At around $700 per share, ASML Holding (ASML 5.43%) has one of the highest share prices among semiconductor stocks. That raises the possibility of a stock split. While stock splits have become less common in 2025, they can come in bunches. They also stir up interest in a stock, and that could be helpful for the struggling ASML, which is down 18% over the past year.

Let's explore why companies split their stock, review ASML's track record with the practice, and consider whether the stock is worth buying at its current price, with or without a future share split.

NASDAQ: ASML

Key Data Points

What's a stock split?

A stock split is a corporate action that increases the number of a company's outstanding shares while reducing the share price proportionally, leaving the overall market capitalization and investor ownership unchanged. For instance, in a 10-for-1 split, one $700 share becomes 10 shares worth $70 each.

Although stock splits leave a company's fundamentals untouched, they often improve liquidity and make shares more approachable for retail investors. Despite the growing availability of fractional shares, some brokerages still lack this feature, and steep share prices can remain a psychological barrier for potential buyers. In addition, stock splits offer companies more flexibility when structuring stock-based compensation.

Finally, a high stock price can limit eligibility for price-weighted indexes like the Dow Jones Industrial Average, where share prices directly influence weighting. Companies like ASML, with elevated stock prices, are less likely to be included because they could disproportionately impact the index.

ASML has a history of stock splits

ASML has executed four stock splits in its history -- three traditional splits and one reverse split. After going public in 1995, ASML carried out 2-for-1 splits in 1997 and 1998, followed by a 3-for-1 split in 2000. In 2007, ASML reversed course with an 8-for-9 reverse split to simplify its capital structure and return cash to shareholders. A similar plan in 2012 resulted in a 77-for-100 reverse split.

Factoring in its past stock splits, an investor who purchased one share of ASML in 1997 would now hold roughly 8.21 shares. However, it's been nearly 20 years since the company last did a traditional stock split, and ASML's share price has climbed significantly. With shares now trading at a high price point, ASML could be a strong candidate for another split, although management hasn't indicated any plans to move in that direction.

| Date | Event | Cumulative Shares |

|---|---|---|

| March 1995 | IPO | 1 |

| May 1997 | 2-for-1 split | 2 |

| May 1998 | 2-for-1 split | 4 |

| April 2000 | 3-for-1 split | 12 |

| October 2007 | 8-for-9 reverse split | 10.67 |

| November 2012 | 77-for-100 reverse split | 8.21 |

Data source: Companies Market Cap.

ASML's fundamentals are strong

ASML sits at the center of one of the world's most critical technology supply chains. It is the only company that produces extreme ultraviolet lithography machines -- tools that enable chipmakers to produce the smallest, most powerful, and most efficient semiconductors available.

In its most recent quarter, ASML reported 7.7 billion euros ($9 billion) in revenue, a 23% increase compared to the same period last year. Net income rose 45% to 2.3 billion euros ($2.7 billion), highlighting the company's strong profitability despite uncertain trade policies. Perhaps even more impressive is ASML's order backlog, which stood at more than 33 billion euros ($38.5 billion), signaling continued demand from its customers.

Management reiterated full-year revenue guidance of approximately 32.5 billion euros, or 15% growth compared to 2024. Additionally, it projects gross margin, a key profitability metric, to come in at 52% for 2025, an improvement from 2024's gross margin of 51.4%.

Image source: ASML Holding.

ASML prioritizes returning capital to shareholders

Beyond its expanding business, ASML continues to reward shareholders through consistent dividends and stock buybacks. With $4.2 billion in net cash, the company is well positioned to return capital while continuing to invest in future growth.

ASML currently pays a quarterly dividend of 1.60 euros, which equates to a 1% annual yield. Since ASML is a Dutch company, U.S. investors hold shares through American depositary receipts, meaning dividend payments fluctuate based on currency exchange rates.

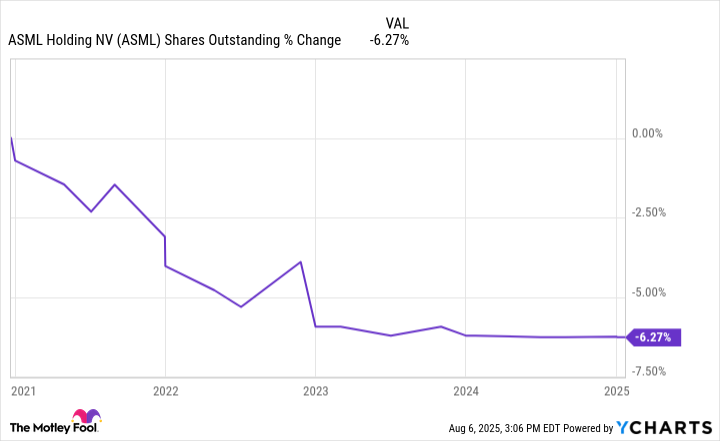

In addition to the dividend, ASML has steadily reduced its share count, lowering shares outstanding by 6.3% over the past five years. In its most recent quarter, the company spent 1.4 billion euros, or approximately $1.6 billion, on share repurchases, further enhancing long-term shareholder value.

ASML Shares Outstanding data by YCharts

Is ASML a buy, sell, or hold?

Stock splits often generate buzz, but they should not be the reason to buy a stock. What matters more are ASML's financial results and whether the stock is attractively valued. Currently, ASML trades at 25.4 times trailing earnings, which is well below its three-year median of 36.3 and marks its lowest level in that period.

Geopolitical uncertainty and tariff concerns may be pressuring the valuation. Still, ASML's strong market position and the continued surge in AI spending from major tech companies make the stock a compelling buy with or without a stock split.

ASML PE Ratio data by YCharts