The quantum computing sector offers an exciting new area to invest in. Quantum machines can perform sophisticated calculations beyond the capabilities of current classical computers. This tech could transform industries such as medicine and artificial intelligence.

But among the bevy of businesses in the field, which are worthwhile long-term investments as the nascent industry grows? Two to consider are D-Wave Quantum (QBTS +7.57%) and Quantum Computing Inc. (QUBT +7.31%), which also refers to itself as QCi.

Between D-Wave and QCi, one looks like the better quantum computing stock. Read on for an exploration of both businesses to understand which one and why.

Image source: Getty Images.

Untangling D-Wave Quantum's business performance

D-Wave produces income primarily through subscriptions to its quantum systems via the cloud and professional services to support customers in the use of its technology.

In 2025, D-Wave's sales have been on a roller coaster. It generated $15 million in the first quarter after selling one of its quantum computers. In Q2, revenue was $3.1 million, a 42% increase from 2024's $2.2 million as the company picked up $1 million to upgrade the device sold in the first quarter.

This sales volatility could continue for some time as D-Wave grows its business. An encouraging sign is 92% year-over-year growth in its Q2 bookings to $1.3 million. Bookings represent customer orders received in the quarter that are expected to produce revenue when the orders are fulfilled.

However, D-Wave isn't turning a profit. Its Q2 operating loss of $26.5 million was a 42% increase from the previous year. That's a concerning trend given its Q2 revenue of just $3.1 million.

Fortunately, D-Wave has stockpiled a record high $819.3 million in cash and equivalents on its balance sheet. It exited Q2 with total assets of $843.6 million versus total liabilities of $149.3 million. This enables the company to maintain operations in the short term on its path to revenue growth.

NYSE: QBTS

Key Data Points

Quantum Computing Inc.'s budding business

QCi uses light particles, called photons, to perform calculations in its quantum computer chips. It sells these chips, other hardware, and professional services to generate revenue.

The company is in an early stage of its business lifecycle with sales coming primarily from research grants and proof-of-concept projects. As a result, its sales are small, and prone to substantial swings. For example, in 2024, QCi generated revenue of $373,000, a 4% year-over-year increase. But through the first half of 2025, sales plunged 52% to $100,000.

QCi's technology has the potential to generate long-term revenue growth. Photons can be used in a wide range of light sensing, imaging, and other optical applications. Nevertheless, until QCi can gain traction with a larger group of customers, sales will continue to struggle. And that does not bode well for its business viability, because the company is not profitable.

The company exited Q2 with an operating loss of $10.2 million against revenue of $61,000 as research and development costs more than doubled year over year to $6 million. QCi's saving grace is that, like D-Wave, it amassed a large war chest to fund operations in the short term. Q2 total assets were $426.1 million with cash and equivalents of $348.8 million. Total liabilities in the quarter were $30.1 million.

NASDAQ: QUBT

Key Data Points

Deciding between D-Wave Quantum and Quantum Computing Inc.

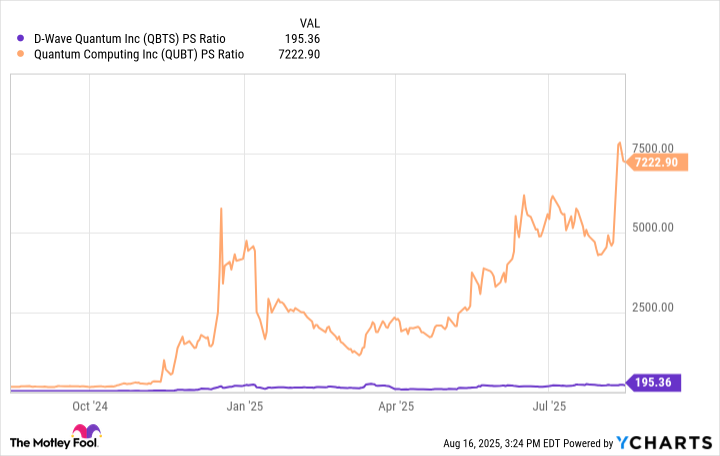

In choosing between D-Wave Quantum or QCi, an important consideration is share price valuation. Since both are not profitable, the way to get at this is using the price-to-sales (P/S) ratio, which measures how much investors are willing to pay for every dollar of revenue generated over the trailing 12 months.

The chart shows QCi's P/S multiple is far above D-Wave's, and the disparity is so great, QCi shares look overpriced. Consequently, D-Wave stock is the better value. This, combined with promising sales and bookings growth, makes D-Wave a more attractive investment than its rival.

At QCi's current phase of development, it's a highly speculative stock given the low revenue, high costs, and limited commercial sales. This doesn't mean D-Wave shares are a bargain, since its sales multiple is quite high as well.

Data by YCharts.

Another factor to consider is that the quantum computing industry is in its early stages. Quantum computers are prone to calculation errors, because the atomic particles in these machines are sensitive to the slightest environmental disturbances, such as a minor temperature change.

So while D-Wave is the better choice versus QCi, any investment in a pure-play quantum computer company is a risk. And it could take years before a scalable quantum device is possible. Some estimates predict that won't happen until 2040. Given these factors, only investors with a high risk tolerance should consider investing in D-Wave.