Five years ago, the world was in the thick of the COVID-19 global pandemic, bringing Pfizer (PFE 1.08%) into the spotlight because of the role it played in developing the COVID-19 vaccine with its partner BioNTech. It was able to get U.S. Food and Drug Administration (FDA) approval for its COVID-19 vaccine on Dec. 11, 2020, and it was released on Dec. 14, 2020.

Image source:???

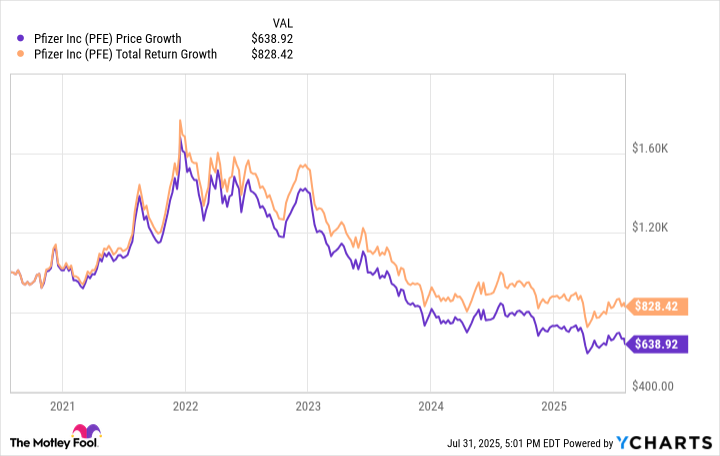

From mid-2020 to late 2021, Pfizer's stock skyrocketed, but since hitting its peak, it has reversed course. Had you invested $1,000 into Pfizer's stock on Aug. 1, 2020, your investment would only be worth around $638 as of Aug. 1, 2025. Pfizer's dividend would've cushioned some of the blow, but an investment then would still be less than your initial investment, at $828.

Why has Pfizer's stock struggled the past few years?

Much of Pfizer's stock price troubles since hitting its Dec. 21 peak come down to a decline in demand for its COVID-19 vaccine and treatments, anticipated patent expirations on drugs like Ibrance (breast cancer) and Eliquis (blood clots), and an underwhelming pipeline. All isn't lost with Pfizer's stock, however.

NYSE: PFE

Key Data Points

At its current levels -- trading at 7.7 times forward earnings -- Pfizer seems to be flirting with bargain territory. I don't expect a quick turnaround, but this low valuation gives it more long-term upside than downside. It also helps that the stock's dividend yield sits above 7.3%, more than 5.5 times the S&P 500 average.