Dividend investors have some advantages over investors who focus solely on growth stocks. The portfolio income they generate often grows over time and can buffer weak returns when markets are flat or declining. And if you choose to automatically reinvest the dividends, you can accumulate more shares when prices are low and amplify your long-term returns.

With those positive points in mind, let's look at two attractive dividend stocks worth buying right now.

Image source: Getty Images.

1. PepsiCo stock is bubbly

PepsiCo's (PEP +0.89%) dividend yield looks tempting at above 3.5% today. Sure, that high yield is partly thanks to the stock underperforming the market over the past two years. Wall Street pros are disappointed with the consumer staples giant's 1.7% organic sales growth so far in 2025, compared to 2024's 2% uptick. Management is expecting earnings to be flat this year, too, as the company works to pass along higher costs in an era of slow demand growth.

Yet there's plenty to like about this investing story. Pepsi is highly profitable with an operating margin sitting at 18% of sales. The company is on track to return nearly $9 billion to shareholders this year, mainly through dividend payments. And the 5% dividend hike the company announced for 2025 was its 53rd consecutive annual raise, meaning it's a Dividend King. As for speeding growth back up, Pepsi is busy reshaping its portfolio to capitalize on demand for more health-focused drinks and snacks. It recently closed a $2 billion purchase of the Poppi prebiotic soda brand.

You can own the stock for 2.2 times sales, compared to the 3 times sales (price-to sales valuation) that investors were paying for Pepsi in 2023. That discount should pave the way for better returns from here, even if it takes time for the company to accelerate organic sales gains back up toward the 10% spike that shareholders enjoyed in 2023.

2. McDonald's looks tasty

In early August, McDonald's (MCD +1.20%) had some good news for investors to celebrate in its Q2 earnings report. The restaurant company returned to comparable-store sales growth as gains hit 4% compared to the prior quarter's slight decline. Management credited its focus on value along with aggressive spending in areas like mobile ordering and delivery. "Our technology investments and ability to scale digital solutions at speed will continue to elevate the McDonald's experience," CEO Chris Kempczinski said .

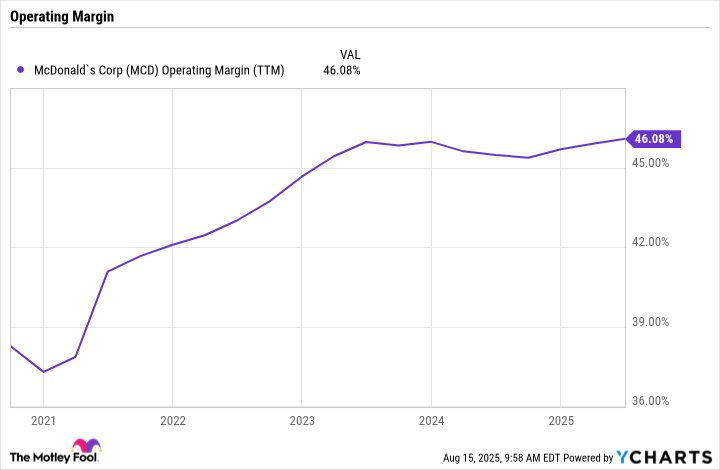

Those investments aren't harming profitability, either. McDonald's posted 5% higher Q2 earnings and ample free cash flow. The chain's operating margin continues to climb toward 50% of sales.

MCD Operating Margin (TTM) data by YCharts

Shareholders will want to see more improvements in growth trends in the second half of 2025. I'll be watching for McDonald's to return to customer traffic gains, too, so it doesn't have to rely so much on higher average spending in its restaurants or on the digital selling channel.

In any case, this 2.6%-yielding dividend stock has a good shot at boosting your portfolio returns from here, given its sluggish performance so far in 2025. Investors are clearly more interested in tech stocks right now, and that's creating an opportunity for income investors to pick up shares of high-performing companies like McDonald's and PepsiCo, securing many years of rising dividend payments in the process.