Alcohol giant Constellation Brands (STZ +4.47%) has faced challenges in recent years. Although it owns distribution rights to Modelo, the best-selling beer in the U.S., concerns over tariffs and declining demand for alcohol from Gen Z have led investors to doubt the stock. Over the last five years, its returns have been flat, even when including the dividend.

However, that decline has also made its valuation more attractive, and a high-profile investment group has recently upped its stake in Constellation. Given that catalyst, is it likely to outperform the market over the next year, or should investors continue to avoid the alcohol stock?

Image source: Getty Images.

The state of Constellation Brands

Constellation stock looks like a desirable holding on the surface. The company owns or holds the distribution rights to many highly recognized brands, especially in the beer market. Beer makes up approximately 80% of the company's revenue, and it distributes Corona, Pacifico, and Modelo. Other brands owned by the company include Robert Mondavi wines and Casa Noble tequila.

That may have played a part in the increased investor interest from Warren Buffett's Berkshire Hathaway. Despite being a net seller of stocks in the first quarter of 2025, Berkshire increased its stake by 114%.

Buffett's team may have found opportunity among its challenges, and indeed, Constellation faces significant headwinds. Its most popular beers come from Mexico, and the threat of tariffs could reduce sales and possibly cost Modelo its market leadership.

Even more concerning are competition and consumption patterns. Alcohol companies have more competition than ever from independent breweries and distillers. Plus, alcohol consumption among Gen Z significantly lags its older counterparts, likely because of the increased prevalence of cannabis-based products. Such obstacles have likely led some investors to lose confidence in this stock.

NYSE: STZ

Key Data Points

Constellation's financials

Investors may be justified in feeling pessimistic, as net sales fell 6% yearly in Q1 of fiscal 2026 (ended May 31) to $2.5 billion. That same metric increased by slightly more than 2% annually in fiscal 2025 amid declining wine and spirits sales.

Due primarily to impairments in goodwill, intangibles, and assets held for sale, Constellation lost $375 million in fiscal Q1, down from a $392 million profit in the year-ago quarter.

Upcoming quarters point to continued struggles as it forecasts enterprise organic net-sales growth between -2% and 1% for fiscal 2026, but that includes the numbers from Svedka, a vodka brand Constellation recently sold.

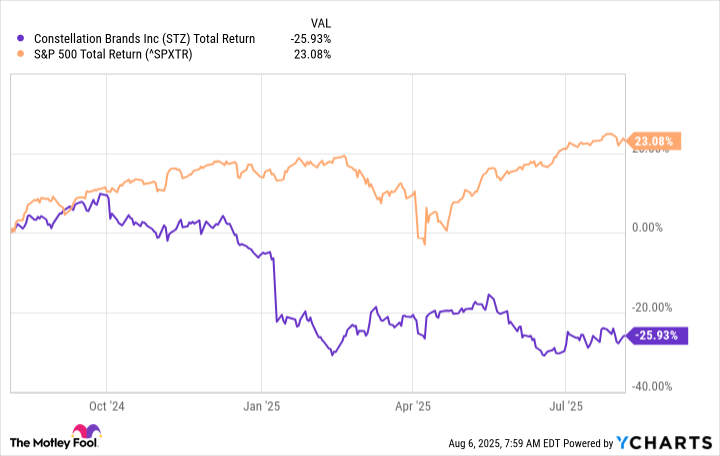

With such sluggish sales, total return levels for Constellation have lagged the S&P 500 by a wide margin. Over the last year alone, the total return is down by more than 25%.

STZ Total Return Level data by YCharts.

Still, a closer look at the financials reveals the likely reason Berkshire has become increasingly interested in Constellation Brands. The goodwill and intangibles impairments temporarily left it without a price-to-earnings (P/E) ratio. However, the forward P/E ratio of 13 shows this to be a low-cost stock.

What's more, Constellation pays $4.08 per share in annual dividends. Its dividend yield of 2.4% is far above the five-year average yield of 1.5% and the S&P 500 average of 1.2%. The payout has also risen for nine consecutive years, making it likely that the annual dividend hikes will continue. That growing payout gives investors an added incentive to hold Constellation stock.

Constellation Brands in one year

Under current conditions, Constellation Brands is highly likely to deliver market-beating returns over the next year.

Admittedly, the stock is cheap for a reason in one sense, given how tariff worries and the lower interest in drinking from Gen Z weighed on net-sales growth.

Nonetheless, a closer look at the stock shows the likely reason that Buffett's team at Berkshire continues to buy. Its rising dividend offers a yield that is well above average compared to the S&P 500 and its past returns. Moreover, the forward P/E ratio, which doesn't include the asset impairments from the trailing 12 months, is 13, a level that likely factors in the company's challenges.

Thus, investors should profit from an above-average dividend yield, a probable payout hike, and a high likelihood that the stock price will begin to recover as more investors follow Berkshire's lead.