Lowe's Companies (LOW +2.15%) has been a staple in the stock market for a while, especially for investors interested in dividends. It has increased its annual dividend for 53 consecutive years, joining the exclusive Dividend Kings club (the name given to companies with at least 50 years of consecutive dividend increases).

NYSE: LOW

Key Data Points

Unfortunately, through Aug. 1, Lowe's stock is down over 8% year to date, and down over 5% in the past 12 months. The S&P 500, which serves as the stock market's main benchmark, is up over 6% and 20% in those timeframes, respectively.

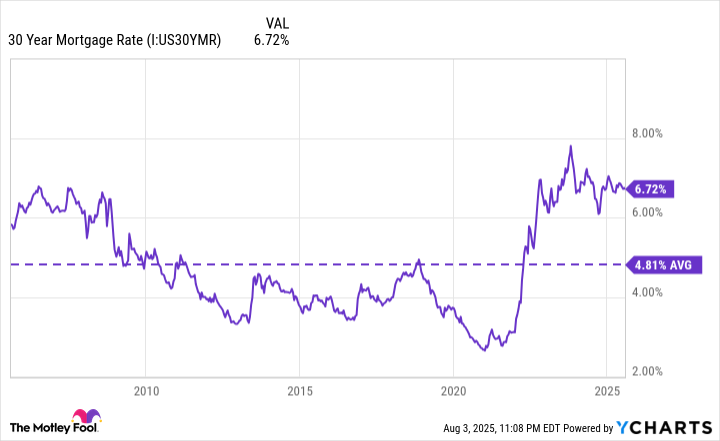

Despite Lowe's lagging stock over the past year, there's one key reason to watch it through the rest of 2025: high interest rates. High rates affect things like credit cards, personal loans, auto loans, and, most notably in Lowe's case, mortgages. At the time of this writing, the average 30-year fixed mortgage rate is 6.72%, well above its 4.81% average over the past 20 years.

30 Year Mortgage Rate data by YCharts.

High interest rates have made purchasing homes much less attractive and the overall housing market much more challenging for both sellers and buyers. This has caused homeowners to opt for renovating their current homes instead of buying new ones.

Image source: Getty Images.

With Lowe's focused on providing home improvement products and services, it stands to gain a lot from the shift in homeowners' spending toward renovations and do-it-yourself projects. This trend hasn't been favorable to Lowe's stock over the past year, but its business could see a boost if mortgage rates remain high.