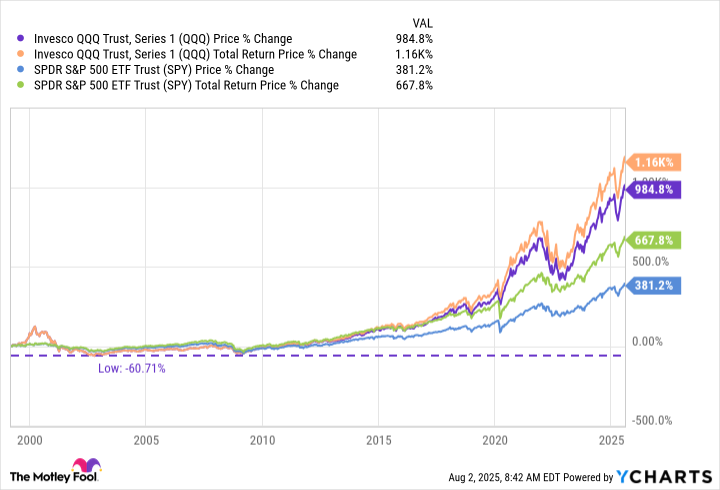

The Invesco QQQ Trust (QQQ 1.75%) has turned a $10,000 investment at its inception in March 1999 into $125,000. Its returns handily outdistance the performance of the S&P 500 index over that span.

Given that backdrop, it seems like this could be the millionaire-maker investment that you've been looking for! But don't rush out to buy it -- there are some pretty big caveats to consider.

What does the Invesco QQQ Trust do?

The Invesco QQQ Trust is an index-tracking exchange-traded fund (ETF). The index it follows is the Nasdaq 100. They can pretty much be seen as interchangeable from an investment standpoint.

The Nasdaq 100 is a fairly simple index, made up of the 100 largest nonfinancial stocks on the Nasdaq exchange. Holdings are weighted by market cap, so the largest holdings have the largest impact on performance.

Image source: Getty Images.

While simple to understand, the ETF has also managed to put up very impressive performance numbers. Notably, the S&P 500 index has risen around 660% (assuming dividends were reinvested) since early March 1999, while the Invesco QQQ's total return was a huge 1,100% or so. It is very difficult to beat the S&P 500 index, but the Invesco fund seems to have achieved the feat.

But don't buy this ETF just yet -- there are some things you need to know before you start putting your money at risk.

The problems with the Invesco QQQ Trust

For starters, the ETF does exactly what it sets out to do. So if you want to track the Nasdaq 100 index, well, it's a great choice. And while the expense ratio of 0.20% is a bit high for an ETF, it isn't outlandish when you compare the cost to the long-term performance.

But the long-term performance is where the biggest problems lie. For starters, the Nasdaq is home to some of the best-known technology companies. Tech companies have a long history of being volatile, going through boom-and-bust periods heavily influenced by investor sentiment. Technology currently makes up roughly 60% of the Invesco QQQ Trust's assets, so this is an ETF that is heavily reliant on tech.

NASDAQ: QQQ

Key Data Points

The concentration risk here is even worse than it seems. Every one of the top 10 holdings is a technology stock. And the top 10 positions account for just over 50% of the fund's assets.

Here's the thing: The Invesco QQQ Trust's performance has been particularly strong over the last few years and almost entirely because of a small number of large technology stocks. This should be a big problem for more conservative investors.

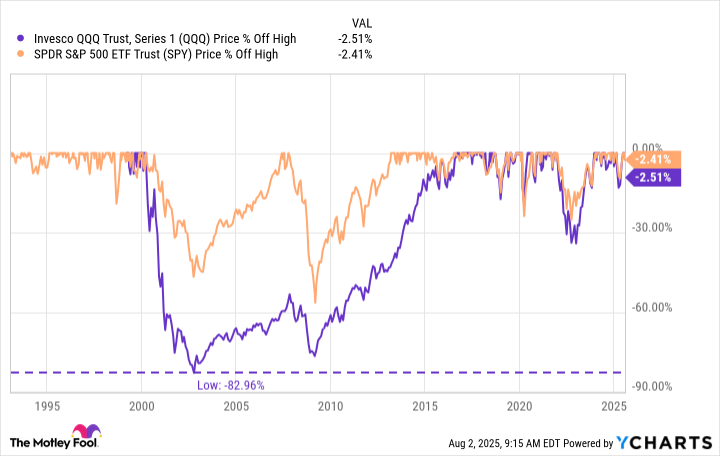

Which brings the story to the drawdown risk. The last time technology stocks were as hot as they are today was during the dot.com boom at the turn of the century. The Invesco QQQ Trust was created just before the boom turned into a bust. During that technology downturn, it lost over 80% of its value. And it took over a decade for the price of the ETF to get back to breakeven.

It seems highly likely that the ETF will provide strong long-term returns. But that means you need to hold on for the long term, which can be very difficult if you are staring at losses of 80% and years of languishing performance. The risk here, meanwhile, is likely to be highest if you buy into the fund while it is drastically outperforming the S&P 500 index, as it is today.

Go in understanding the risks and your investment time frame

Could the Invesco QQQ Trust be a millionaire-maker investment? Sure, the inherent focus on strongly performing technology stocks is likely to work out well over the long term. However, the huge drawdown risk here should probably result in conservative investors avoiding this ETF.

And even if you are an aggressive investor, you need to understand that "long term" here could mean you need to own it for decades. That includes sticking out periods in which technology falls deeply out of favor.