Remember this simple fact as you compare Target (TGT +1.61%) and Walmart (WMT +3.04%): Every company eventually goes through hard times. The really important question is, what does a company do when it faces the gauntlet?

If the answer is that the company always seems to find a way to get back on track, then the time to buy the stock may not be when Wall Street thinks.

Here's a look at Target and Walmart to help explain.

Image source: Getty Images.

What do Target and Walmart do?

There are some notable similarities and differences between Target and Walmart. For example, both operate big-box stores. They each include groceries in the mix in many of their stores, though Walmart also operates grocery-only stores. Both retailers are giants in the U.S. market, but Walmart also operates in foreign markets. And Walmart runs a club store (Sam's Club), with Target running only big-box stores.

In the end, they are close competitors, but they aren't 100% comparable businesses. There's also a nuance in the areas where they do compete, with Walmart focused on everyday low prices and Target attempting to provide a mix of low prices and a higher quality flair (with regard to both the shopping experience and the products it sells).

This difference is highly important because Target has more of a trendy feel to its business. And like many trend-driven businesses, it sometimes falls out of favor with consumers. Walmart, on the other hand, has more of a basic necessities feel that tends to see solid demand most of the time.

Target has lost its way again

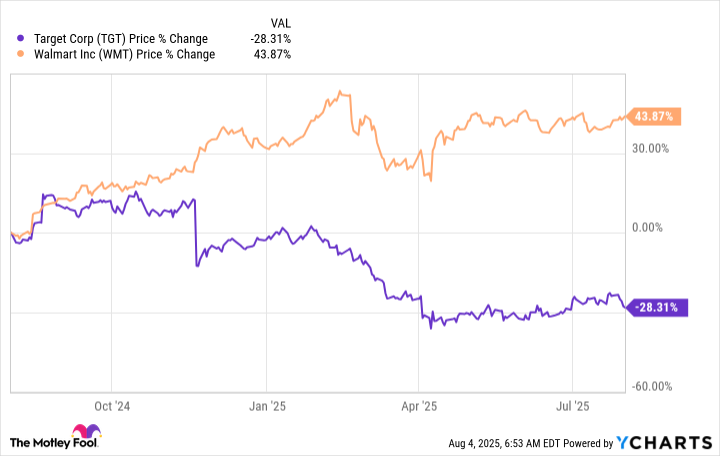

This brings the divergent price performance of Walmart and Target to the fore. Over the past year, Walmart's stock has risen roughly 40%, while Target's stock price has declined nearly 30%. That's a roughly 70 percentage point gap!

As you might expect from the stock price divergence, Walmart's business has been doing reasonably well. Revenues rose 2.5% in the first quarter of fiscal 2026, with same-store sales in the United States up 4.5%. By contrast, Target's top line declined in the first quarter of 2025, with same-store sales off by a troubling 3.8%.

NASDAQ: WMT

Key Data Points

But both Walmart and Target are Dividend Kings. In fact, Target's streak of annual dividend increases is a couple of years longer than Walmart's. And Target just announced another, though modest, dividend increase in June, despite the headwinds it is facing in its business. Management also recently announced that it was revamping its leadership team and adjusting its go-to-market approach, which is what you would expect from a company trying to muddle through temporary hardship. If history is any guide, Target will find a way to get back on track.

Which is where the comparison with Walmart really starts to heat up. Right now, Target has a historically high 4.5% dividend yield. Walmart's roughly 1% yield is low on an absolute level, below that of the market and near the low end of its own historical yield range. Based on the dividend yield, Target is the better deal right now.

NYSE: TGT

Key Data Points

The income and value opportunity is buttressed by Target's price-to-sales (P/S) and price-to-earnings (P/E) ratios, both being well below their five-year averages. Walmart's P/S and P/E ratios are both well above their five-year averages. Simply put, Target is on sale, and Walmart is fetching a premium price.

Often, the best time to buy is when others are selling

It is hard to take a contrarian stance, buying when others are selling. And there's no guarantee that a struggling company will be able to pull itself out of the funk it is in. But history suggests that a Dividend King, like Target, will find a way to survive and thrive again. Given the low valuation Wall Street is affording the stock, it appears to be a better investment opportunity than Walmart right now. Sure, Walmart is performing better as a business, but you are paying what appears to be a historically high price to own it.