's NVLink interconnect and its InfiniBand-based networking gear (inherited from the Mellanox acquisition) allow these clusters to function as a single, cohesive AI engine.

This integrated stack -- chips, interconnects, software, and systems -- makes Nvidia more than a parts supplier. It's the orchestrator of modern AI infrastructure, and that role is far harder to dislodge than many assume.

Valuation reflects optimism, but fundamentals support a premium

At 56 times trailing earnings, Nvidia's stock isn't cheap by traditional metrics. However, these multiples must be viewed against robust growth and broadening market opportunity. The company delivered $130.5 billion in total revenue in fiscal 2025, up 114% year over year, with data center revenue alone reaching $115 billion. Gross margin simultaneously expanded to 75%.

The key question isn't whether Nvidia deserves a premium valuation -- it does given its dominant market position and growth prospects. Rather, investors must assess whether the current premium adequately reflects both the upside potential and inherent risks in the AI infrastructure buildout. The China policy reversal provides a concrete catalyst for near-term revenue acceleration, while growing use cases in automotive, robotics, and edge computing offer additional growth vectors beyond the core data center business.

Looking ahead, Nvidia's three-year GPU roadmap through 2027 demonstrates the company's commitment to maintaining its technological edge. With new architectures planned annually and processing capabilities expanding dramatically, Nvidia appears well positioned to stay ahead of both traditional competitors and in-house alternatives from hyperscale customers.

Early innings or peak hype determine the buy case

For investors considering Nvidia at current levels, the investment thesis boils down to one fundamental question: Is the AI revolution in its early innings or approaching maturity? The evidence suggests we're still in the opening act. China's market reversal, persistent supply constraints, and Nvidia's roadmap dominance through 2027 with Blackwell, Rubin, and beyond point to expanding opportunities that dwarf today's already massive market.

NASDAQ: NVDA

Key Data Points

The risks are real. Demand cyclicality, intensifying competition from hyperscalers building custom chips, and geopolitical uncertainties all merit careful consideration. Yet for investors convinced that artificial intelligence represents a generational shift, Nvidia's unique positioning at the intersection of hardware, software, and AI infrastructure makes it one of the most compelling ways to capitalize on this transformation.