When you think of stock market success, it's hard not to think about Warren Buffett. Buffett, known as the Oracle of Omaha, has been at the helm of Berkshire Hathaway (BRK.A 0.72%)(BRK.B 1.14%) since 1965 but plans to retire at the end of this year at the age of 95.

Since Buffett has been the head of Berkshire, it has been one of the stock market's most consistent top performers. From 1964 to 2024, Berkshire has outperformed the S&P 500 (^GSPC +0.03%), returning more than 5,500,000% compared to the index's roughly 39,000% (and that's including reinvested dividends). This averages out to 19.9% and 10.4% annual returns, respectively.

With Buffett leaving the keys to Berkshire to Greg Abel at the end of the year, many may wonder if Berkshire will continue to be the juggernaut it has been during the past six decades. In my opinion, the answer is yes, and I'm still all in on the stock.

NYSE: BRK.B

Key Data Points

Buffett handpicked Greg Abel to succeed him

Investors have grown accustomed to trusting Buffett's investing moves, and I plan to take the same approach, trusting him to leave Berkshire in great hands with Abel. Abel is currently the chairman of Berkshire Hathaway Energy (BHE) and vice chairman of Berkshire's non-insurance operations and has been with the company since 2000.

Abel's experience lets me know that few, if anybody, are as qualified to follow up Buffett. At Berkshire's annual meeting in May, Buffett even said that "Greg will be more successful than I have been." Admittedly, part of Buffett's job on the way out is to instill confidence in investors, but I firmly believe Buffett wouldn't have handpicked Abel if he didn't feel as though he is more than capable of continuing the company's historical success.

Under Abel's leadership, BHE has tripled its earnings, and he has overseen more than $16 billion in acquisitions.

Berkshire's large cash pile leaves it with a lot of financial flexibility

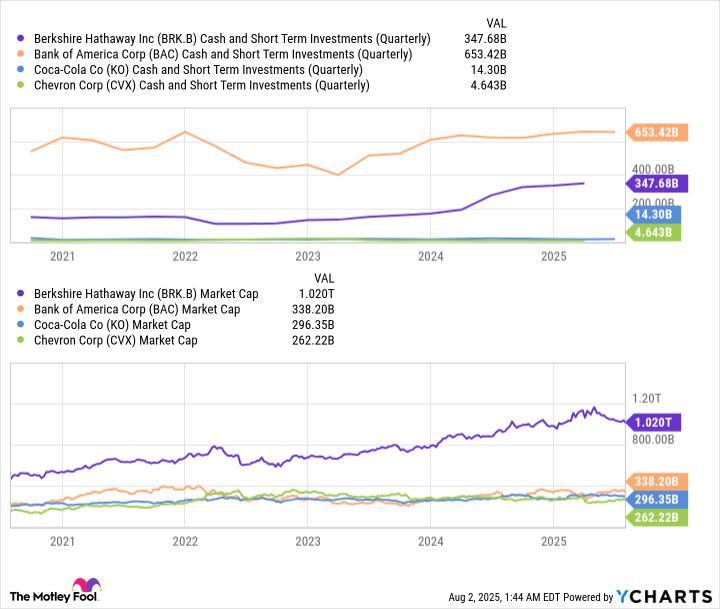

Berkshire is known for its acquisitions and stakes in public companies, but it has slowed down on both during the past couple of years. At the end of the first quarter, Berkshire had more than $347 billion in cash, cash equivalents, and short-term U.S. Treasury bills. That's more than the individual market caps of Bank of America, Chevron, and Coca-Cola (three of Berkshire's top five stock holdings).

BRK.B Cash and Short Term Investments (Quarterly) data by YCharts

This large cash pile leaves Abel with a lot of financial flexibility once he takes over. I wouldn't expect him to deploy the cash for the sake of doing so, but it does leave the door open for potential opportunities, stock buybacks, and potentially a future dividend (something Berkshire has never paid).

Buffett's core businesses operate without his interference

Buffett is known for letting the leaders of Berkshire's subsidiaries -- Geico, BHE, BNSF Railway, Pilot Travel Centers, and a handful of others -- operate without interfering in their day-to-day operations. This means that even without Buffett leading the way, these businesses should continue running smoothly under their current leadership.

This approach has been a longtime strategy in Berkshire's business. By removing the need to seek Buffett's approval or falling victim to unneeded corporate bureaucracy, these businesses are able to make quick decisions and lean on the respective experts in each field. I don't expect this to change.

Berkshire makes billions without lifting a finger

With a large stake in so many public companies, Berkshire has positioned itself to make billions solely from dividends. Below are its top five holdings and how much it can expect at those companies' current quarterly dividends:

| Company | Shares Owed | Quarterly Dividend | Dividends Received Quarterly |

|---|---|---|---|

| Apple | 300,000,000 | $0.26 | $78,000,000 |

| American Express | 151,610,700 | $0.82 | $124,320,774 |

| Bank of America | 631,573,531 | $0.28 | $176,840,588 |

| Coca-Cola | 400,000,000 | $0.51 | $204,000,000 |

| Chevron | 118,6110,534 | $1.70 | $201,637,907 |

Data source: Berkshire Hathaway 13F filing. Share amounts as of March 31.

From just five holdings, Berkshire receives more than $784 million in quarterly dividends. Annually, that's more than $3.1 billion, which is more than many S&P 500 companies earn in revenue. This is income that grows over time as companies increase their annual payouts, and it doesn't require any operational oversight on Berkshire's behalf.

The dividend is just one part of the equation that makes me confident in loading up on Berkshire, regardless of who's leading the charge. It's a powerful conglomerate built for long-term success.