I'll be the first to admit that seeing the price increase on your stocks can be exciting. It's a simple mental equation: This stock has risen X% since my investment, so I've made a X% profit. That said, I also appreciate the guaranteed income that comes from investing in dividend stocks.

The stock market is notably irrational, and prices can swing either way without much logic. However, with dividend stocks, you can be sure to receive your quarterly or monthly payout regardless of stock price movements. That can relieve some of the unpredictability that comes with investing in stocks.

To further reduce unpredictability and risk, I encourage people to consider investing in a dividend-focused exchange-traded fund (ETF), as many provide dividend yields comparable to individual stocks and have much less uncertainty. If you have $100 available to invest, I'd recommend considering the Schwab U.S. Dividend Equity ETF (SCHD 0.45%). Let's take a look at why.

NYSEMKT: SCHD

Key Data Points

SCHD is careful with the companies it includes

Some dividend ETFs will include companies solely based on their dividend yield. While this isn't inherently an issue, it does mean that companies with unsustainable dividends or weak fundamentals sometimes get included. However, SCHD has a more rigorous set of criteria for choosing the companies it holds.

To be included in SCHD, a company must have a strong balance sheet and consistent cash flow, a history of annual dividend increases, and at least 10 years of dividend payouts. Because of the criteria, SCHD leans more toward companies in value-oriented sectors. These are the major sectors represented:

- Energy: 19.23%

- Consumer staples: 18.81%

- Healthcare: 15.53%

- Industrials: 12.50%

- Information technology: 9%

- Financials: 8.91%

- Consumer discretionary: 8.38%

- Communication services: 4.52%

- Materials: 3.07%

- Utilities: 0.04%

Companies in sectors like energy, consumer staples, healthcare, and industrials tend to generate reliable cash flow, which is what you want from dividend stocks.

A solid dividend payout for a broad ETF

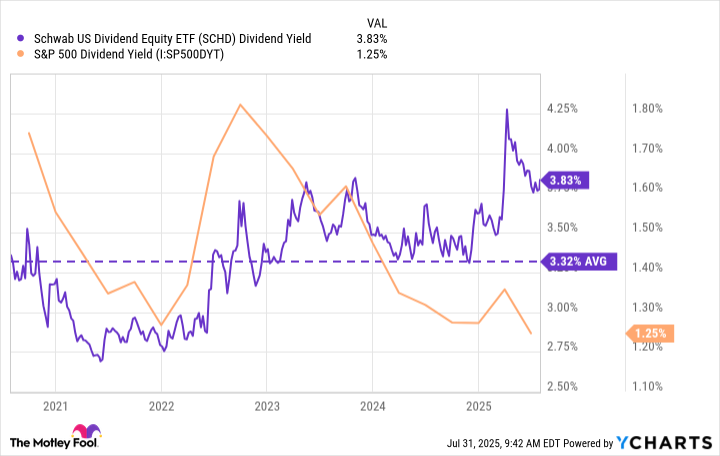

The quarterly payout from SCHD will fluctuate because different companies pay out their dividends on different schedules. Even then, SCHD has maintained an impressive dividend that's routinely at least double the S&P 500's average.

SCHD Dividend Yield data by YCharts

At its current 3.8% yield, a $100 investment could pay out $3.80 annually. This obviously isn't life-changing money, but it's a start and can compound as you reinvest dividends to buy more shares and get higher payouts. Starting small and staying consistent can work wonders in the stock market.

In the past decade, SCHD has increased its quarterly dividend by over 160%. This could be the gift that keeps giving. And its 0.06% expense ratio -- one of the lowest in its category -- means you can keep more of your gains and payouts to yourself.

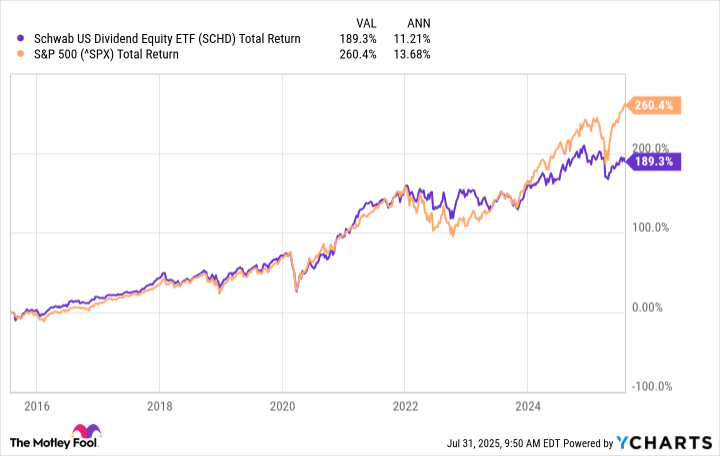

SCHD has underperformed the S&P 500, but is great for income

Over the past decade, SCHD has underperformed the S&P 500, averaging 11.2% annual total returns compared to the index's 13.6% average.

SCHD Total Return Level data by YCharts

At first glance, this may suggest that investors should skip SCHD and go straight to an S&P 500 ETF, but that doesn't tell the full story. For investors looking for income, SCHD could still be a great choice because of its consistent (and growing) payouts and its ability to return value without relying on stock price appreciation.

The S&P 500 will generally outperform SCHD during bull markets, but SCHD tends to hold up better during market down periods, still delivering its attractive dividend. SCHD is an ETF that income investors can feel comfortable holding on to for the long haul.