Got some idle cash in your portfolio waiting to be put to work, but fear the market's most popular stocks are a bit overpriced? You're not imagining things. Names like Nvidia and AI software outfit Palantir Technologies have become incredibly crowded trades. It might be wise to look for something a little lower profile that not everyone's heard of yet and piled into already.

One name in particular surfaces for anyone willing to look a bit off the beaten path for a new growth investment. That's Arm Holdings (ARM 3.01%). Here's why.

What's Arm Holdings?

Most investors have likely heard of it, but there's a good chance you don't quite know what it does. Yes, it's typically lumped together with semiconductor stocks like Intel, Taiwan Semiconductor Manufacturing, and the aforementioned Nvidia -- and for good reason. Its fortunes are tightly tethered to the overall chipmaking business.

NASDAQ: ARM

Key Data Points

Arm Holdings isn't actually a chipmaker, though. It doesn't outsource manufacturing of its own silicon to third-party contract manufacturers like Taiwan Semiconductor either -- at least not yet (although there are rumors).

Rather, Arm designs chips and licenses this technology to companies that want the superior performance its chip architecture provides. Apple, Qualcomm, Microsoft, and even Nvidia are all paying customers, largely due to the incredible power efficiency of its know-how.

Amazon Web Services, for instance, says customers using its Arm-powered Graviton processors enjoy 60% more efficiency, ultimately lowering their net costs of using the e-commerce giant's cloud computing service. Apple's newest AI-capable iPhones are also powered by processors based on Arm's chip architecture, preserving battery life that would normally be used up by power-hungry artificial intelligence applications.

Picking up steam

As impressive as Arm's low-power silicon may be, its most game-changing stuff is also still relatively new. The timing of its advent, however, couldn't be any more ideal.

See, when artificial intelligence was in its infancy, power consumption wasn't a concern. These efforts were fairly small-scale, and mostly experimental to see if it would work at all. Developers didn't mind the relatively big electric bills resulting from using and also cooling these high-performance chips.

Not now, though. Now that AI platforms are proven, demand is exploding. So is the amount of electricity they collectively need. Goldman Sachs expects the planet's AI data center power consumption to grow to the tune of 165% between now and 2030, in fact, yet it will still continue growing beyond that level. Indeed, electricity is quickly becoming data centers' single biggest expense; the technological improvements that perpetually lower the costs of processors and networking hardware don't apply to utilities.

Image source: Getty Images.

And that's just artificial intelligence data centers. In the meantime, ordinary data centers that handle less complicated tasks (like allowing you to check your brokerage account online or stream a movie) also continue to proliferate.

Both industries are starting to recognize the value of the solutions that Arm Holdings brings to the table, though. Based on the demand it's already experiencing, in fact, Arm says its share of the global data center processor market is likely to soar to 50% by the end of this year, versus only about 15% last year.

It won't be nearly as far along on the AI data center front by the end of 2025, mostly because the industry has already made sizable investments in non-Arm processors it will need to utilize for at least a while longer. But that opportunity is simmering too.

The company's so-called Arm Neoverse architecture is purpose-built for artificial intelligence applications, for instance, while AI-powered manufacturing quality control and superior generative AI graphics for mobile devices are a couple of other proven power-efficient solutions its technology can already offer. It shouldn't take much longer for this know-how to work its way into these corners of the artificial intelligence market, with even more mainstream AI processing solutions likely to follow.

Not cheap, but undervalued

Arm Holdings shares aren't "cheap" by marketwide standards right now, for the record -- the stock is trading at about 80 times this year's consensus per-share earnings of $1.62. That's technically more expensive than Nvidia, or Taiwan Semiconductor, or Qualcomm, or most other names of its ilk.

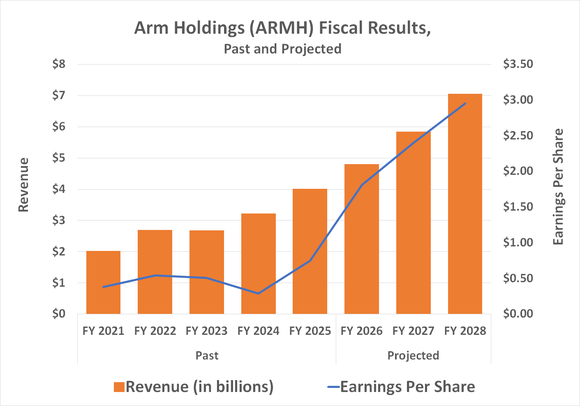

Just take a step back and look at the bigger picture. Arm is one of the few names in the business that's expected to experience a slight acceleration in revenue growth rather than a slowdown in top-line growth over the course of the coming three years. Earnings are expected to grow at an even faster clip, reaching a per-share profit of $2.95 in fiscal 2028 (calendar 2027).

Data source: Getty Images. Chart by author.

That's still just the beginning, though. Industry research outfit Global Market Insights suggests the worldwide AI chipset market is set to grow at an average annualized pace of 34% through 2032. It's a pretty safe bet that much of that demand will be for silicon that doesn't cost a growing fortune in electricity bills just to use.

Bottom line? Arm Holdings would be a compelling growth investment regardless of the backdrop. With the stock having made no net forward progress for over a year, though, if you've got a couple thousand bucks you're ready to put to work, this is arguably one of the smartest growth investments to buy here. Most of the technology industry simply can't afford not to utilize its power-efficient processing solutions.