Artificial intelligence (AI) is a hot sector with forecasts predicting the market to grow from $244 billion in 2025 to over $800 billion by 2030. This astounding growth could be supercharged by the advent of quantum computers.

Quantum machines possess the ability to complete intricate calculations that surpass the capacities of classic computers. Marrying quantum devices with AI opens up new possibilities not attainable today.

That's what makes the release of AI tools by D-Wave Quantum (QBTS +4.74%) a significant development. The tool set enables integration with D-Wave's quantum computers.

Does this melding of AI and quantum tech suggest D-Wave stock is worth investing in? To assess the opportunity, let's look into what the company is doing and whether now is the time to buy shares in D-Wave.

Image source: Getty Images.

Details of D-Wave's new AI features

On Aug. 4, D-Wave rolled out new tools allowing AI software developers to experiment with its quantum computer processors. This tool kit integrates the company's quantum systems with PyTorch, a framework for building AI models that has become a leader in the space.

D-Wave's tools provide a PyTorch neural network module, enabling the development and training of AI models using a quantum computer. Today, these models require massive computational power and energy. As a result, the cost to build AI is escalating.

According to Dr. Alan Baratz, CEO of D-Wave, "Quantum computing's integration with AI and machine learning could offer scalable, energy-efficient solutions to address these issues and potentially offer enhanced AI capabilities."

The company is already working with customers to advance the use of AI with quantum machines. For instance, it's partnering with the pharmaceutical division of Japan Tobacco to combine quantum systems and AI in the drug-discovery process.

NYSE: QBTS

Key Data Points

The impact of D-Wave's tech on financial performance

Delivering the ability of quantum computers to assist with AI development is an impressive milestone. But how have D-Wave's technological advances helped the company?

Through the first half of 2025, D-Wave's sales have skyrocketed 289% year over year to $18.1 million. Its Japan Tobacco partnership is an example of broader customer demand, as orders in the Asia-Pacific region have grown 83% over the past 12 months.

Clients in the area seek to apply D-Wave's quantum tech to AI and other business challenges. As a result, the company is holding its first quantum computing conference in Tokyo on Sept. 17.

Moreover, D-Wave's gross margin ticked up to 63.8% in the second quarter from 63.6% in the prior year. You want to see gross margin steadily rise, as it means the company is improving cost management and thereby growing gross profit, which improved 42% year over year for D-Wave to $2 million off $3.1 million in Q2 sales.

However, D-Wave doesn't operate a profitable business. Its Q2 loss from operations reached $26.5 million, up from a loss of $18.8 million in 2024, as research and development costs grew more than 50% year over year to $12.7 million.

The increase in D-Wave's expenses are to be expected, since developing cutting-edge technology is not easy -- or cheap. In fact, many tech companies operate at a loss for years as they pour earnings into building up their businesses. So D-Wave's situation is not uncommon.

In addition, the company has amassed a sizable war chest of $819.3 million in cash and equivalents at the end of Q2. This brought Q2 total assets to $843.6 million versus total liabilities of $149.3 million.

The solid balance sheet funds operations in the short term while the company ramps up sales and seeks strategic acquisitions.

Evaluating whether to invest in D-Wave stock

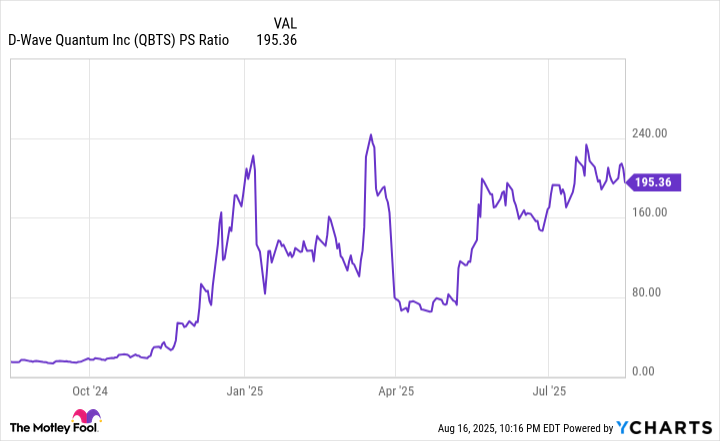

Do these factors mean now is the time to invest in D-Wave stock? One consideration is share-price valuation. This can be assessed using the price-to-sales (P/S) ratio, which measures how much investors are willing to pay for every dollar of revenue generated over the trailing 12 months.

Data by YCharts.

The chart shows D-Wave's P/S multiple has gone up since it plunged in April along with the broader stock market due to President Trump's aggressive tariff approach. As of Aug. 15, it's near previous peaks, suggesting D-Wave shares are pricey.

The other consideration is that quantum computers suffer challenges that prevent them from becoming scalable and cost effective. These devices use atomic particles to perform computations, but the particles are sensitive to the slightest environmental disruption, such as vibrations or temperature fluctuations.

D-Wave is working to overcome these challenges but so are its many competitors, and it could take years to solve the issues. As a result, investing in D-Wave is only for those with a high risk tolerance. A judicious approach is to wait for D-Wave's share price to drop before deciding to buy.