Recent artificial intelligence (AI) developments, and the investor excitement that has come with them, have sent a spark through many tech companies' stocks. One of the main beneficiaries has been graphics processing unit (GPU) maker Nvidia (NVDA 0.46%). As of Aug. 14, Nvidia sits as the world's most valuable public company, with a market cap of over $4.4 trillion. It's the first company to cross the $4 trillion mark.

Image source: Getty Images.

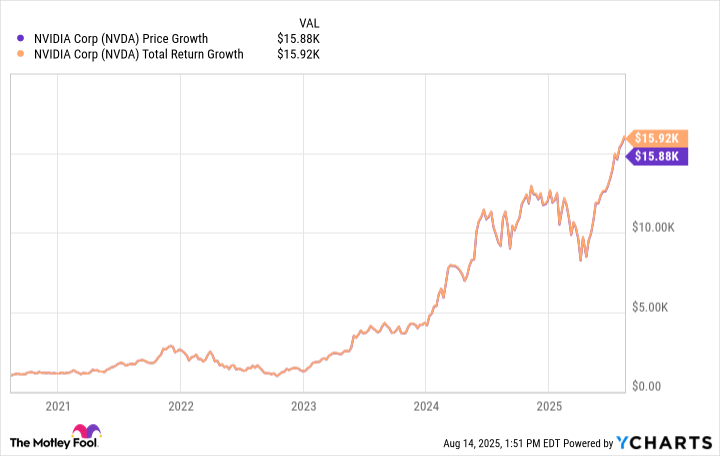

Nvidia first went public in January 1999, but the past few years have been what have ascended the company into elite territory -- and it has made many investors a lot of money along the way. Had you invested $1,000 into Nvidia stock five years ago (using Aug. 14, 2020, as the start date), your investment would be worth around $15,900, at the time of this writing.

Why has Nvidia's stock become so popular?

I mentioned Nvidia as a GPU maker because that has been the fuel behind its recent impressive business and stock performance. Nvidia has over a 90% market share of data center GPUs, which are critical to the AI ecosystem. Nvidia's GPUs allow companies to train, deploy, and scale AI models efficiently. Their capabilities have made Nvidia the go-to.

NASDAQ: NVDA

Key Data Points

In Nvidia's fiscal first quarter (ended April 27), its revenue increased 69% year over year to $44.1 billion. Its data center revenue increased 73% year over year to $39.1 billion. With data centers accounting for almost 89% of Nvidia's total revenue, it's easy to see just how important the current AI boom has been for its business.

I wouldn't expect similar returns over the next five years for Nvidia, but the company holds a commanding position in the AI ecosystem.