Five years ago, the country was just a few months into the COVID-19 pandemic. Many businesses remained closed to in-person customers, and those that were open generally had restrictive social-distancing and capacity policies.

This created a massive problem for real estate investment trust (REIT) EPR Properties (EPR -2.20%), which owns a portfolio of experiential properties, such as waterparks, eat and play businesses (TopGolf is a major tenant), ski attractions, and movie theaters. When the pandemic hit, EPR's tenants were all initially closed, and many weren't paying rent.

Image source: Getty Images.

As you might have expected, EPR's stock tanked in 2020. At one point, it has fallen more than 80% from its prior high.

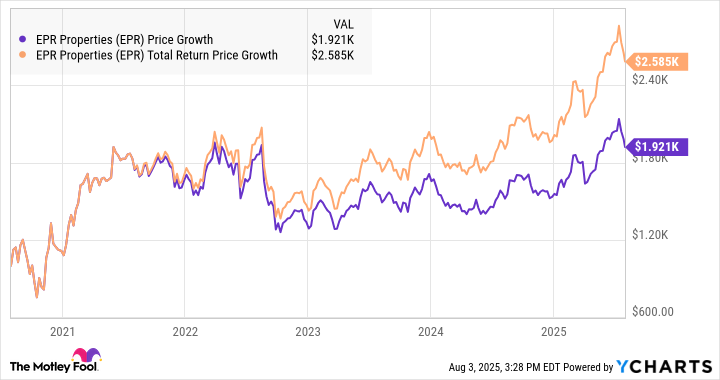

However, there was a major inflection point in late 2020 when vaccines were rolling out and investors saw light at the end of the tunnel. If you had invested $1,000 in EPR Properties five years ago (early August 2020), your investment would have grown to nearly $2,600 today, thanks to a combination of stock-price gains and dividends, which EPR resumed paying in mid-2021.

In fact, EPR has outperformed the S&P 500 benchmark index by more than 50 percentage points over the past five years, and its performance translates to an annualized return of about 21%.

Could EPR Properties still be cheap?

Despite its excellent performance, EPR trades for a relatively cheap valuation of about 10.8 times its full-year guidance for funds from operations (FFO -- the real estate equivalent of earnings). There's still some uncertainty surrounding the future of the movie theater business, but the main reason is the persistent high-interest-rate environment.

If rates fall, it could create a more favorable growth environment for EPR to pursue its massive market opportunity. The stock could still be a bargain, despite its excellent performance.