In recent years, growth investors and large financial institutions alike have warmed up to volatile, speculative asset classes such as cryptocurrency. Within the crypto realm, early disruptors such as Bitcoin and Ethereum have witnessed substantial price appreciation.

In the background, however, a relative newcomer called XRP (XRP +1.17%) has entered the spotlight. XRP is a component of Ripple's payments network, a financial services infrastructure designed to disrupt incumbent international payments systems.

With the token trading for just $3.20 as of this writing (Aug. 10), could XRP be the next cryptocurrency to break out and experience a Bitcoin-style run for the ages?

CRYPTO: XRP

Key Data Points

How cheap is XRP in reality?

One of the most common mistakes an investor can make is confusing value with share price. A price of a few dollars doesn't necessarily make an asset cheap, just as a high price doesn't necessarily imply overvaluation. To get a better sense of a company's valuation, investors should look past price per share (or token) and instead analyze market capitalization.

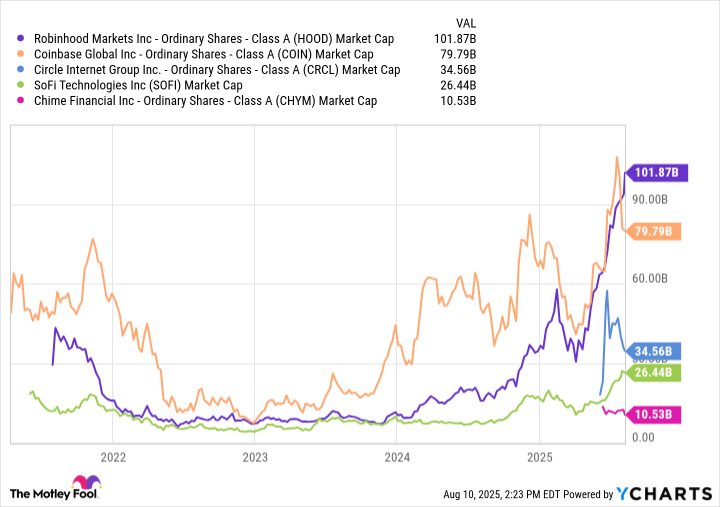

Right now, XRP boasts a market cap of about $190 billion. As the chart below illustrates, that's more than the combined total for crypto-centric companies Robinhood Markets and Coinbase. Taking this a step further, XRP's market cap is almost triple that of the combined market capitalizations of neobanks SoFi Technologies, Chime, and stablecoin issuer Circle Internet Group.

HOOD Market Cap data by YCharts

These are not trivial details. Even though XRP is trading for significantly less than $5, the market is already attributing greater value to it than to established, revenue-generating businesses with diversified ecosystems that serve customers on a global scale.

Image source: Getty Images.

Is XRP a buy right now?

Last year, the global market value for cross-border transactions was estimated by Grand View Research at $212 trillion. The firm forecast this to grow to $320 trillion by 2030 -- growth that would imply both immense potential and an accelerated need for innovative payments infrastructure.

The distinction that I think many investors are misunderstanding is that an expanding cross-border transactions market is likely a more meaningful tailwind for solutions providers like Ripple than for bridge currencies such as XRP. In other words, broader adoption of the Ripple payment network is not necessarily a direct catalyst for XRP.

Although Ripple's growth could lead to new uses for XRP down the road, there is no guarantee the token will experience meaningful adoption. There are plausible scenarios in which Ripple's payment network sees success in niche use cases that do not require the application of XRP at scale. In such cases, XRP's upside probably will remain at current levels.

I see XRP as a speculative opportunity tied to an already abnormally volatile cryptocurrency industry. While its low per-token price may be tempting, XRP already sports a frothy valuation unsupported by traditional financial measures such as revenue growth or profitability -- and it reflects an optimistic narrative beyond proven competitive dynamics and scaled economics.

Ultimately, viewing XRP as inexpensive because of its $3 price tag is a misinterpretation of value investing. The token is already pricey, in my view, and believing it will maintaining this valuation requires high conviction in an unproven growth narrative hinging on enormous utility adoption.

Given the amount of unknowns surrounding XRP's future, I do not see the cryptocurrency as a rock-solid buying opportunity now.