To say that it has been an interesting year for Elon Musk would be a gross understatement. From his tumultuous time in Washington, D.C. to his decisions to start and then not start a political party, Tesla (TSLA +0.04%) shareholders have clearly disapproved of Musk's exploits since the start of 2025. These factors and questions around Tesla's electric vehicle (EV) business have sent the stock down more than 21% as of this writing.

But how have investors who bought Tesla stock several years ago made out? Let's consider what an investment of $10,000 from three years ago would be worth today.

Image source: Tesla.

Recent shareholders have endured quite the winding road with Tesla stock

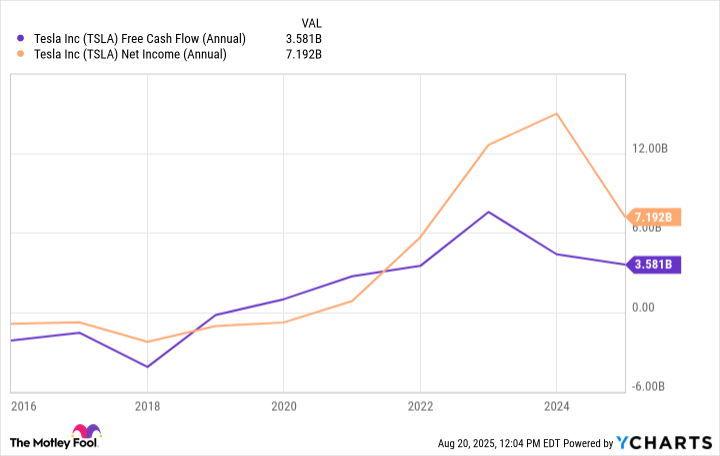

Disrupting the automotive industry is hardly easy. Recognizing this, early investors in Tesla had faith that Elon Musk was steering the EV maker in the right direction -- and they were rewarded in 2020 when the company reported its first annual profit. Shortly thereafter, Tesla stock charged higher in concert with the company's growing profitability and strong free cash flow.

Data by YCharts.

Those metrics have both reversed course over the past few years, however, and investors have been much less enthusiastic about the company's prospects.

NASDAQ: TSLA

Key Data Points

Investors who've parked the EV maker's stock in their portfolios for a decade have seen their investments surge 1,900% higher. But those who have only held Tesla stock for the past three years have hardly fared as well. Those who invested $10,000 on August 22, 2022, have seen their investment grow in value to about $10,880 as of this writing.

Has the time to power your portfolio with Tesla stock passed?

Since Tesla stock first began trading on public markets, skeptics have dismissed Elon Musk and doubted his overly ambitious projections. Musk has often proved them wrong, though not in every instance.

While Tesla stock has struggled this year, it would be foolhardy to write the company off altogether. Even as the core EV business struggles, there are plenty of Tesla bulls who believe the stock still has plenty of growth potential.