As of the closing bell on Aug. 12, shares of data mining darling Palantir Technologies (PLTR +3.90%) have skyrocketed by 147% year to date -- making it the top-performing stock in the S&P 500 for two years running.

The obvious talking point here is that Palantir has been on a monster run throughout the course of the artificial intelligence (AI) revolution. Skeptics point to Palantir's lofty valuation as the cornerstone of the bear argument, as the stock trades at levels encroaching on dot-com-era bubble territory. While that's true, such concerns haven't stopped the stock from repeatedly notching new highs.

I think there is a far subtler detail surrounding Palantir stock that rarely gets discussed. If history is any guide, it could set the stage for an epic reversal.

Is now the time to sell Palantir stock? Read on to find out.

NASDAQ: PLTR

Key Data Points

Valuation that redefines what it means to be "expensive"

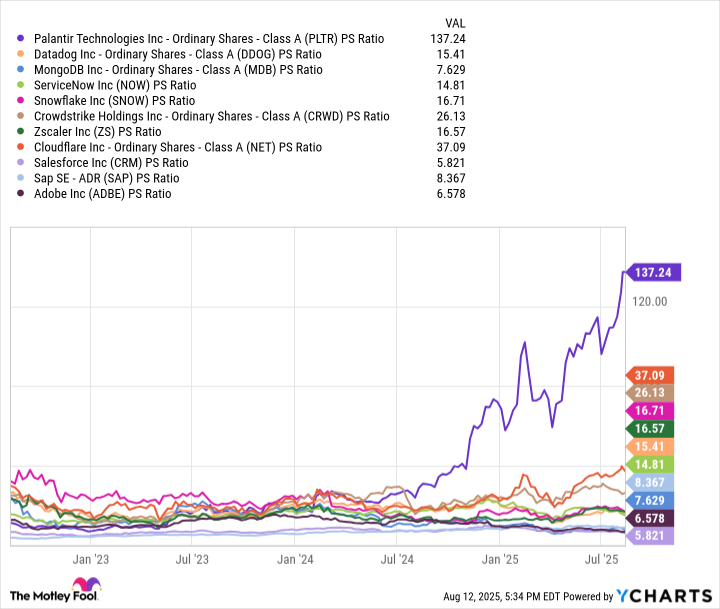

During the late 1990s, internet companies were often measured by non-financial metrics based on user engagement. Businesses such as Amazon, Cisco, Microsoft, Alphabet, and Yahoo! were valued based on eyeballs and clicks rather than sales and profits. At the peak of dot-com euphoria, many of these internet pioneers traded at price-to-sales (P/S) multiples between 30 and 40 -- considered unsustainably high at the time.

Palantir has completely redefined how next-generation technology businesses are valued, though. As of Aug. 12, Palantir boasts a market cap of nearly $444 billion -- larger than Salesforce, SAP, and Adobe, which are far more mature, diversified businesses. Perhaps even more striking is that Palantir's P/S of 137 exists in its own stratosphere -- completely outside the dimensions of its software-as-a-service (SaaS) peers.

PLTR PS Ratio data by YCharts

Some argue that traditional valuation methodologies such as P/S or earnings multiples don't fully capture Palantir's true value or its full potential. Instead, they urge investors to focus on industry-specific and financially engineered metrics such as the Rule of 40 to see just how "cheap" Palantir stock really is.

I think this argument is flawed. There's a more telling metric -- and one that almost nobody talks about -- that makes me think Palantir stock could be on a collision course with history.

Image source: Getty Images.

Is "smart money" trying to tell us something?

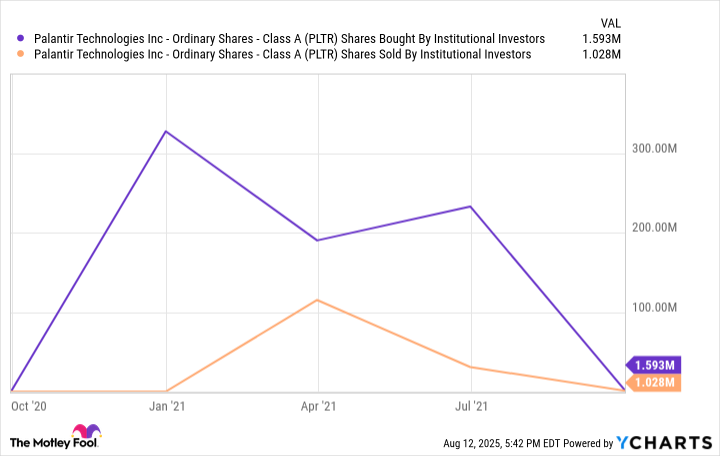

The chart below tracks buying activity in Palantir stock across institutional investors since its initial public offering (IPO) in late 2020.

PLTR Shares Bought By Institutional Investors data by YCharts

Initially, there was a wave of "smart money" buying during early 2021, which was met with substantial selling during the latter half of that year. Palantir's institutional ownership picked up again following the company's splash into the AI realm a couple of years ago. It's this dynamic where I think the retail investing crowd is missing the bigger picture and buying into a mirage.

As the chart above illustrates, there is a convergence happening between the institutional buying and selling in Palantir stock. When net demand tightens -- meaning that buying is no longer materially higher than selling -- it takes less downside pressure to inspire a precipitous drop in share price. I see the dynamics illustrated in the chart above as an inflection point for Palantir stock.

In addition, banks, wealth management firms, mutual funds, and hedge funds all have different priorities. Many of these institutions are required to hold large-cap stocks for benchmarking purposes, not because they think the stock is undervalued or because they carry some "diamond hands" conviction that shares are going higher despite abnormal volatility in the present. When a stock becomes an abnormally high weight relative to the overall portfolio, institutional investors often trim their exposure. This is known as portfolio rebalancing.

Ron Baron on Tesla

-- Tesla Owners Silicon Valley (@teslaownersSV) March 12, 2025

"I'm the last in, I'll be the last out. I won't sell a single share personally until I sell all the shares for clients; I have not sold a single share personally" pic.twitter.com/EBT1esY14A

This scenario can be perfectly explained in the video clip above in which mutual fund billionaire Ron Baron describes his fiduciary responsibility to take profits from time to time in even his highest-conviction positions, such as Tesla. If a stock becomes overinflated, institutions will use this market liquidity as a mechanism to sell their shares to retail at a premium. This dynamic is more colloquially referred to leaving retail "holding the bag" when the hype narrative fades.

While I can't say for certain where Palantir stock is headed, my thought is that fund investors are going to pressure portfolio managers to trim exposure to Palantir and take some money off the table, much like what Baron experienced. I think the pressure will be rooted in the anticipation of a valuation reset for Palantir given its frothy positioning relative to peers.

Will history repeat itself?

Although history is not always a perfect predictor, I think it's a strong barometer in this case. While it's virtually impossible to pick the perfect time to sell a stock, I think there are some compelling -- and overlooked -- details that suggest Palantir stock could be headed lower from current price points sooner than many bulls expect.