When I last spoke to you about SoundHound AI (SOUN +1.76%) in mid-July, I outlined three reasons the stock could explode to the upside. The stock rocketed 40% since the article was published, assisted by another stellar earnings report. Given the recent action, a debriefing is definitely in order. Let's take a look at what went right and what's next for this up-and-coming artificial intelligence (AI) player.

NASDAQ: SOUN

Key Data Points

Market, customers, and revenue (oh my!)

The first pillar I mentioned in the previous article was the massive market that speech recognition has. Automobiles, drive-thrus, retail, and customer service are some of the largest and most obvious markets. Voice recognition technology in automobiles is advancing rapidly thanks to companies like SoundHound AI. The days of simply saying "play music" and hoping it doesn't make another phone call are gone.

Future voice technology in vehicles will enable complex interactions, such as "give me directions to the highest rated Italian restaurant within five miles of my route home." Quite a step up!

Drive-thrus and customer service will also be served by AI technology with limited human involvement. This is a game-changer for the cost structures of businesses. The savings will be immense, and companies can't afford to be left behind. Statista pegs the market opportunity at $16 billion by 2030; however, this estimate may be too conservative.

Getty Images

Other research firms peg the total addressable market at more than $140 billion. The truth probably lies somewhere in between.

The key for SoundHound to capture as large a piece of the pie as possible is to win new customers and expand offerings with current customers. SoundHound's customer list is impressive, with well-known brands like Stellantis, Hyundai, White Castle, Jersey Mike's, and many more. SoundHound reported Q2 wins of Red Lobster, Applebee's, IHOP, and a major Chinese automotive brands, and expansions with current customers like Chipotle and Firehouse Subs. SoundHound tech is now operating at more than 10,000 restaurant locations.

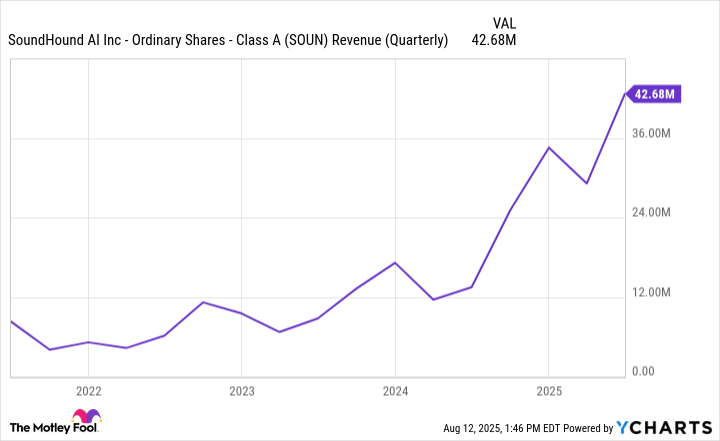

The terrific execution translated easily to the top line with 217% year-over-year sales growth from $13.5 million to $42.7 million. As shown below, not only is SoundHound's revenue growing, but the growth rate is accelerating.

SOUN Revenue (Quarterly) data by YCharts

Sales grew 151% year over year in Q1 2025, which was exciting. But the 217% growth in Q2 took it to a new level.

What's next?

In addition to the obvious use cases for speech recognition AI, emerging markets include smart homes, financial services, smart TVs and entertainment, healthcare, and employee training. Using AI in employee training, for example, will be a huge time and cost saver. A new team member can request step-by-step instructions for procedures, seek specific guidance from company handbooks, and receive coaching from AI on best practices, brand features, and more. The technology is only scratching the surface so far.

But what does this mean for SoundHound stock? It's important to note that SoundHound isn't profitable and is losing cash from its operations. This isn't unusual for smaller, fast-growing tech companies, but it means that the company raises money to fund growth by selling additional shares of stock. This dilutes current shareholders. It isn't ideal, but it is necessary for now. The plan is for the company to become cash-flow-positive as revenue continues to rise.

The stock trades for 46 times the last 12 months' sales; however, this will drop to 36 if SoundHound hits the high end of its 2025 guidance of $178 million in revenue. The valuation is high by traditional metrics, but a company growing sales by more than 200% is not at all typical. The bottom line is that the stock is exceedingly difficult to value at this stage. For this reason, the stock isn't for everyone, and investors should be cautious. Here's a handy guide to risk tolerance.

The biggest long-term factor for success for investors will be whether the company continues to execute its growth strategy. So far, so good. The stock will likely experience significant fluctuations as it matures. Long-term investors should consider taking some profits when it rises, and adding to a core position on significant dips.