Investing styles tend to evolve as people age. Seniors who are already retired often look for steady, reliable, dividend-paying companies. Younger investors, on the other hand, can afford to take more risks and tend to seek out companies that, despite being more volatile, also boast significant long-term upside potential.

With that in mind, let's consider two stocks that people in their 30s -- who are still a good distance away from retirement -- should consider investing in: Intuitive Surgical (ISRG 1.09%) and Moderna (MRNA 3.02%).

Image source: Getty Images.

1. Intuitive Surgical

Intuitive Surgical is a medical specialist that leads the market for robotic-assisted surgery (RAS) devices, thanks to its famous da Vinci system, which is by far its most important growth driver. This machine enables physicians to perform minimally invasive surgeries across a range of approved indications, including bariatric, urologic, and general surgery.

The company has faced several challenges over the past few years, including a decline in bariatric surgeries due to the growing popularity of anti-obesity medications, and the threat posed by the Trump administration's tariffs.

NASDAQ: ISRG

Key Data Points

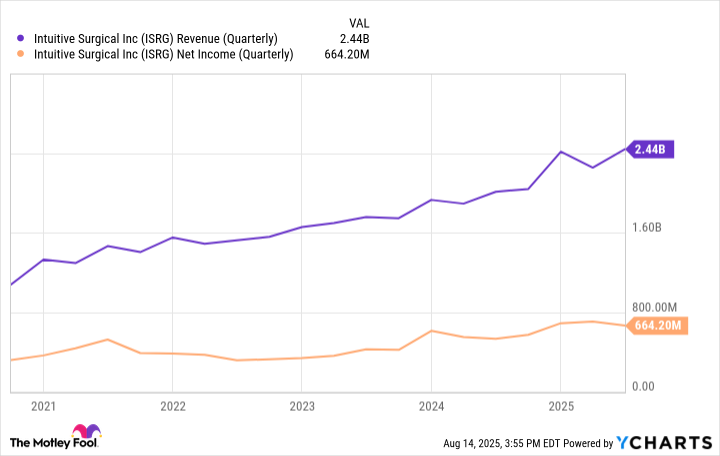

Despite those problems, its long-term prospects look incredibly attractive. One reason is that Intuitive Surgical has a resilient business. The company has achieved excellent results over the past five years, with consistently growing top- and bottom-line numbers:

ISRG Revenue (Quarterly) data by YCharts.

Another great reason to remain bullish on the company's long-term prospects is that its addressable market still looks underpenetrated. Intuitive Surgical makes more than half of its revenue from sales of instruments and accessories, which are tied to procedure volume. The more surgeries physicians perform with its devices, the higher its sales. Thus, Intuitive Surgical will benefit from demographic changes that are happening right under our noses, as the world's population ages.

By the time investors in their 30s retire, a much higher proportion of the population will be seniors who are in greater need of the kinds of procedures Intuitive Surgical offers. Furthermore, even with mounting competition, the company benefits from a wide moat due to switching costs (da Vinci systems are expensive) and intangible assets, namely patents that protect its inventions.

Intuitive Surgical has consistently outperformed the market over the past 25 years, and it's likely to continue doing so, helping younger investors significantly grow their capital over time.

2. Moderna

Moderna is a riskier bet than Intuitive Surgical, but the biotech also has significant upside potential. The vaccine maker demonstrated its innovative capabilities by developing one of the most successful COVID-19 vaccines on the market. Several pharmaceutical leaders tried and failed, but Moderna succeeded; that's saying something. The company's mRNA platform is attractive because vaccines based on it tend to be faster and cheaper to develop.

And since its success in the coronavirus space, Moderna has recorded several clinical and regulatory wins. It earned approval for a vaccine for respiratory syncytial virus (RSV) and recorded phase 2 or phase 3 wins for vaccines against influenza, influenza plus COVID, and even cancer.

NASDAQ: MRNA

Key Data Points

Why, then, has the stock significantly lagged the market over the past three years? Moderna's coronavirus vaccine franchise is no longer generating the sales and profits it once did. The company's shares probably rose too much too fast in the early pandemic years, meaning a sell-off was justified. However, now Moderna could take off and deliver superior returns over the long run, provided it continues to innovate.

To that end, the company's pipeline looks attractive, with potential candidates across even ambitious targets. Moderna's personalized cancer vaccine, mRNA-4157, which helped decrease the risk of recurrence and death in melanoma patients in phase 2 studies, is now in late-stage clinical trials. The company is targeting many other cancers, and is even working on a potential HIV vaccine that's in early-stage clinical trials.

While mRNA vaccines are still relatively new to the market, if Moderna manages to make them mainstream by launching several over the next five years, there could be a massive upside for the stock. Again, it's a riskier bet, but investors in their 30s who can handle the volatility should seriously consider Moderna.