Nvidia (NVDA 0.35%) recently became the world's first $4 trillion company. Demand continues to outstrip supply for its data center chips, which are the best in the world for developing artificial intelligence (AI) models. With all the added revenue pouring in, Nvidia has been looking for ways to put it to use. One way is by investing in smaller AI companies, equipping them with the financial resources and technical expertise they need to commercialize their products.

Between 2022 and 2024, the chip giant invested $12 million in Serve Robotics (SERV +3.31%), which develops autonomous last-mile logistics solutions. However, Serve stock has lost 55% of its value since Feb. 14, 2025, which is the date Nvidia filed a 13-F with the Securities and Exchange Commission (SEC), revealing it sold its entire stake in the start-up at the end of 2024.

Serve is currently working to deploy 2,000 of its latest food delivery robots as part of a major deal with Uber Technologies' (UBER +5.95%) Uber Eats platform, which could drive stratospheric growth in its revenue over the next year. With that in mind, should investors buy the dip, or was Nvidia's exit a sign to steer clear?

Image source: Getty Images.

A potential $450 billion opportunity

Serve believes existing last-mile logistics solutions are extremely inefficient because they rely on human drivers and 2-ton cars to deliver small commercial loads like food and retail goods. The company thinks autonomous robots and drones are better options, and a forecast by Ark Investment Management suggests a shift to these solutions could create a $450 billion opportunity by 2030.

Serve's latest Gen3 robots are powered by Nvidia's Jetson Orin platform, which includes the hardware and software they need to achieve Level 4 autonomy. This means they can safely drive on sidewalks within designated areas with no human intervention, making them ideal for deliveries from local restaurants and retailers.

Serve's robots have made more than 100,000 deliveries on behalf of 2,500 restaurants since the beginning of 2022, and they boast an incredible 99.8% completion rate, so they are extremely reliable. As the company achieves scale, it believes it can drive the cost of each delivery down to just $1, which could potentially displace human-driven last-mile services entirely.

Serve is working to deploy 2,000 Gen3 robots at the moment, which will complete food deliveries on behalf of the Uber Eats platform. Around 400 were already in service at the end of the second quarter of 2025 (ended June 30), with 400 more set to enter the market during the third quarter. They are active in Los Angeles, Miami, Dallas, and Atlanta already, and will enter Chicago in the next few months.

NASDAQ: SERV

Key Data Points

Serve's revenue is set to soar, but the company is losing truckloads of money

Serve generated $642,000 in total revenue during the second quarter of 2025, which was up 37% from the year-ago period. That's a tiny amount of revenue for a company with a market capitalization of over $500 million, but growth could be astronomical as the company scales.

In fact, Wall Street's consensus estimate (provided by Yahoo! Finance) suggests Serve's total 2025 revenue could come in at around $3.6 million, which would be up 99% from 2024. Then, according to management's guidance, Serve's annual revenue could explode to as much as $80 million once the rollout of all 2,000 Gen3 robots is complete, which is expected to happen sometime in 2026.

However, Serve is burning truckloads of money to commercialize its business. It lost $33.7 million during the first two quarters of 2025 alone on a GAAP (generally accepted accounting principles) basis, so it's on track to exceed its $39.2 million loss from 2024 by a very wide margin.

Serve has around $183 million in cash on hand, which is a comfortable buffer for now, but management warns it might only last until the end of 2026. If the company has to conduct another capital raise, it will dilute existing shareholders and dent their future returns, which is something to consider before buying the stock.

Nvidia probably made the right call when it sold Serve stock

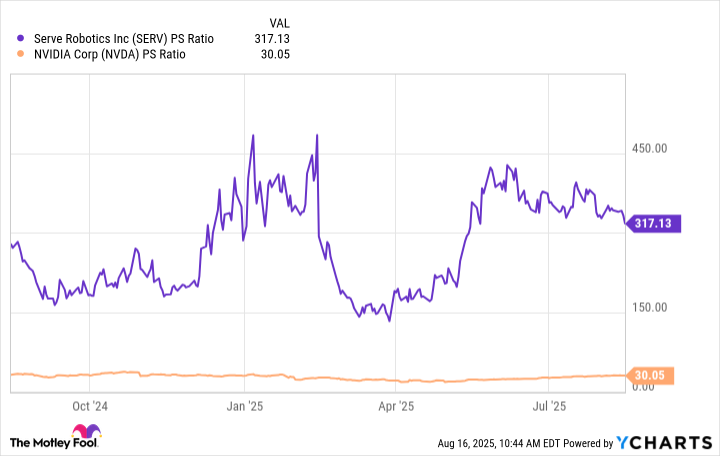

Serve stock might be a risky investment because of the company's financial situation, but to make matters worse, investors will have to pay a sky-high valuation to buy it now because it's trading at a price-to-sales (P/S) ratio of 317.

For some perspective, Nvidia stock trades at a P/S ratio of just 30. I don't think Serve deserves a tenfold premium to one of the highest-quality companies in the entire world, despite its potential to deliver significant revenue growth next year.

Data by YCharts.

Nvidia never disclosed its reason for selling Serve stock, but its valuation might have been a factor. Even though the chip giant is worth $4.4 trillion, it doesn't make sense to hold on to an investment that is objectively overvalued, because it opens the door to significant potential downside.

As a result, investors probably shouldn't rush to buy Serve stock despite its 55% decline since February. Its valuation leaves very little room for upside, and there is no guarantee management meets its ambitious revenue target next year.