Apple (AAPL +0.82%) is one of the most valuable companies in the world, with a market cap of $3 trillion. With around 1.5 billion active iPhone users worldwide, it has a massive userbase, which is connected to its vast and growing ecosystem. Warren Buffett once referred to Apple as one of the best businesses he's ever known.

Yet, despite all its success, accolades, and seemingly terrific growth prospects, the stock has been struggling this year, down by 19% as of the end of last week. While the company has been falling behind in the race to develop artificial intelligence (AI) capabilities, is that enough of a reason to justify such an underwhelming performance? Or could Apple be one of the best tech stocks to buy right now, given its reduced valuation?

Image source: Getty Images.

Is Apple's business heading in the right direction?

A challenge for Apple in recent years has been its diminishing growth rate. With a troubling AI rollout that has resulted in the company delaying features, there hasn't been a strong upgrade cycle with users buying new iPhones. There hasn't been an overwhelming reason to do so, especially if people are anticipating new AI features on the horizon; there's been arguably more of a reason to wait.

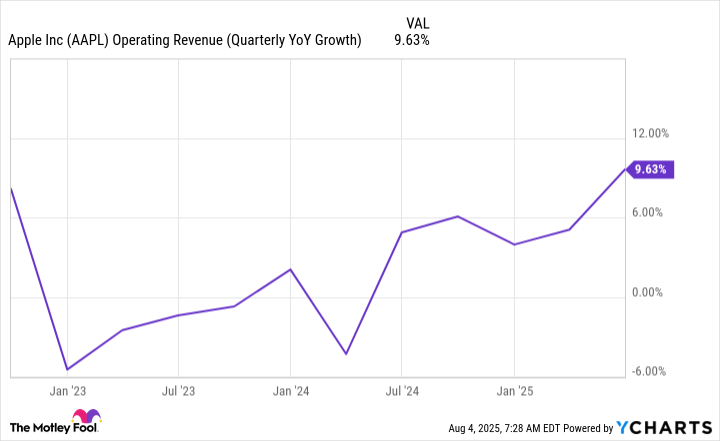

The company recently reported earnings, and it did experience an unusual uptick in sales, with its top line rising by close to 10%.

AAPL Operating Revenue (Quarterly YoY Growth) data by YCharts.

For the period ending June 28, iPhone sales rose by 13%. But a big reason for that is likely to do with tariffs. The fear of rising prices in the future may have resulted in many people deciding to upgrade their devices sooner rather than later. Thus, it wasn't necessarily innovative new products that pushed demand up, but rather, a fear of challenging macroeconomic conditions ahead. As a result, investors haven't been buying up Apple's stock despite the seemingly strong growth -- the best the company has achieved in multiple years.

The good news is that the company's revenue may be stronger next year. Apple is launching a new foldable phone (without creases), which may give customers an exciting new product to buy.

Just how cheap is Apple stock today?

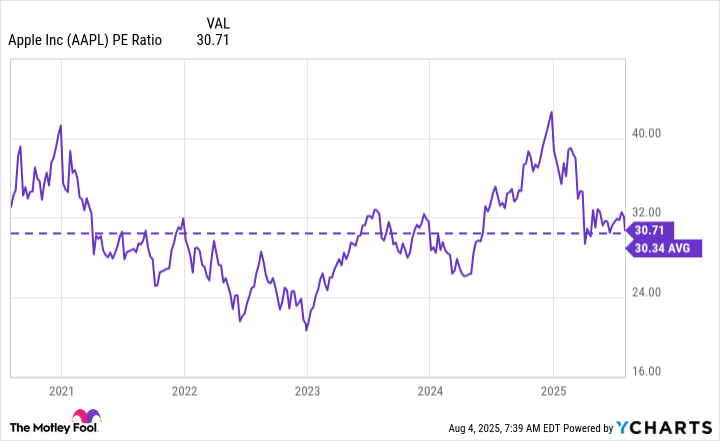

There's little doubt about how strong Apple's business is. This is still a company that generates more than $400 billion in annual revenue, with excellent profit margins of around 24%. The big question, however, is whether the stock is too expensive, especially if its growth rate may not be all that high going forward. Shares of Apple are down big this year, and that has pushed the stock's price-to-earnings multiple down to around its five-year average.

AAPL PE Ratio data by YCharts.

Apple is still nowhere near its 52-week low of $169.21, which it reached in April when U.S. President Donald Trump announced reciprocal tariffs. But the consensus analyst price target for the stock is set to around $237, indicating that analysts do see Apple rising by around 17% in value from where it is right now.

NASDAQ: AAPL

Key Data Points

Should you buy Apple stock today?

Apple's stock has been having a challenging year in 2025. With a vast user base and the business expanding its array of services over the years, there's still room for the company to become much larger in the future. But at 30 times its earnings, I can understand the apprehension from investors in buying the stock, as that's a steep multiple for a company where double-digit sales growth may simply not be the norm.

While it's still a good business to invest in for the long term, I don't think Apple's valuation is cheap enough where there's enough margin of safety to make it worth buying, given the uncertainty around tariffs and the economy. Although it's down this year, the stock is by no means a bargain.