Rivian (RIVN -7.56%) just drove in its second quarter that certainly felt negative impacts from multiple angles. The company reported a 13% rise in revenue to $1.3 billion and a narrowing net loss of $1.1 billion compared to the prior year's $1.5 billion, and reaffirmed its delivery guidance of 40,000 to 46,000 vehicles. Rivian also reported its full-year adjusted EBITDA loss is expected to be between $2 billion and $2.25 billion, worse than the prior forecast of $1.7 billion to $1.9 billion. Let's take a quick look at the triple whammy sending speed bumps at the young electric vehicle (EV) maker.

Goodbye easy money

When it comes to easy money, it doesn't get much easier than EV makers selling zero-emission, or regulatory, credits. Essentially, automakers that produce EVs are given credit for meeting emissions standards, while vehicles that don't meet emissions standards are fined. One way to get out of the fine is to simply purchase regulatory credits from automakers such as Rivian that don't have an internal combustion vehicle portfolio to offset.

However, the Trump administration recently did away with the penalty for not meeting emissions standards, and thus removed the incentive to buy these regulatory credits. That's a significant, and sudden, removal of a vital chunk of business for Rivian. Now Rivian expects to receive no more revenue for the credits and for regulatory credits to generate roughly $160 million in 2025, down from the prior expectation of $300 million.

Tortuous tariffs

You aren't to be blamed if you can't keep up on all the tariffs, reciprocal tariffs, retaliatory tariffs, trade policy changes, among other developments. But the simple truth is the introduction of these tariffs complicated the lives of automakers and their investors, and Rivian is no different.

The tariffs set by the current administration hit imported auto parts, causing pain even for companies such as Rivian that manufacture vehicles inside the U.S. Not only is that raising costs and eroding margins, it's causing supply chain disruptions and constraints that contributed to Rivian producing under 6,000 vehicles during the quarter, compared to nearly 14,000 during the prior year.

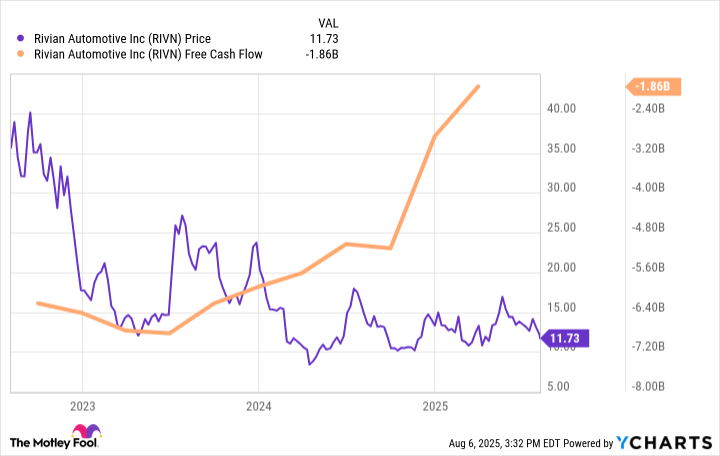

Unfortunately for investors, management expects changes in trade regulation and tariffs to have a negative impact on cash flow, which had been long trending in the right direction, as you can see in the graph below. Rivian also expects tariffs to negatively impact vehicles by a couple thousand dollars per unit for the remainder of 2025, which is a big deal for a company already losing tens of thousands per vehicle.

But tariffs are only part of the problem, and it goes hand in hand with the administration's removal of the $7,500 federal EV tax credit.

No longer a shock

In the world's least kept secret, the $7,500 federal tax credit for EV purchases is set to go away at the end of September. It's apparent that long-term demand will be negatively impacted with the tax credit making every qualifying vehicle more expensive. But investors also need to be aware of the impact the knowledge of the credit's removal had on demand.

Image source: Rivian.

First, it created a pull forward effect as consumers on the fence rushed to buy an EV before the credit disappeared. That coincided with a boost in OEM production as automakers rushed production ahead of tariffs, increasing costs on imported parts and vehicles. But that also means there's almost certainly going to be an equally powerful lull once that pull-through demand is worked through and the new reality of likely cost increases sets in, probably during the fourth quarter.

That's important because for Rivian to hit its full-year delivery target it needs a strong second half for demand and deliveries. It currently expects the third quarter to post the strongest for deliveries, so it will be a key quarter for investors to watch after demand and deliveries have trended lower.

Data source: Rivian press releases. Image by author.

What it all means

A triple whammy of negative impacts from tariffs and trade regulation, removal of the federal tax credit, and lost revenue from regulatory credits amid slower than anticipated EV industry growth makes for a rough year for Rivian. For long-term investors, the thesis hasn't changed: It's all hands on deck until the R2, R3, and R3X are driving into consumer garages. Rivian can absolutely recover from these negative developments. However, it's becoming more and more clear how much Rivian's future depends on the R2, and that's why the company remains high risk, high reward. Invest accordingly.