The "Ten Titans" are the largest growth-focused U.S. companies by market cap -- consisting of Nvidia (NVDA 0.56%), Microsoft (MSFT 0.79%), Apple, Amazon, Alphabet (NASDAQ: GOOGL) (GOOG 0.24%), Meta Platforms, Broadcom (AVGO 1.07%), Tesla, Oracle (ORCL 1.17%), and Netflix.

Combined, they make up over 37% of the S&P 500, showcasing the top-heavy nature of the index and how just a handful of companies can move the market.

If I could only buy and hold half of the Ten Titans through 2030, I'd go with Nvidia, Broadcom, Microsoft, Oracle, and Alphabet. Here's what separates these growth stocks from the rest of the pack.

Image source: Getty Images.

The building blocks of AI

Nvidia and Broadcom both play crucial roles in the buildout of artificial intelligence (AI).

Nvidia's graphics processing units, CUDA software platform, and associated infrastructure provide a full-scale AI ecosystem for data centers. Orders continue to pour in for Nvidia's chips as big tech companies ramp up capital expenditures to support AI models.

Broadcom makes application-specific integrated circuits, which are AI accelerators that can perform specific functions. The company's latest customer accelerator (XPU) is its 3.5D eXtreme Dimension System in Package, which drastically cuts down on power consumption and boosts efficiency between components -- all within a smaller package size. Broadcom offers compute, memory, network, and packaging capabilities, giving customers a vertically integrated solution for AI at scale.

Broadcom has a highly differentiated networking and infrastructure software business. In addition to AI accelerators, its semiconductor segment also offers a variety of solutions for enterprise clients, like broadband, wireless, storage, and more.

NASDAQ: NVDA

Key Data Points

Three different ways to bet on cloud computing

Microsoft, Alphabet, and Oracle offer three distinctly different ways to invest in cloud computing.

Microsoft Azure is the No. 2 cloud player behind Amazon Web Services. Azure is Microsoft's fastest-growing segment -- capitalizing on AI demand through cloud offerings specifically geared toward handling AI workloads. But what separates Microsoft from other cloud plays is the strength of the rest of its business. Copilot for Azure, the Microsoft 365 software suite, and GitHub continue to grow their active user base. Microsoft's revenue growth has accelerated, and profit margins are at their highest level in over a decade -- driving Microsoft's surging stock price.

Alphabet's Google Cloud doesn't have as much market share as Azure, but it is growing quickly and becoming more profitable. But unlike Microsoft, where cloud is the centerpiece of the investment thesis, Google Cloud doesn't contribute nearly as much to Alphabet's bottom line as other services -- namely Google Search and YouTube.

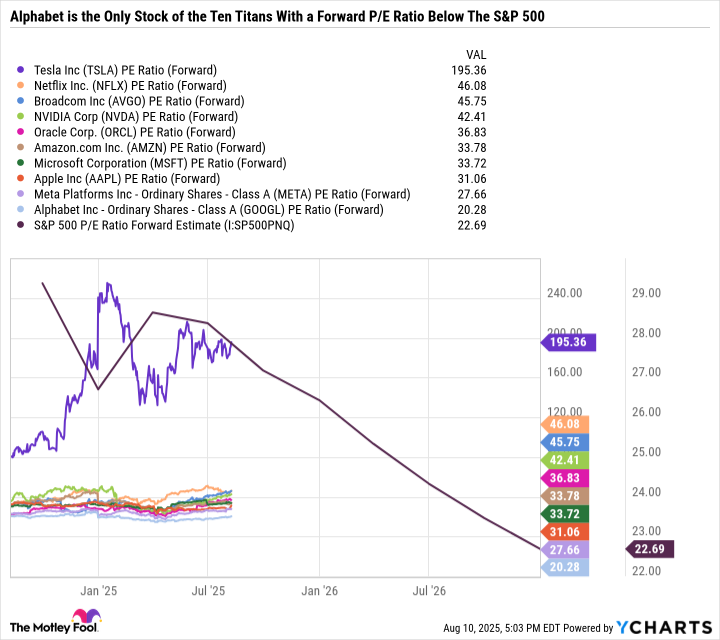

Alphabet stock has roared higher in recent months, but it's still arguably the best value of the Ten Titans.

TSLA PE Ratio (Forward) data by YCharts

While Google Search could see disruption from rival information resources like ChatGPT, it's worth noting that Google Gemini has gained significant traction in recent quarters -- showing Alphabet's ability to adapt.

Oracle Cloud Infrastructure (OCI) is arguably the most exciting play in cloud computing right now. OCI is thriving due to its flexible structure, which leans on Oracle's established database ecosystem. It is best paired with Oracle databases and applications, with certain services not available on other clouds.

Instead of going toe-to-toe with the "big three" cloud providers, Oracle partners with them by combining its database services with the AWS, Azure, and Google Cloud infrastructure. All told, Oracle is a top play in cloud computing because it offers its own vertically integrated suite of solutions, but also stands to benefit from the overall growth of the industry through its partnerships.

These titans are worth their premium price tags

Nvidia, Broadcom, Microsoft, Alphabet, and Oracle have all been phenomenal stocks -- crushing the S&P 500 over the last five years. With the exception of Alphabet, outsized gains have made valuations expensive based on their trailing and forward earnings estimates, which may deter some investors from approaching these names.

However, folks who are looking for top companies to buy and hold through at least 2030 will care more about where a company will be years from now than the next few quarters. The advantage of a longer investment time horizon is that you can give a company time to grow into its valuation. Nvidia, Broadcom, and Oracle are some of the most expensive of the Ten Titans, but they also have the most attractive runways for growth. Meanwhile, Microsoft and Alphabet have more reasonable valuations and multiple levers to pull for growing earnings for years to come.

There are valid cases for buying all of the Ten Titans, but Nvidia, Broadcom, Microsoft, Alphabet, and Oracle truly stand out as the best of the best for long-term investors.