Twilio (TWLO 5.24%) is a cloud communications company that's known for its application programming interfaces (APIs) that help its clients build software tools to remain in touch with their customers through various channels such as voice, text, email, video, and instant messaging. Its growth has accelerated in recent quarters thanks to the integration of artificial intelligence (AI)-focused tools into its communications platforms.

However, Twilio stock has witnessed a lot of volatility on the market this year. It has lost just over 4% of its value in 2025 as of this writing, driven by the company's mixed quarterly performances. It fell like a rock in February this year, and a similar story unfolded following the release of its second-quarter results on Aug. 7.

NYSE: TWLO

Key Data Points

Shares of Twilio sank over 19% after its latest report, thanks to disappointing guidance. However, Twilio's 12-month median price target of $131, as per 30 analysts covering the stock, points toward a 27% jump from current levels. Let's see why analysts are upbeat about Twilio's direction in the coming year.

Image source: Getty Images.

Twilio's growth is accelerating thanks to AI

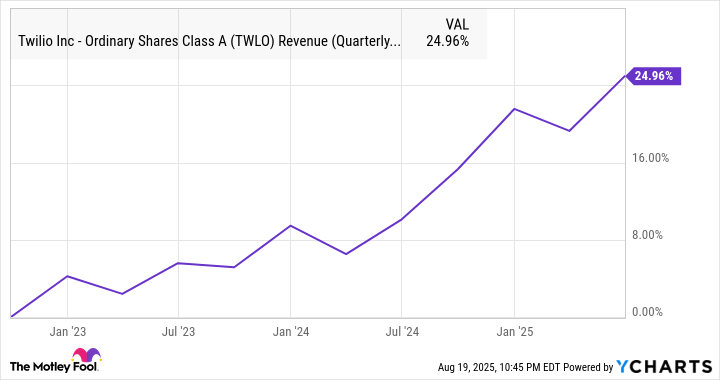

Twilio reported a 13% year-over-year increase in revenue in Q2. Its earnings grew at a faster pace of 37% to $1.19 per share. It is worth noting that Twilio's revenue growth has accelerated in the past year.

TWLO Revenue (Quarterly) data by YCharts.

The company's improving growth profile can be attributed to the stronger growth in its customer base in recent quarters, as well as a jump in spending by existing customers on its solutions. This is evident in the following table.

|

Period |

Active customer accounts |

Year-over-year growth (in %) |

Dollar-based net expansion rate (in %) |

|---|---|---|---|

|

Q1 2024 |

313,000 |

4% |

102% |

|

Q2 2024 |

316,000 |

4% |

102% |

|

Q3 2024 |

320,000 |

5% |

105% |

|

Q4 2024 |

325,000 |

7% |

106% |

|

Q1 2025 |

335,000 |

7% |

107% |

|

Q2 2025 |

349,000 |

10% |

108% |

Data source: Twilio quarterly reports.

The active customer accounts refer to customers from whom Twilio generated at least $5 in revenue in the final month of the quarter. Meanwhile, the dollar-based net expansion rate compares the spending by active customer accounts in a quarter to the spending by those same customers in the year-ago period.

The company is witnessing a nice uptick on both fronts, and this explains why its top- and bottom-line growth have started getting better in recent quarters. The adoption of Twilio's AI tools is playing a central role in giving its growth a shot in the arm. For instance, the company is witnessing a "surge in voice AI start-ups who are building on Twilio."

Management points out that it saw an 86% year-over-year increase in the number of customer accounts using its conversational intelligence messaging platform last quarter. Twilio's conversational intelligence solutions allow its clients to extract and analyze insights from voice calls and chats, convert voice calls into transcripts in real time, summarize conversations, and measure customer sentiment.

Companies can integrate this tool into their communications software with Twilio's APIs so they can use the data from conversations for improving sales and reducing customer churn. So, it is easy to see why Twilio's AI communications tools are helping it attract more customers, while also allowing it to win a bigger share of existing customers' wallets.

Investors need to look past the near-term guidance

Twilio's Q3 revenue guidance calls for 10% to 11% growth from the year-ago period. That would be a slight deceleration from the growth it reported in the previous quarter. Even the earnings guidance range of $1.01 per share to $1.06 per share doesn't point toward a significant improvement over the year-ago period's reading of $1.02 per share.

However, don't be surprised to see Twilio exceeding its expectations and reporting stronger growth. That's because the adoption of AI in the cloud-based contact center market is expected to generate a revenue opportunity of $10 billion in 2032, compared to less than $2 billion last year. As a result, Twilio can keep attracting new customers and cross-sell its AI tools to existing ones.

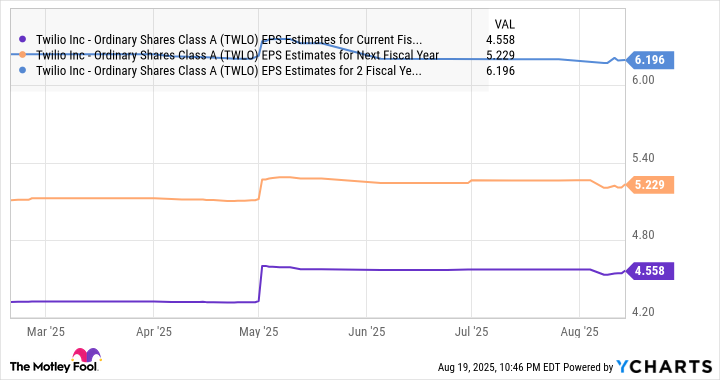

This should lead to an improvement in its bottom line in the future, and this is what analysts are expecting.

TWLO EPS Estimates for Current Fiscal Year data by YCharts.

An improvement in Twilio's earnings growth could lead the market to reward it with a higher multiple. The stock is trading at 24 times forward earnings, which is a discount to the tech-focused Nasdaq-100 index's forward earnings multiple of 30 (using the index as a proxy for tech stocks). If Twilio can indeed hit $6.20 per share in earnings in 2027 and trades in line with the index's forward earnings multiple at that time, its stock price could jump to $186.

That would be an 80% jump from current levels. So, Twilio seems to be in a position to not just hit Wall Street's price target in the coming year, but deliver stronger gains in the long run. That's why investors should consider buying this AI stock on the dip, since its weakness shouldn't last for long.