Opendoor Technologies (OPEN 7.71%) has been one of the hottest meme stocks to own of late. It was just a month ago that shares were trading at less than $1, and they have more than doubled in value since then.

The company is involved in iBuying, which effectively involves flipping houses. It's a capital-intensive business, and it worked well for Opendoor when the housing market was hot a few years ago. These days, however, it's struggling to generate much growth.

Investors, however, appear to be willing to take a chance on the stock, despite the challenges ahead. And recently, the company released its latest earnings numbers, which suggested it may be trending in the right direction. Could Opendoor finally be on the right track, or are investors still better off avoiding the stock?

Image source: Getty Images.

Opendoor reported its first quarter of positive adjusted EBITDA in multiple years

Last week, Opendoor posted its second-quarter results, and it was a big success for the business, as it was the first time since 2022 that the company reported positive adjusted earnings before interest, taxes, depreciation and amortization (EBITDA).

Adjusted EBITDA came in at $23 million, which was a big improvement from the $5 million loss it reported in the prior-year period. But this is an adjusted calculation and not true net income. The company still incurred a net loss for the quarter, totaling $29 million, but that was also an improvement from a loss of $92 million a year earlier.

NASDAQ: OPEN

Key Data Points

Revenue also rose by 4% to $1.6 billion for the period. It sold more homes during the period, and its homes in inventory also came down to 4,538, compared with 6,399 a year ago. Overall, it was a decent quarter for the business, but it wasn't enough to give the stock a boost, as investors appear to be worried about what lies ahead for the company.

Why profitability may be hard to come by for Opendoor

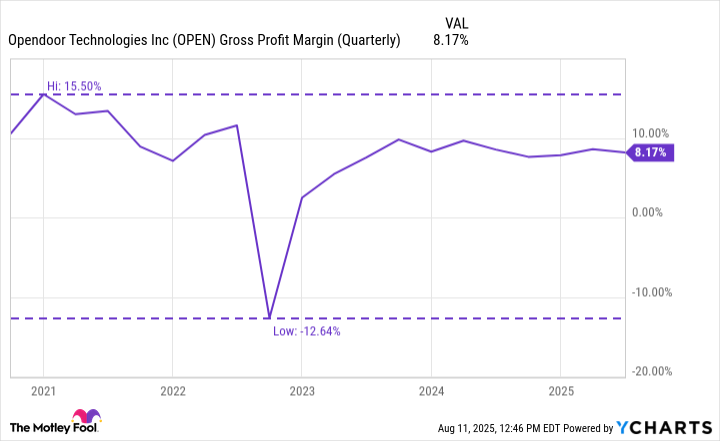

Despite the positive trend on Opendoor's bottom line last quarter, investors still shouldn't assume hitting breakeven will be easy, or that the company will be able to achieve significant earnings growth in the future. And that's because of its thin gross margins.

OPEN Gross Profit Margin (Quarterly) data by YCharts.

When margins are thin, it can be difficult for the business to stay out of the red. Gross profit last quarter was $128 million, while operating expenses totaled $141 million. What's particularly disappointing is that even though the company grew its sales, its gross profit was still less than what it generated in the same period last year ($129 million).

It's little wonder why companies such as Zillow and Redfin exited iBuying, because the business model simply doesn't look lucrative.

Opendoor remains a highly risky stock

Although Opendoor has been a trendy and popular stock to own recently, it's still largely a meme stock. The company faces an uncertain future as the economy is shaky at best, and there is the threat of a recession, especially as tariffs and trade wars affect families and businesses across the country.

The company's recent results were encouraging, but they don't make the stock any safer as an investment, particularly for the long haul. Without a stronger housing market and better overall financials, this is a stock that's going to appeal primarily to speculators rather than long-term investors.

This may be an intriguing stock to watch and follow, but you're probably going to want to steer clear of Opendoor Technologies given its volatility and the many question marks hovering over its business.