The best stocks to own aren't always the companies dominating the news headlines.

Sometimes, a world-class company sits right under your nose. You may even drive by it in your neighborhood every day.

Did you know that AutoZone (AZO 0.36%), the automotive parts retailer, has returned over 14,000% since 1994? That trounces the S&P 500 index, and it's not ancient history, either -- the stock has beaten the index over the past year, three years, five years, and decade!

What is the stock's recipe for success, and can AutoZone continue to deliver such impressive returns moving forward? Here is what you need to know.

Image source: Getty Images.

AutoZone's secret formula: expansion, efficiency, and relentless buybacks

AutoZone is an automotive parts retailer with a network of over 7,500 company-owned stores across the United States, Mexico, Puerto Rico, and the Virgin Islands. It sells parts and accessories to consumers and commercial customers, as well as offers some complementary in-store services, like battery testing and engine light diagnostics.

As a retailer, efficiency is paramount to business performance. Late investing great Charlie Munger loved companies with a high ROIC, or return on invested capital. Essentially, that's a measurement of a company's post-tax profits versus the money needed to operate the business. In other words, you look for companies that can put a little bit of money into the business and get a lot of profit out of it.

AutoZone stands out in this regard. The company's ROIC has averaged 37.6% over the past decade, a tremendously high figure. It's a sign of the company's well-run operations and competitive advantages. Additionally, AutoZone has continually expanded over the years. Its store count has increased from 4,984 at the end of 2014 to 7,516 stores today.

The combination of growth and business efficiency helps explain the stock's staggering performance.

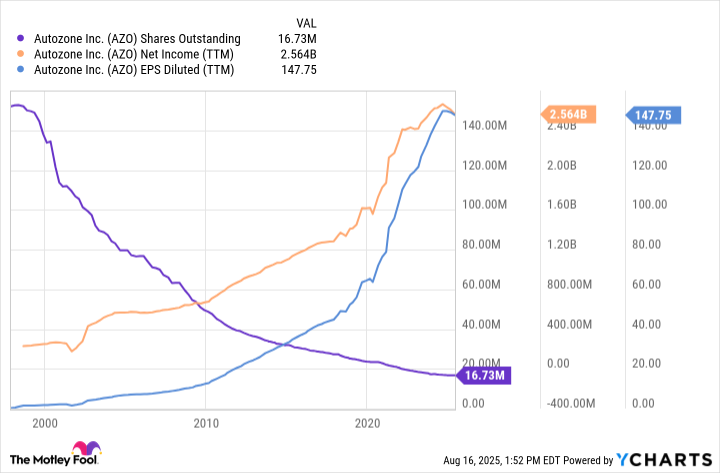

But that's not all. AutoZone takes its profits and uses them to repurchase shares, helping further increase earnings per share and the stock's share price. AutoZone's share count has declined nearly 90% from its peak in the late 1990s.

AZO Shares Outstanding data by YCharts

It's this trifecta -- expanding, operating efficiently, and ruthlessly buying back stock -- that has made AutoZone such a winner over the years.

Why AutoZone's success is sustainable

As long as AutoZone's formula stays intact, there's no reason the stock can't continue to perform well.

Management sees room for growth, with long-term goals to bring its store count to over 10,000 in the United States, plus an additional 1,000 in Mexico. It could also choose to expand into new countries over time. The key will be for AutoZone to maintain its high efficiency and focus on its core competence. For instance, Genuine Parts is a competitor that operates the NAPA automotive parts store brand. However, the company also deals in industrial replacement parts. Operating in two very different markets may help explain its drastically lower ROIC, just 12.3% on average over the past decade.

The one thing investors can count on is that AutoZone's stores should stay busy for the foreseeable future. The typical passenger vehicle lasts 16.5 years and over 150,000 miles. There are nearly 300 million vehicles on America's roads. Vehicles have become increasingly high-tech over time, but are still ultimately a system of moving parts and components that wear out and break down over time. It's hard to envision the need for replacement parts going away anytime soon.

Should investors buy the stock right now?

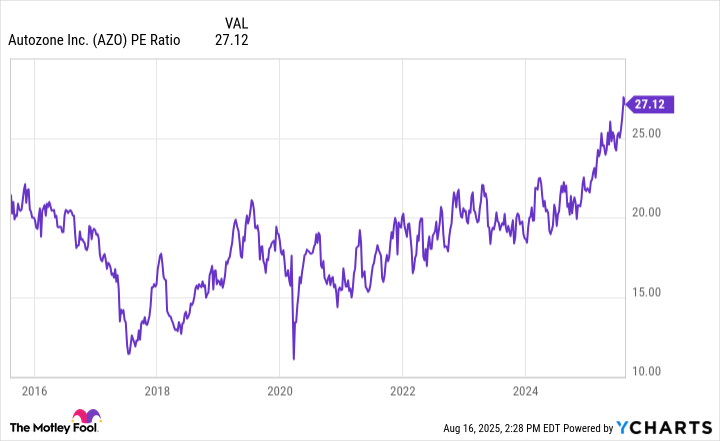

Investors who wish to own the stock may want to nibble for now or wait for a better entry point. AutoZone currently trades at 27 times its earnings, its most expensive valuation in over a decade.

AZO PE Ratio data by YCharts

AutoZone could face some near-term risks that make it difficult to justify paying such a high price for the stock.

Many people are struggling financially right now. People can't avoid critical repairs when a vehicle breaks down, but they might avoid more discretionary purchases, such as accessories or routine maintenance. On top of that, tariffs could raise prices or pressure AutoZone's profits since many automotive parts and components are imported to the United States.

Wall Street analysts have lowered their growth estimates over the past year for AutoZone, and these headwinds likely have something to do with that. That said, long-term investors shouldn't hesitate to buy the dip on this monster stock if these headwinds eventually drag the stock down.