Celsius Holdings (CELH -1.29%) stock has climbed 43% since releasing its earnings results for the second quarter of 2025 on April 7. The energy drink company has benefited from strong sales of its core flavors, the popularity of limited time offerings, and its recent acquisition of Alani Nu.

Amid those successes, investors should focus on one key metric in 2025 that is likely to continue driving the stock price going forward.

Image source: Getty Images.

The key metric

The metric that is arguably most critical to Celsius stock investors is its net sales.

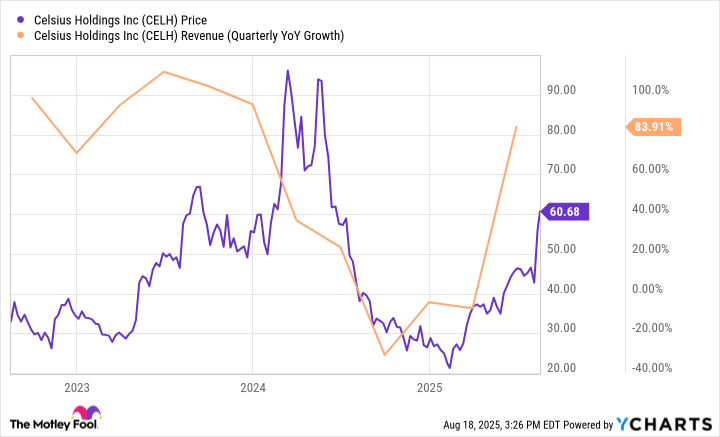

In Q2, net sales rose to more than $739 million, a year-over-year increase of 84%. This impressive growth, however, was largely due to Alani Nu. Sales of Celsius brand products rose 9% year over year. While that was an improvement from recent quarters, it fell far short of the 129% growth for the Alani Nu brand.

Investors who have been following this stock the past few years know that massive sales growth helped take Celsius to a record closing price of $96.11 per share in Mar. 2024. Conversely, they likely also recall when slower purchases from a key distributor, PepsiCo, resulted in declining revenue growth and, in turn, a plummeting stock price as you can see below.

Data by YCharts.

PepsiCo has powered much of the sales growth for Celsius since the two companies signed a distribution agreement in Aug. 2022, and the snack and beverage giant remains critical to Celsius' continued success.

Meanwhile, selling, general, and administrative expenses rose 107% year over year amid acquisition-related costs and higher spending on marketing. Celsius shareholders need to keep track of these expenses as well.

Still, investors should note that Celsius' share of the U.S. market rose 1.8 percentage points to 17.3% last quarter. As long as Celsius continues to grow revenue at a rapid pace, investors are likely to bid the stock higher.