Nvidia's (NVDA -0.41%) pioneering role in the artificial intelligence (AI) hardware market helped it become the world's most valuable company. It now has a market cap of $4.2 trillion, and it has delivered incredible returns of more than 1,310% in the past five years.

Investors may be wondering if Nvidia is capable of delivering more gains over the next five years considering its expensive valuation and market cap. But there is another semiconductor stock that's benefiting from the adoption of AI on multiple fronts and has the ability to deliver bigger gains than Nvidia by 2030.

Let's take a closer look at that company.

Image source: Getty Images

Investors looking for the next Nvidia shouldn't ignore this chip designer

Advanced Micro Devices (AMD -0.67%) remained in the shadow of Nvidia in the past five years. The stock has registered much smaller gains of 99% as compared to its bigger rival, and that's not surprising because it has failed to capitalize on the AI data center boom. AMD reportedly controlled just 4% of the market for data-center graphics processing units (GPUs) last year, way behind Nvidia's 92% share.

But it won't be right to gauge AMD's AI potential based on just its data center business. The company also sells processors and GPUs that are used in personal computers, gaming consoles, and industrial applications such as robotics and factory automation. It is more diversified than Nvidia because it also sells server processors that are deployed in data centers.

These markets are likely to help AMD register robust growth over the next five years. A closer look at the company's recent results for the second quarter of 2025 tells us that it is already making the most of these markets.

Overall revenue increased by a healthy 32% year over year in the second quarter to a record $7.7 billion. It is expecting another jump of 28% in the current quarter.

The secular growth opportunity in each of the markets for AI personal computers, server central processing units (CPUs), and gaming markets are three key factors that should enable AMD to sustain momentum through 2030. For instance, revenue in the AI personal computer market is expected to jump by a multiple of four and a half by 2030 as compared to last year, according to a third-party report.

AMD has been grabbing a bigger slice of the PC processor market. At the end of the second quarter, it controlled 23.9% of the client CPU market, an increase of 2.8 percentage points from the prior-year period. Its revenue share increased by almost 10 points to 27.8%.

The strong demand for AMD's recently released AI-focused PC processors has been instrumental in helping it increase its share. Also, the faster growth in its revenue share suggests that it is enjoying strong pricing power. The company's focus on launching AI-capable PC processors could help it land a bigger share of the client CPU market in the future.

A similar story is likely to unfold in the server processor space, where its Epyc chips are being used for tackling AI workloads in data centers. Management said on the company's recent earnings conference call that the adoption of its Epyc processors improved thanks to Alphabet's Google and Oracle.

AMD says that its Epyc server chips are ideal for running AI inference applications in the cloud. Given that AMD already established a strong customer base for its AI server processors and GPUs, including the likes of Microsoft, Meta Platforms, Amazon, and others, its data center business seems poised for outstanding growth over the next five years.

Moreover, investors shouldn't forget that AMD's growth is likely to be supercharged by the launch of the next-generation gaming consoles from Microsoft and Sony. The consoles from these companies are expected to arrive in the next three years, as per various estimates. AMD is once again going to design the semi-custom chips powering these consoles.

The company historically witnesses a big jump in sales and earnings when new consoles are launched, and a similar story could unfold in the next five years.

How much upside can investors expect by 2030?

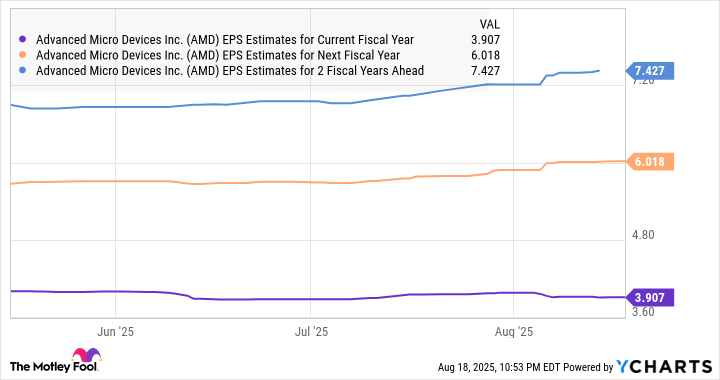

Analysts are forecasting healthy growth in AMD's earnings through 2027 following an estimated jump of 18% this year to $3.91 per share.

AMD EPS Estimates for Current Fiscal Year data by YCharts; EPS = earnings per share.

It can sustain this healthy momentum in the three years beyond 2027. Assuming that the company can increase its earnings at a conservative annual rate of 15% in 2028, 2029, and 2030, its bottom line could jump to $11.30 per share after five years. The stock has a five-year forward earnings multiple of 31, which is a slight discount to the tech-laden Nasdaq-100 index's average earnings multiple of 33.6.

If AMD trades at even 30 times earnings after five years, its stock price could hit $339 based on its projected earnings in 2030. That points toward potential gains of 109% from current levels and is higher than what Nvidia may deliver over the same period.