The stock market has been on a roller coaster this year as President Donald Trump's tariff policies have injected more uncertainty into the macroeconomic picture. But one stock that has been on a tear is Uber Technologies (UBER 0.63%).

Uber's shares were up 50% in 2025 through Aug. 11, and hit a 52-week high of $97.72 in July. But shares have pulled back by around 7% from this high, which could be a more appealing buying opportunity.

The company is aggressively moving to deploy a fleet of autonomous vehicles, and that's just one of three good reasons to consider investing in its shares now.

Image source: Getty Images.

1. Uber's autonomous vehicle future

Uber made a name for itself with its ride-hailing service, and the future of that business is self-driving cars. At first, the company attempted to build its own autonomous vehicles, but it has since switched tactics.

Now, Uber is taking a partnership approach. This strategy makes a lot of sense. It avoids the high costs of constructing vehicles, and can instead join forces with top autonomous vehicle makers around the world.

Management says it plans to build up a fleet of 20,000 self-driving cars over the next six years, operating in markets across the globe. It's doing this through a partnership with electric vehicle upstart Lucid and autonomous driving specialist Nuro. Uber says it will invest hundreds of millions of dollars into each of them.

That deal is far from the only one Uber has in the space: It currently has 20 autonomous vehicle partners, among them Alphabet-owned Waymo and U.K.-based Wayve. Uber's role in this ecosystem is to provide AI-driven vehicles with massive troves of driving data on billions of trips in a variety of traffic and weather conditions across 70 countries.

The stakes are high for Uber's autonomous vehicle business. As its ride services division gradually transitions toward a model that's more reliant on self-driving vehicles, the risk that rising compensation costs for human drivers will cut into its profits could diminish. Over the long run, as more of its drivers are replaced by artificial intelligence systems and complex arrays of sensors and cameras, the company's ride-hailing economics are likely to improve.

NYSE: UBER

Key Data Points

2. Strong financial performance

While its self-driving operations ramp up, Uber's income will continue to come primarily from its ride-hailing and delivery divisions. Both are performing well. As CEO Dara Khosrowshahi noted in the second-quarter earnings release, "Our platform strategy is working, with record audience, frequency, and profitability across Mobility and Delivery."

Trips grew 18% year over year in Q2 to 3.3 billion, enabling Uber's ride services segment to see sales of $7.3 billion, a 19% increase. The company's delivery business enjoyed excellent 25% revenue growth to $4.1 billion. As a result, total revenue reached $12.7 billion, up from the prior year's $10.7 billion.

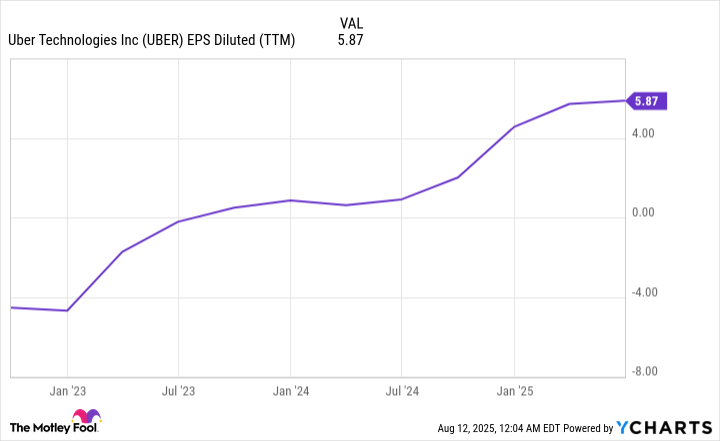

These strong sales numbers led to outstanding financials across the company. Uber's income from operations surged 82% to $1.5 billion in Q2, while its diluted earnings per share (EPS) rose to $0.63 from $0.47 in the prior year, continuing a multiyear trend of steadily rising EPS.

Data by YCharts.

Not only that, Q2 free cash flow increased 44% year over year to $2.5 billion. That strong growth, coupled with management's confidence in the future of Uber's business, led to its announcement of a $20 billion share repurchase program, which will be a boon for shareholders.

3. A compelling stock valuation

With the success Uber is seeing, it's no wonder the company's share price has gone up this year. And yet, Uber stock maintains a reasonable valuation.

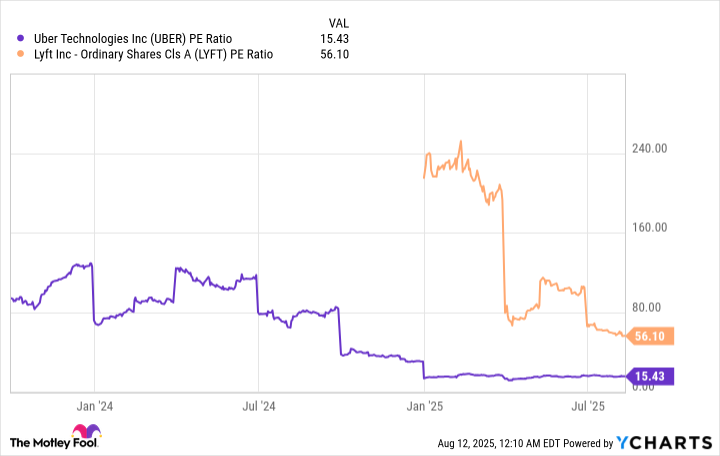

This can be seen in the price-to-earnings (P/E) ratio, which tells you how much investors are willing to pay for a dollar's worth of a company's earnings.

Data by YCharts.

The chart shows Uber's P/E multiple is low relative to where it was in 2024 and earlier, indicating the stock is a better value now. Moreover, compared to the shares of competitor Lyft, Uber stock looks like a bargain.

Uber's promising future in autonomous vehicles, its outstanding financials, and its compelling share price valuation are just three of the reasons that make its stock a worthwhile long-term investment.

Its business is still growing, and there are more catalysts ahead. Consider the partnership it announced on Aug. 8 with Dollar General to deliver the chain's household goods to customers. Uber has made significant strides in its business, and it looks like its best days still lie ahead.