Shares of Datadog (DDOG 7.28%) fell 4% after the company announced its second-quarter results on Aug. 7, and that seems surprising. Datadog's revenue and earnings were well ahead of expectations, and the company increased its revenue guidance for the year.

Datadog provides a cloud-based platform with which its customers can monitor and analyze their cloud infrastructure and applications. It also sells cloud security services to help customers scan their cloud infrastructure for vulnerabilities. The latest results make it clear that demand for its cloud-based solutions is increasing thanks to the proliferation of artificial intelligence (AI).

Let's see how AI is driving Datadog's growth and why it may be a good idea to buy the stock after its latest drop.

Image source: Getty Images.

AI tools are firing up the company's growth

Datadog reported a 28% year-over-year revenue increase in the second quarter to $827 million, easily crushing the $791 million consensus Wall Street estimate. Its earnings of $0.46 per share also exceeded the $0.41 consensus estimate.

CEO Olivier Pomel said on the latest earnings conference call that the "number of AI-native customers are growing meaningfully with us as they see rapid usage growth with their products."

The company has been aggressively launching new AI-powered observability and security tools, and customers have been adopting them. Management announced more than 125 new products and features a couple of months ago, including fully autonomous AI agents to monitor and respond to alerts, an AI-powered security assistant, and an AI-enabled coding assistant to fix issues with customers' cloud applications.

It offers end-to-end AI-enabled data observability that can be deployed at popular cloud AI infrastructure providers like CoreWeave. That should be a tailwind for Datadog considering the fast-growing demand for AI applications in the cloud. The company is already witnessing meaningful gains in the adoption of its services because of AI.

NASDAQ: DDOG

Key Data Points

More than 4,500 of its approximately 31,400 customers are now using its AI tools, and they are spending more, Pomel said on the earnings conference call.

The CEO added that the company is now getting 11% of its top line from AI-native customers, up from just 4% in the year-ago period. Specifically, these customers accounted for an increase of 10 percentage points in revenue in the second quarter, a fivefold increase from the year-ago period. The company's customer base increased by 9% year over year, and existing customers spent more money on its services.

Datadog's dollar-based net retention rate increased to 120% from the mid-110% range last year. This metric compares the annual recurring revenue (ARR) from customers in a quarter to the ARR from the same customer cohort in the year-ago period. A large chunk of Datadog's customer base has yet to use its AI tools, which opens up the possibility for more cross-selling and stronger growth.

In all, the combination of an increase in customer count along with an improvement in spending by existing customers are the reasons its remaining performance obligations (RPO) jumped by 35% in the previous quarter to $2.4 billion. That was faster than the increase in its quarterly revenue, which is a positive since this metric refers to the total value of a company's contracts that are yet to be fulfilled.

The stock is expensive, but stronger growth could help justify it

Datadog trades at an expensive 76 times forward earnings. One reason is its aggressive outlay on research and development, along with sales and marketing. The company's total operating expenses increased by almost 37% year over year in the previous quarter. This spike seems justified considering the pace at which it is launching new AI tools.

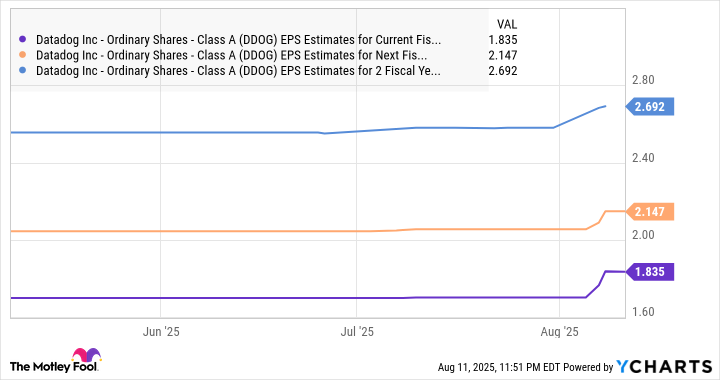

However, the higher outlay is going to affect the company's bottom-line growth in 2025. Datadog expects its earnings to remain flat this year as compared to last year's $1.82 per share. But these investments are helping it build a stronger revenue pipeline by winning more business from existing customers.

This should eventually lead to stronger growth in earnings, which is precisely what analysts are expecting.

DDOG EPS Estimates for Current Fiscal Year data by YCharts; EPS = earnings per share.

The company has the ability to outpace consensus estimates in the future as the adoption of its AI tools improves. That's why investors looking for a growth stock can consider Datadog following its latest dip because AI can help it regain its mojo.