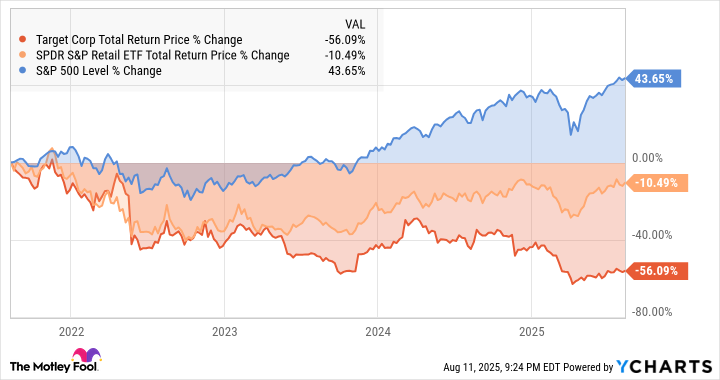

Retail stocks have been through a few tough years. The SPDR S&P Retail ETF (XRT +1.23%) posted a total return of 12% over the last year, far behind the S&P 500 (^GSPC +0.26%) index's 19%. Stretching the view to a four-year span is even worse. The S&P 500 saw a 44% total return in this period, as of Aug. 11, while the leading exchange-traded fund (ETF) of retailer stocks saw a negative-10% return.

Big-box retail veteran and dividend king Target (TGT +1.22%) has lagged behind the broader market and the retail sector in these periods. It's not a close race, and the four-year overview is kind of scary:

TGT Total Return Price data by YCharts

But I think Target is poised for a robust rebound, starting from this low point. The company is getting back to the brand experience people used to love, under the mock-French "Tar-zhay" banner.

Target shouldn't try to out-bargain the low-cost kings

Target's management has figured out that the company can't compete with archrivals Walmart (WMT 0.70%) and Costco (COST +0.54%) on price alone. That strategy has been tried and abandoned, as the penny-pinching marketing message fell flat. As a result, Target's sales have been swooning since 2022 while Costco and Walmart experienced revenue growth of more than 16%.

It's not a complete disaster for Target, though.

Balancing out the slower sales, Target's profit margins are among the best in the business. Walmart's and Costco's focus on affordable goods leaves them with slim margins across the board. Target's customers are prepared to pay a little more for a better shopping experience. Target's strong margins are not new, but I'd like to point out that they have stayed in the lead despite the recent revenue challenges.

NYSE: TGT

Key Data Points

The fancy French twist has deep roots

The playful Tar-zhay moniker is also a pretty old idea. I mean that both as a cultural phenomenon and a business strategy.

Target embraced the glitzy twist on its name in 2017, along with a new set of store-brand names for different product types. The commitment didn't really stick, as Target never really built its marketing around the Frenchified name itself, but the idea has been explored before. And long before that, I found a lot of people in the upper-crust parts of Miami and Jacksonville using the French-flavored Target name unironically. This was in the late 1990s.

So Tar-zhay is a well-known little twist on the Target brand, reflecting a common view of its stores as a nicer place to shop. You don't go to Tar-zhay when you want the lowest price on bananas, jeans, and cat food. That's what Costco and Walmart are for. Here, you're supposed to enjoy the shopping experience in wider aisles with better lighting and maintenance. Human assistance should be easy to find. And the store brands exude a certain je ne sais quoi that even Costco's Kirkland can't always match.

Image source: Getty Images.

Premium Tar-zhay shares at a discount -- where do I sign up?

In that sense, the renewed Tar-zhay strategy takes Target back to a proven success story. I mean, it's not a top-shelf luxury store like RH (RH +2.90%) or the Apple (AAPL 0.73%) store. But it's also a significant step above Walmart's extreme bargain hunt or Costco's overcrowded warehouses.

Target's leadership has rediscovered this longtime business advantage, and is busy rebuilding that modestly high-end reputation in 2025.

Meanwhile, Target's stock is on fire sale. After years of underperforming the stock market and retail sector, Target shares carry the bargain-bin valuation of 11.4 times earnings and 0.45 times sales. The stock could double or even triple in price and still look affordable next to Walmart or Costco.

And if you buy Target shares right now, you're locking in a generous 4.4% dividend yield -- miles ahead of Walmart's 0.9% and Costco's 0.5%, and near the highest yields in Target's dividend-paying history.

Turnaround stories don't always have happy endings, but this one is off to a good start. I like the smart-yet-whimsical Tar-zhay focus and this company already runs a profitable business. All Target has to do is inspire people to revisit its stores. I think that's a very achievable goal, making Tar-zhay stock a promising investment these days.