The big draw with Energy Transfer (ET 0.85%) is likely to be the master limited partnership's (MLP's) huge 7.4% distribution yield. That's completely reasonable, noting that the S&P 500 index (^GSPC 0.03%) has a miserly yield of just 1.2% and the average energy stock's yield is just 3.3%. Before you jump aboard what looks like a boring stock, you'll want to know a little of the history backing that yield.

Energy Transfer is a toll taker

The broader energy sector is known for being volatile because of the inherent volatility of oil and natural gas prices. These two commodities have a bad habit of moving both dramatically and quickly based on supply/demand dynamics, economic trends, and geopolitical issues. But Energy Transfer's revenues aren't really tied to commodity prices, which makes it a fairly reliable cash flow generator in an industry that is anything but reliable.

Image source: Getty Images.

Essentially, Energy Transfer owns the energy infrastructure, like pipelines, that helps to move oil and natural gas around the world. It is what is known as a midstream business, because it sits between the upstream (energy production) and the downstream (energy processing). Energy Transfer largely collects fees for the use of its assets, with the volume running through its systems being more important to its financial results than commodity prices. Given the importance of energy to modern life, demand for energy transportation tends to remain robust regardless of energy prices.

This is the reason why Energy Transfer will look like a boring dividend stock to many investors. And, in some ways, it is exactly what it looks like. But there's a history here that you need to understand before you buy into this MLP.

Energy Transfer has a worrying track record

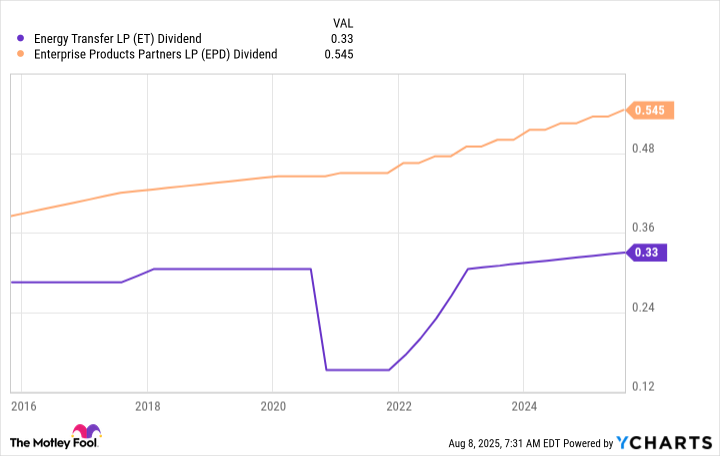

Starting with the most recent question mark first, Energy Transfer cut its dividend in half during the energy downturn that was precipitated by the coronavirus pandemic. That 2020 decision was made so that Energy Transfer could focus on strengthening its balance sheet, which is a worthy cause. However, dividend investors were probably hoping for the distribution to at least be maintained through the energy downturn and global health crisis. Indeed, right when consistency was the goal for investors, Energy Transfer gave its unitholders a drastic income shock.

ET Dividend data by YCharts

To be fair, the distribution is growing again. In fact, it is above where it was prior to the cut. But one of Energy Transfer's most direct peers, Enterprise Product Partners (EPD 0.66%), didn't resort to a distribution cut. In fact, Enterprise raised its distribution despite the pandemic. Enterprise's streak of increases is now up to 26 consecutive years. If you are trying to live off of the income your portfolio generates, you may want to rethink a commitment to Energy Transfer.

The trust issues don't stop there, however. Way back in 2016, the last time the energy sector was facing a material downturn, Energy Transfer inked a deal to buy Williams Companies (WMB +0.10%). It got cold feet and scuttled the deal because it might have necessitated a dividend cut. It was probably the right call, but it involved selling convertible securities, a large amount of which would have gone to the CEO at the time. Although it never came to that, it appeared like the convertibles would have protected the CEO from a dividend cut if it had been needed.

NYSE: ET

Key Data Points

Conservative investors would be forgiven if they had concerns about whether or not Energy Transfer was favoring insiders at the expense of unitholders. Enterprise Products Partners doesn't have a similar event in its past.

How boring is this yield?

Here's the thing -- Energy Transfer's 7.4% yield is just a touch higher than Enterprise's roughly 7% yield. Is 0.4 percentage points of yield worth the worry that Energy Transfer might let income-focused investors down in some way? Probably not, and thus this "boring" high-yield stock is probably best avoided by conservative income investors. But don't fret; you can just switch your attention to legitimately boring Enterprise Products Partners, instead.