Modern organizations often use dozens, if not hundreds of digital applications in their day-to-day operations. This creates a nightmare for managers who have to collect data to compile progress reports or to comply with laws and regulations. But Workiva's (WK 0.57%) flagship platform eases that burden, and it's becoming very popular.

On July 31, Workiva reported a great set of operating results for the second quarter of 2025 (ended June 30), which sent its stock soaring by 32% the very next day. However, the stock is still trading 47% below its record high from 2021, when a frenzy in the technology sector drove it to unsustainable heights.

Wall Street is betting the recovery will continue. The Wall Street Journal tracks 12 analysts who cover Workiva stock, and they are overwhelmingly bullish on its prospects. Read on to learn more.

Image source: Getty Images.

Unifying data for the most complex organizations

Workiva's platform integrates with most systems of record, performance management software, cloud storage solutions, and accounting applications, allowing managers to extract data from all of them and view it on one dashboard. Therefore, they no longer have to open every digital software application individually. Whether employees are using Alphabet's Google Drive or Workday, data can be unified using Workiva.

This saves managers a significant amount of time, and it reduces human error because the data is extracted into Workiva directly from the source, rather than copied manually. The platform also offers hundreds of ready-made templates to help managers rapidly compile reports, whether they need to submit forms to regulators like the Securities and Exchange Commission, deliver critical information to clients, or update executives on internal projects.

Workiva is particularly popular among organizations with stringent compliance requirements, like those in banking, insurance, and even government. But in an attempt to broaden its potential customer base, Workiva expanded into the ESG (environmental, social, and governance) reporting space in 2021 to help companies comply with an expanding set of regulations around the world.

The ESG solution can help organizations create frameworks to track their carbon emissions, the diversity of their workforce, and the non-financial impacts on the societies in which they operate. ESG reporting requirements initially targeted large organizations, but new rules in regions like Europe are gradually capturing small and midsized enterprises, too, which creates a growing opportunity for Workiva.

NYSE: WK

Key Data Points

Workiva's revenue growth accelerated in Q2

Workiva generated $215 million in revenue during the second quarter of 2025, which was above management's forecast of $209 million (at the midpoint of the range). It represented a year-over-year increase of 21%, which was an acceleration from the 17% growth the company delivered in the first quarter three months earlier.

The strong result was attributable to two things. First, Workiva's net revenue retention rate rose to a multiyear high of 114%, which means existing customers were spending 14% more money than they were in the same quarter of 2024.

Second, Workiva had a record 6,467 customers at the end of the second quarter, which was a 5% increase from the year-ago period. However, the company's highest-spending customer cohorts with annual contract values of over $100,000, $300,000, and $500,000 grew significantly faster, highlighting Workiva's increasing popularity among large, complex organizations:

Image source: Workiva.

The strong second-quarter result prompted management to increase its full-year revenue forecast for 2025 to $871.5 million (at the midpoint of the range), from $866 million previously. This is a key reason Workiva stock popped 32% after the company's earnings report hit the wires last week.

Wall Street is overwhelmingly bullish on Workiva stock

The Wall Street Journal tracks 12 analysts who cover Workiva stock, and 10 of them have given it the highest-possible buy rating. The other two are in the overweight (bullish) camp, which means none recommend selling.

The analysts have an average price target of $94.10, which suggests Workiva stock can climb by a modest 11% over the next 12 to 18 months. The Street-high target is $105, implying a little more potential upside of 24%.

But Workiva stock could soar even higher than Wall Street's price targets over the longer term, because the company values its addressable market at a whopping $35 billion. It has barely scratched the surface of that opportunity based on its current revenue, and not to mention, its market capitalization is just $4.7 billion right now.

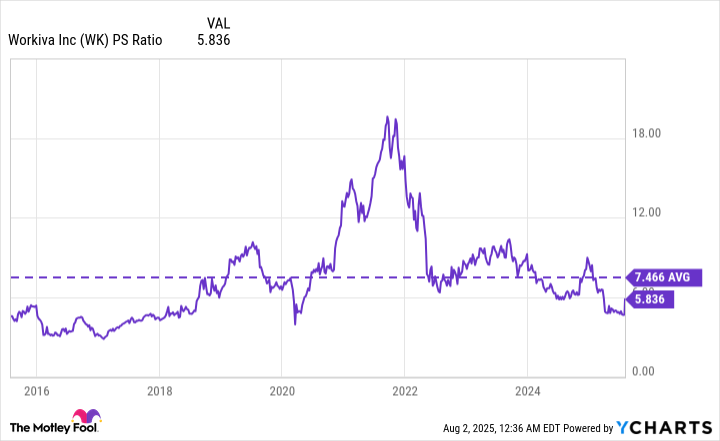

This might be a great entry point for long-term investors, because despite last week's surge, the stock is trading at a price-to-sales (P/S) ratio of just 6.1 -- a discount to its 10-year average of 7.4:

WK PS Ratio data by YCharts

When you combine Workiva's accelerating revenue growth, its sizable addressable market, and its attractive valuation, the stock looks like a solid long-term buy.