The smartest investors don't flock to hot sectors without taking into consideration the opportunities and the risks. If you are looking for a Vanguard exchange-traded fund (ETF) to buy today, with $1,000 or $10,000, you could invest in tech stocks -- or you could buy into a sector that's supplying something vital to the technology sector.

Here's why conservative investors, income investors, and even growth investors may want to buy the Vanguard Utilities Index ETF (VPU 0.47%) today.

Utilities are boring, right?

Utilities used to be called "widows and orphans" stocks because they were so boring and reliable, and the income they produced could be used to pay for living expenses. The dividend story remains -- the Vanguard Utilities ETF's roughly 2.8% dividend yield is more than twice that of the S&P 500. (For reference, the Vanguard 500 ETF is an S&P 500 clone if that interests you.)

Image source: Getty Images.

The boring part isn't quite the same as it used to be, however. But that's not because the utility business has suddenly become erratic. Regulated utilities still provide services that are vital to modern life, and they remain reliable businesses with monopoly operations and government overseers. The difference is that growth is likely to be a more important part of the story than it has been historically.

To put some numbers on that, demand for electricity grew a total of 9% between 2000 and 2020. But the world is becoming more and more dependent on technology, which has increased the demand for electricity and will likely continue to do so. That's why electricity demand is expected to grow by over 50% between 2020 and 2040. Big drivers are technologies like artificial intelligence, data centers, and electric vehicles.

The key is that this isn't a one-year trend. Rising electricity demand will play out over decades, and that means there's a long-term opportunity for investors. But what utility stock should you buy? You don't need to pick -- you can just buy the Vanguard Utilities Index ETF and get diversified exposure to the entire utilities sector.

NYSEMKT: VPU

Key Data Points

What does the Vanguard Utilities Index ETF do?

To be fair, the Vanguard Utilities Index ETF is not an exciting exchange-traded fund. It invests in utilities, which are fairly boring. And it is just an index fund, so it isn't actually doing anything special. But boring is good for some investors, particularly those with an income focus.

Technically, this ETF tracks the MSCI US Investable Market Utilities 25/50 Index.That sounds fancy, but it really isn't. The 25/50 is simply a reference to diversification requirements. The ETF just provides a diversified portfolio of electric, natural gas, water, and independent power companies. That said, electricity is a key component at around 90% of the portfolio, so this is a direct play on electricity demand growth.

With an expense ratio of around 0.09%, it's a pretty low-cost way to invest in the utility sector. It's a well-diversified choice for investors who want a fairly conservative income-oriented investment with some long-term growth tailwinds behind it. That's going to appeal to a lot of people. A $1,000 investment will net you around five shares of this ETF.

What if the growth doesn't play out as expected?

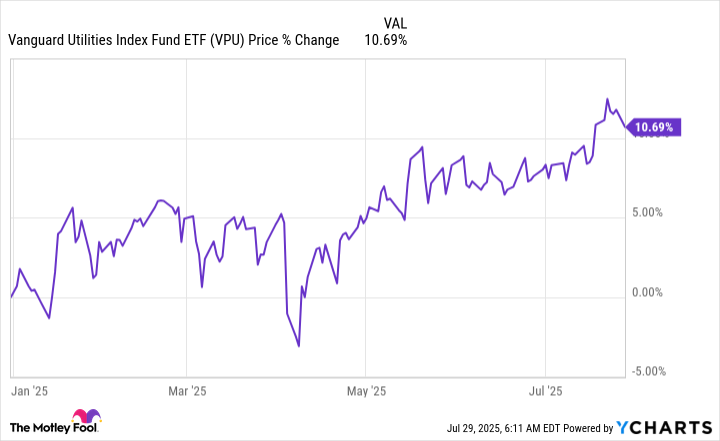

The big risk right now is that the growth that Wall Street expects in the utility sector doesn't materialize. After all, the Vanguard Utilities Index ETF is up around 10% so far this year, which is pretty good for a utility. While it is possible that growth will stall out for the sector, that seems pretty unlikely given the long-term trends and the importance of power to technology.

Sure, the Vanguard Utilities Index ETF could pull back in the near term, but then there's the well-above-market dividend yield to fall back on. That will help keep you invested to take advantage of the long-term growth opportunity. So even in a worst-case scenario, most investors will still have something to appreciate here as they wait for electricity demand to grow over the coming decades.