Dividend stocks are some of the best investments you can make because they provide guaranteed income (in most cases), regardless of stock price movements.

However, not all dividend stocks are created equal. Investing in Dividend Kings -- the name given to stocks that have increased their annual dividend for at least 50 years -- can provide more stability because a company has proven it has the financials to maintain the dividend and keep its business afloat.

There are about 55 Dividend Kings, so it's an elite group that has stood the test of time. Reaching at least 50 years of annual dividend increases means these companies have made it through historical events like Black Monday (1987), the dot-com bubble (2000), the global financial crisis (2007), and the COVID-19 pandemic (2020), and still managed to keep their streaks going. That's impressive and a testament to resilience.

Image source: Getty Images.

Arguably the most popular Dividend King in the stock market is beverage giant Coca-Cola (KO 0.19%). It has 63 years of dividend increases, which is more than every company except for eight. Coca-Cola has historically been a great investment to make, but does it still have enough gas in the tank to double your money in the next five years?

Based on the Rule of 72, this would require the stock to average 14.4% annual returns in that span. Let's take a look at the likelihood of that happening.

The bullish case for it to happen

Coca-Cola remains one of the more thorough businesses in the world. It has the brand power, a global distribution network, and the willingness to adjust its portfolio as needed to meet changing consumer preferences. It has brands in virtually every beverage category, from soft drinks, water, coffee, tea, juices, dairy, plant-based, and even ready-to-drink alcohol.

And the way Coca-Cola's business is structured -- where it sells concentrates/syrups and licenses while relying on bottling partners to handle the more expensive manufacturing, packaging, and logistics -- it can keep assets light and focus on its products, brand, and distribution. That's why it routinely operates with much higher margins than other competitors.

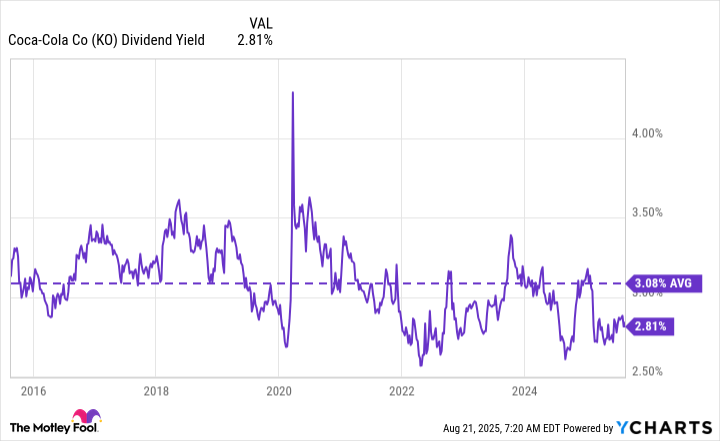

Coca-Cola's above-average dividend also means that it won't have to rely as heavily on stock price appreciation to hit the marks needed to double an investment in five years. It has averaged just over a 3% dividend yield in the past decade.

KO Dividend Yield data by YCharts

Dividend yields fluctuate with stock prices (moving in opposite directions), so they won't stay the same. However, assuming it remains around the 3% range, Coca-Cola's stock would "only" need to average 11.4% annual growth over five years.

The bearish case for it not to happen

Although Coca-Cola has maintained healthy finances, much of its recent performance can be attributed to its pricing power, not volume growth. For example, in the second quarter, its revenue increased by 1% year over year to $12.5 billion, yet its global unit case volume declined by 1%.

At some point, simply increasing prices won't be a sustainable strategy to deal with flat or declining volume. Coca-Cola will need to spark more consistent volume growth at some point.

There are also a couple of headwinds Coca-Cola could face in the near future, including newly introduced tariffs on aluminum (which it uses a lot of for its canned drinks) and potential higher taxes on sugary products (such as sodas).

Only time will tell how those play out, but they could be hurdles for Coca-Cola's business in the coming years and change investor optimism about the company's growth prospects.

NYSE: KO

Key Data Points

Which is more likely to happen?

Averaging 14.4% annual returns is a tough ask for a business as mature as Coca-Cola's. In all fairness, the stock is up 14.3% year to date (through Aug. 21) and has hit that mark in six of the past 20 years, but it hasn't had a five-year average of that much since 2009 to 2013.

In my opinion, an investment today is unlikely to double in the next five years. I think the investment will be much better off, barring a drastic change in Coca-Cola's business, but doubling in that time may be a stretch.

Coca-Cola is still a great dividend stock for your portfolio if you're looking for consistent and reliable income, so I would approach it with a long-term mindset and look to take advantage of the added compound effect that comes with dividend stocks.