Energy is one of the highest-yielding stock-market sectors. Many oil and gas companies pass along a considerable amount of their profits to shareholders through dividends, which can help offset the inherent volatility of energy markets. However, a dividend is only as reliable as the company paying it, so it's best to focus on dividend quality over dividend quantity.

ExxonMobil (XOM 2.06%), Chevron (CVX 1.53%), and Cheniere Energy Partners (CQP 0.71%) are unique in that they offer high dividend yields and reliable payouts. By investing $7,500 into each stock, you can expect to generate at least $1,000 in passive income per year.

Here's why all three dividend stocks are worth buying now.

Image source: Getty Images.

For passive income, look to the oil patch and pick up shares of ExxonMobil

Scott Levine (ExxonMobil): While it's critical to keep your eyes on the future when evaluating potential stock buys, it's also worthwhile to dig into a company's previous performance. In doing so with ExxonMobil, it's readily apparent that the company has created a culture supportive of consistently rewarding shareholders -- a valuable quality for those looking for a long-term dividend opportunity. For this and other reasons, now's a great time for investors to grease the wheels of their passive-income machines with ExxonMobil and its 3.6% forward-yielding dividend.

For 42 consecutive years, ExxonMobil has hiked its dividend higher -- and I'm not talking about nominal increases. From 1982 to 2024, ExxonMobil has boosted its payout at a near 6% compound annual growth rate (CAGR). Of course, there's no certainty that ExxonMobil will continue to maintain the same cadence with dividend hikes, but the company's strong growth prospects suggest that it's well-positioned to extend the trend of dividend hikes.

In 2024, ExxonMobil reported $55 million in cash flow from operations. Management projects that expanding liquid natural gas (LNG) production, as well as oil production from assets in the Permian basin and Guyana, along with a projected $6 billion in cost reductions have the potential to help the company grow operational cash flow by about $30 billion by 2030.

For those interested in placing ExxonMobil on their watch lists, it's important to recognize that the company is subject to ups and downs stemming from energy prices, so investors must be comfortable with enduring potential volatility. But with ExxonMobil's five-year average payout ratio of 77.4%, management has proven that it's adept at balancing the company's financial health with rewarding shareholders.

NYSE: XOM

Key Data Points

Chevron's upstream portfolio just got a massive jolt

Daniel Foelber (Chevron): Chevron's acquisition of Hess boosts the integrated oil major's exposure to U.S. onshore assets and gives it a stake in a consortium that's developing Guyana's rich offshore reserves. It's a deal that will significantly boost Chevron's free cash flow and, in turn, provide a runway for earnings and dividend growth and stock repurchases.

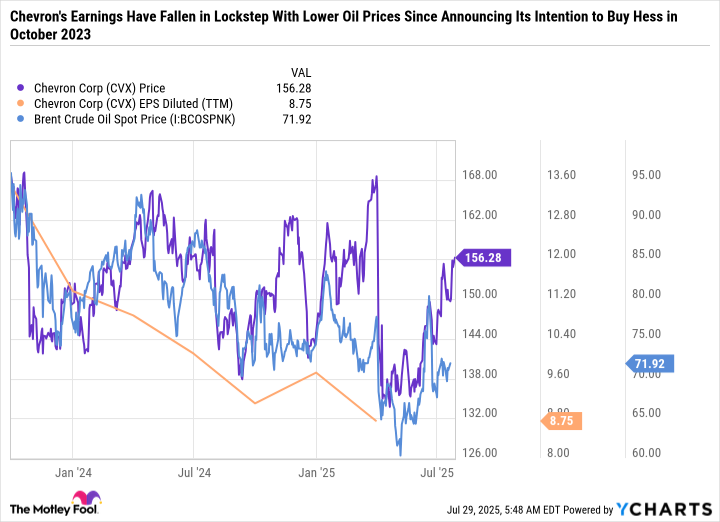

However, a lot has changed since Chevron announced its intent to buy Hess in October 2023. Brent crude oil prices (the international benchmark) have fallen from the mid-$90 per-barrel range to the low $70 per-barrel range. Meanwhile, Chevron's stock price has also ticked down despite what's been a rapid run-up in the S&P 500 (^GSPC +0.54%).

As you can see in the following chart, Chevron's earnings have also been falling in lockstep with lower oil prices.

If Chevron had been able to acquire Hess in today's market, it might have been able to pay a more attractive price. However, the deal should still pay off in the long run.

For starters, Chevron has the balance sheet and free cash flow to make it work. In recent years, it reduced its leverage and ramped up buybacks -- with plenty of cash left over to continue boosting its dividend.

Hess offers Chevron a way to diversify its production portfolio. Like its peer ExxonMobil, Chevron has been growing production in the largest onshore oil and gas field in the U.S. -- the Permian Basin. However, it has also been investing in U.S. offshore production, international production in Kazakhstan, West Africa, and the Eastern Mediterranean, and LNG in Australia.

Guyana has geological conditions and rich reserves that should provide a low development-cost profile, increasing the overall quality of Chevron's portfolio. In fact, ExxonMobil (which holds a 45% stake in the Guyana consortium, compared to a 30% stake for Chevron) has identified Guyana as one of its best long-term assets, along with the Permian Basin and LNG.

All told, the Hess deal should help Chevron accelerate its earnings growth without impacting its ability to increase its dividend steadily. Chevron sports a 38-year streak of raising its dividend. The stock yields 4.5% at the time of this writing, which is sizable, relative to the mere 1.2% yield of the S&P 500.

Chevron is also a great value, with a price-to-earnings ratio of 17.9. However, it's worth understanding that this metric is based on Chevron's trailing-12-month earnings -- which coincided with fairly mediocre oil and gas prices and a challenging refining operating environment. Chevron could look even cheaper if prices recover and it benefits from the added production from Hess.

All told, Chevron stands out as a compelling high-yield dividend stock to buy now.

A high-yield stock favored by current events

Lee Samaha (Cheniere Energy Partners): The recent trade deal between the European Union (E.U.) and the United States included an agreement for the E.U. to acquire $750 billion in energy exports through 2028. That's excellent news for LNG exporters like Cheniere Energy Partners. The company owns and operates liquefaction facilities (where natural gas is converted into LNG) and the Sabine Pass LNG Terminal in Louisiana.

Its major customers include power companies as far away as India and South Korea, as well as European customers. As such, it's likely to be a key player in an export-led push by the current administration to sell U.S. energy across the globe.

The importation of U.S. LNG will facilitate the phasing out or reduction of LNG volumes imported to the E.U. from Russia. Given current geopolitical affairs, this trend is likely to gain momentum.

In addition, Cheniere tends to work on long-term counterparty arrangements with fixed fees that produce stable cash flow. Once a customer is on board, they tend to generate a stream of long-term income.

Putting all these factors together, Cheniere Energy Partners and its 5.8% dividend yield are a good option for investors seeking passive income.