Quantum computing is the next big technology that could change the world. It has massive implications for artificial intelligence (AI), as we're currently using traditional computing methods to train these models. While the results we've seen are impressive, they pale in comparison to what quantum computing can do.

Finding solid quantum computing stocks can be difficult, as there are multiple approaches and the technology is complex. However, I think there's one company that's well-positioned to drive massive quantum computing growth over the next decade, and the implications it will have in the AI realm will be massive.

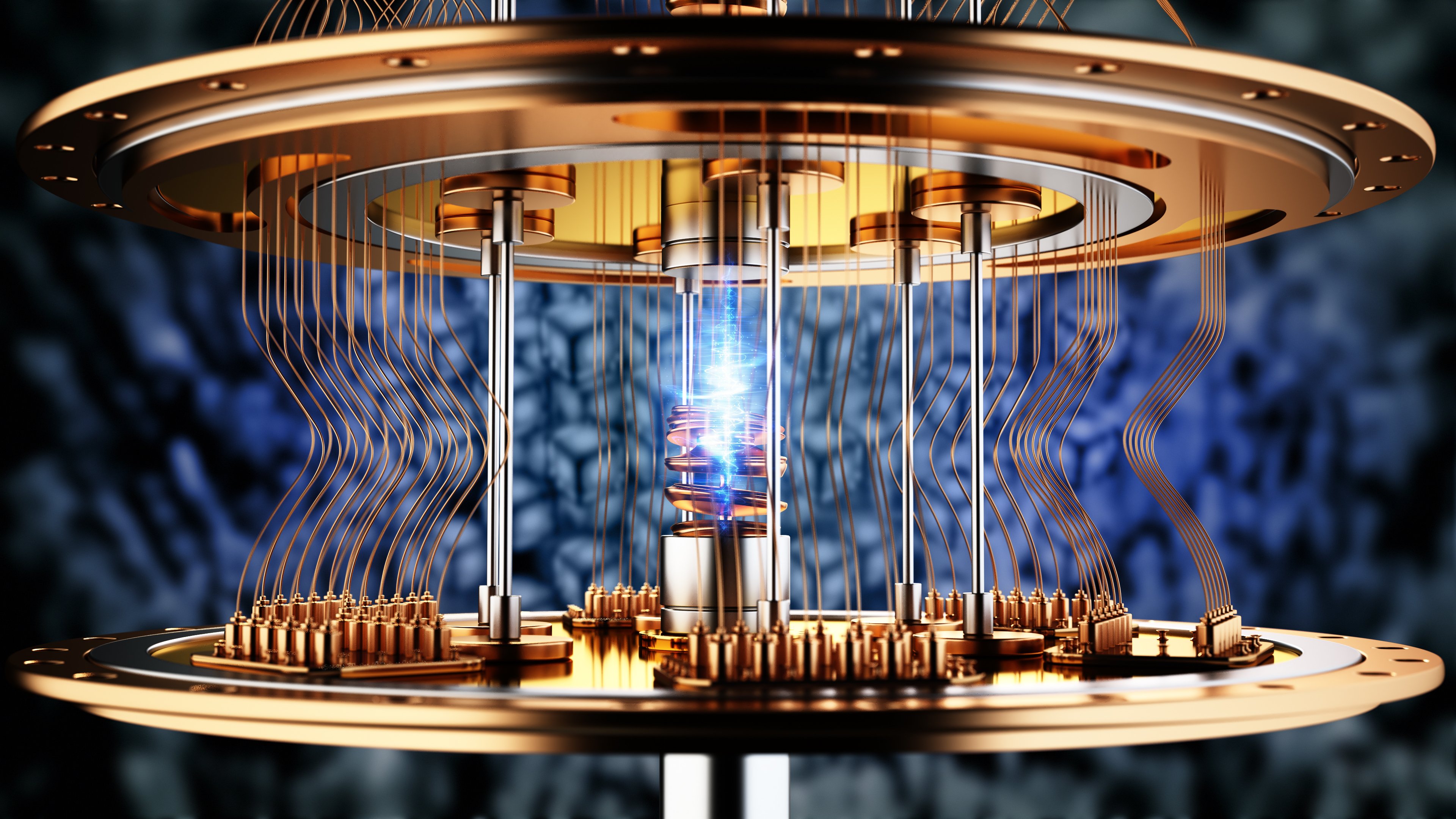

Image source: Getty Images.

IonQ's approach has a significant advantage over most of the competition

While there are many competitors in the quantum computing arms race, one that I think will be a huge winner is IonQ (IONQ 3.08%). IonQ is a pure-play quantum computing company, which means that it has no choice but to have success in the quantum computing realm or it will go bankrupt.

IonQ has several key partnerships in the research world, including the U.S. Air Force Research Lab, a facility renowned for investigating cutting-edge technologies. The Lab is also interested in how this technology can be deployed, so it keeps IonQ focused on the practicality of quantum computing rather than just theory.

IonQ's approach to quantum computing supports this goal, as it has several key advantages over its competitors. IonQ has chosen the "trapped-ion" approach for quantum computing. Most quantum computing companies are choosing the superconducting approach, regardless of whether they're a big tech competitor or a quantum computing start-up. Should the trapped-ion approach become the best option, IonQ will have a significant head start on the competition, as there are relatively few companies that have picked this approach.

The biggest advantage the trapped-ion approach has over superconducting is the temperature at which quantum computing is performed. Superconducting requires cooling the particle to near absolute zero, a very expensive process. The trapped-ion approach can be done at room temperature, which eliminates that cost completely. This could allow IonQ's quantum computing approach to achieve commercial viability faster than other options, making it an excellent pick in this space.

But it also has another key advantage over the superconducting approach.

NYSE: IONQ

Key Data Points

IonQ's market potential is massive

Quantum computers process information in qubits, rather than bits. Bits are straightforward, sending information as either a 0 or a 1. Qubits are better described as the probability of the information being a 0 or a 1. This is the key advantage of quantum computing, as it doesn't have to follow a linear path to arrive at an answer. This makes quantum computing ideal for tasks like drug discovery, weather forecasting, logistics networks, and potentially AI.

However, because the answer isn't exactly a 0 or a 1, qubits can introduce errors into a calculation. It's widely accepted that allowing qubits to interact with each other decreases errors. As a result, superconducting quantum computers usually arrange qubits in a grid to interact with each other to improve fidelity. The trapped-ion approach takes this one step further and allows every qubit to interact with each other, leading to industry-leading accuracy.

IonQ's approach makes me bullish on the stock, and it could deliver outstanding returns moving forward. IonQ estimates that the total addressable market will be $87 billion by 2035, which showcases the significant potential for IonQ.

Still, IonQ's method may turn out to have inherent flaws that haven't been discovered, and it could ultimately lose the quantum computing arms race. As a result, investors should keep IonQ to a fairly small position size, so it doesn't affect a portfolio too much if it goes to $0. However, if it turns out to be a success, that small percentage can transform into a massive winning position.